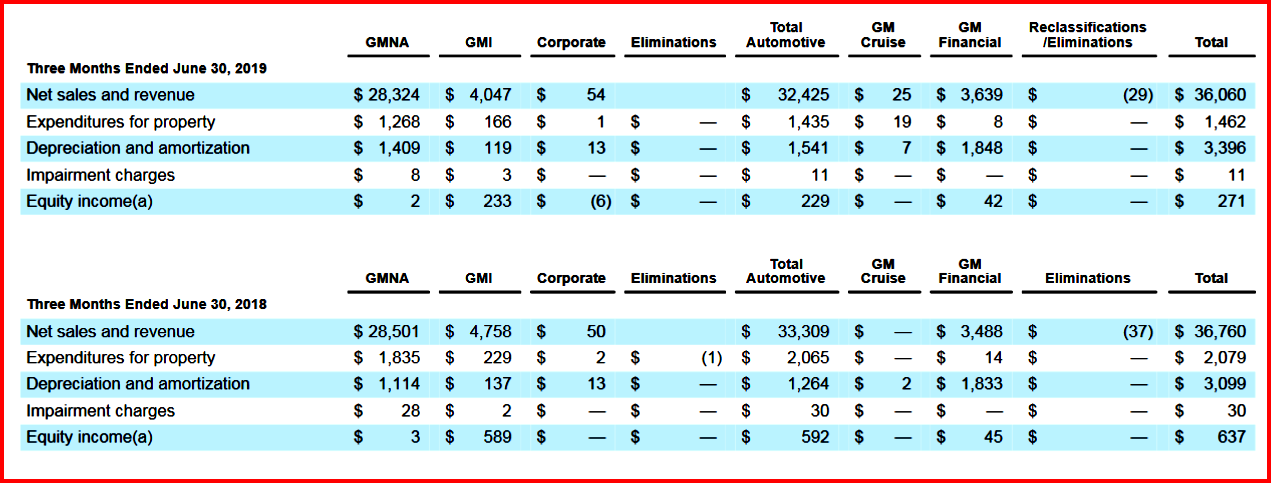

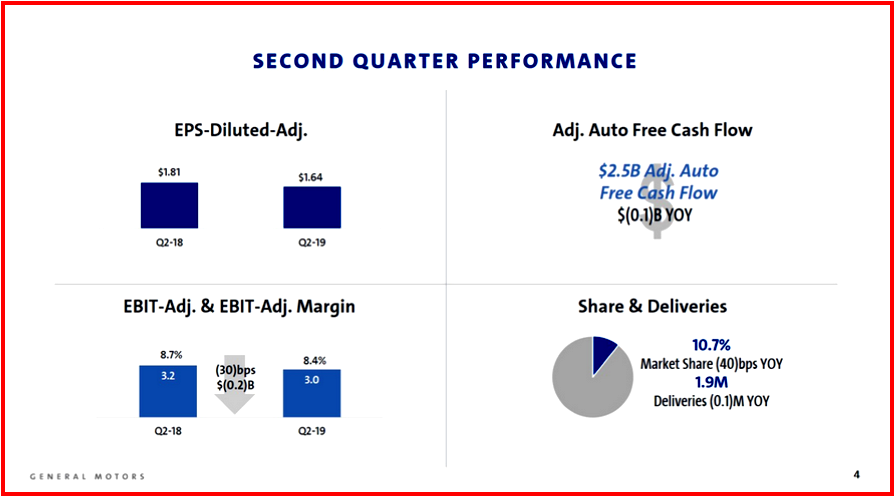

General Motors Corporation posted weak Q2 operating results as trade wars, increased taxes on consumers called tariffs, and the ongoing Brexit crisis hurt sales and earnings. In brief, year- over-year comparisons: During Q2 2019 GM earnings per share dropped to 2,353 or $1.64 a share (2018 $2,591 $1.81); sales dropped globally; US sales dropped; China sales dropped. Total sales were down in every region except for a modest rise in GM International to 146,569, up 15,073 or 11.5%.The six-month results are worse: 4,373 million or $3.04 a share compared to $4,635 million or $3.24 per share.

Another job-destroying economic correction on way?

The best Q2 performance came in North America as GM’s all-new light-duty, crossovers and cost savings via job eliminations. This resulted in a 10.7% EBIT-adj. margin. Elsewhere, things were tougher. GM China sold 754,000 vehicles in the second quarter, about 100,000 fewer than the previous year’s quarter, due to an overall market decline, segment shifts and lower demand.

Ho-hum.

Due to China’s economic slowdown, China industry unit sales are expected to remain weak through the second half of the year, with industry deliveries projected to be down for the full year. However, GM expects equity income in the second half of the year to be flat or roughly the same as the first half. GM China expects “to benefit from about 20 new vehicle launches, the majority of which will go on sale later in the year.”

Trump’s escalation of the trade wars will likely make things worse not only for GM, but Ford Motor and Fiat Chrysler as well. After GM released earnings, Trump said he would dictate a 10% tariff (aka tax on U.S. consumers on consumer goods and manufacturers on intermediate goods) on $300 billion worth of Chinese imports not already covered with penalties.

These are likely more than “headwinds” in the argot of auto P.R. spin doctors. It looks more like a tsunami warning that will hit ground in the U.S. and soak consumers to AutoInformed. The Federal Reserve cutting interest rates this week was a tacit admission that Trump economics has failed. Business isn’t investing and we have returned to relatively weak pre-Trump-mis-Administration anemic levels of growth.

GM’s high profile but low performing Cruise Autonomous Vehicle venture – after a new equity increase in May of $1.15 billion which raised its valuation to $19 billion – Cruise posted a Q2 loss of 279,000,000, up from a loss of $154,000,000 during Q2 of 2018.

In July Cruise announced actions to advance its launch in San Francisco. “To deploy at large scale, Cruise will significantly increase its testing and validation miles over the balance of 2019; increase community engagement through advertising and live events; and continue work on the development of a purpose-built autonomous vehicle– the effort of hundreds of talented Cruise, GM and Honda engineers.” Talented they may be, but this is an expensive learning experience for shareholders. Are we headed for +$1 Billion in annual losses?

In July Cruise announced actions to advance its launch in San Francisco. “To deploy at large scale, Cruise will significantly increase its testing and validation miles over the balance of 2019; increase community engagement through advertising and live events; and continue work on the development of a purpose-built autonomous vehicle– the effort of hundreds of talented Cruise, GM and Honda engineers.” Talented they may be, but this is an expensive learning experience for shareholders. Are we headed for +$1 Billion in annual losses?

General Motors declared a third quarter 2019 dividend of 38 cents per outstanding share of common stock. The dividend is payable Friday, Sept. 20, 2019, to all common shareholders of record at the close of business on Friday, Sept. 6, 2019.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

GM Q2 Confirms US Economic Slowdown

General Motors Corporation posted weak Q2 operating results as trade wars, increased taxes on consumers called tariffs, and the ongoing Brexit crisis hurt sales and earnings. In brief, year- over-year comparisons: During Q2 2019 GM earnings per share dropped to 2,353 or $1.64 a share (2018 $2,591 $1.81); sales dropped globally; US sales dropped; China sales dropped. Total sales were down in every region except for a modest rise in GM International to 146,569, up 15,073 or 11.5%.The six-month results are worse: 4,373 million or $3.04 a share compared to $4,635 million or $3.24 per share.

Another job-destroying economic correction on way?

The best Q2 performance came in North America as GM’s all-new light-duty, crossovers and cost savings via job eliminations. This resulted in a 10.7% EBIT-adj. margin. Elsewhere, things were tougher. GM China sold 754,000 vehicles in the second quarter, about 100,000 fewer than the previous year’s quarter, due to an overall market decline, segment shifts and lower demand.

Ho-hum.

Due to China’s economic slowdown, China industry unit sales are expected to remain weak through the second half of the year, with industry deliveries projected to be down for the full year. However, GM expects equity income in the second half of the year to be flat or roughly the same as the first half. GM China expects “to benefit from about 20 new vehicle launches, the majority of which will go on sale later in the year.”

Trump’s escalation of the trade wars will likely make things worse not only for GM, but Ford Motor and Fiat Chrysler as well. After GM released earnings, Trump said he would dictate a 10% tariff (aka tax on U.S. consumers on consumer goods and manufacturers on intermediate goods) on $300 billion worth of Chinese imports not already covered with penalties.

These are likely more than “headwinds” in the argot of auto P.R. spin doctors. It looks more like a tsunami warning that will hit ground in the U.S. and soak consumers to AutoInformed. The Federal Reserve cutting interest rates this week was a tacit admission that Trump economics has failed. Business isn’t investing and we have returned to relatively weak pre-Trump-mis-Administration anemic levels of growth.

GM’s high profile but low performing Cruise Autonomous Vehicle venture – after a new equity increase in May of $1.15 billion which raised its valuation to $19 billion – Cruise posted a Q2 loss of 279,000,000, up from a loss of $154,000,000 during Q2 of 2018.

General Motors declared a third quarter 2019 dividend of 38 cents per outstanding share of common stock. The dividend is payable Friday, Sept. 20, 2019, to all common shareholders of record at the close of business on Friday, Sept. 6, 2019.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.