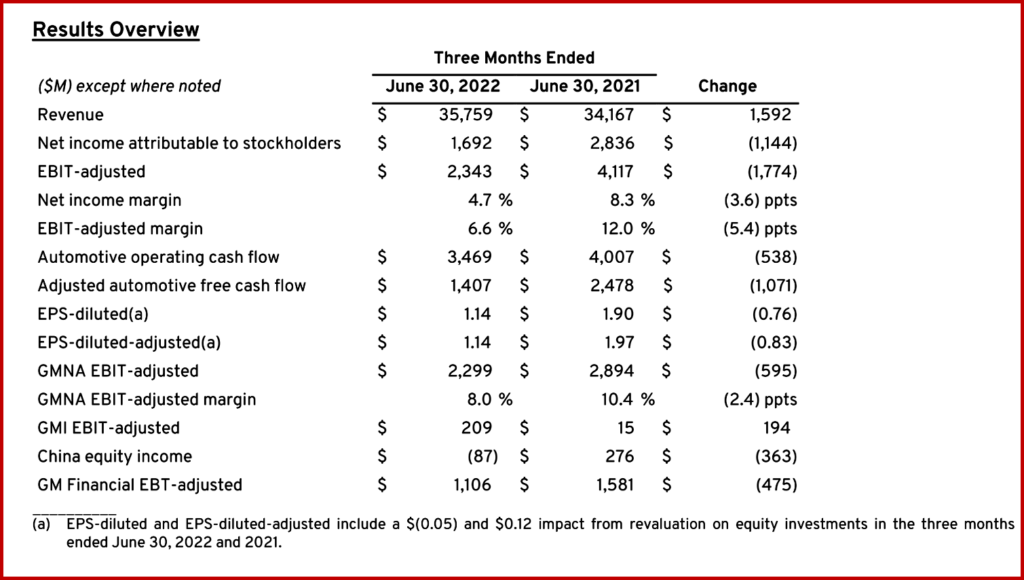

General Motors Co. (NYSE: GM) today reported second-quarter net income attributable to stockholders of $1.7 billion and EBIT-adjusted of $2.3 billion, in line with the earnings update the company issued on July 1.

This was a significant drop of $1.1 billion in a year-over year comparison as net pricing increases, strong demand and more upscale vehicle sales were more than offset by disrupted production, increased costs and lost sales (90,000 built but not complete?) from lean inventories especially in June. In a word – semiconductors.

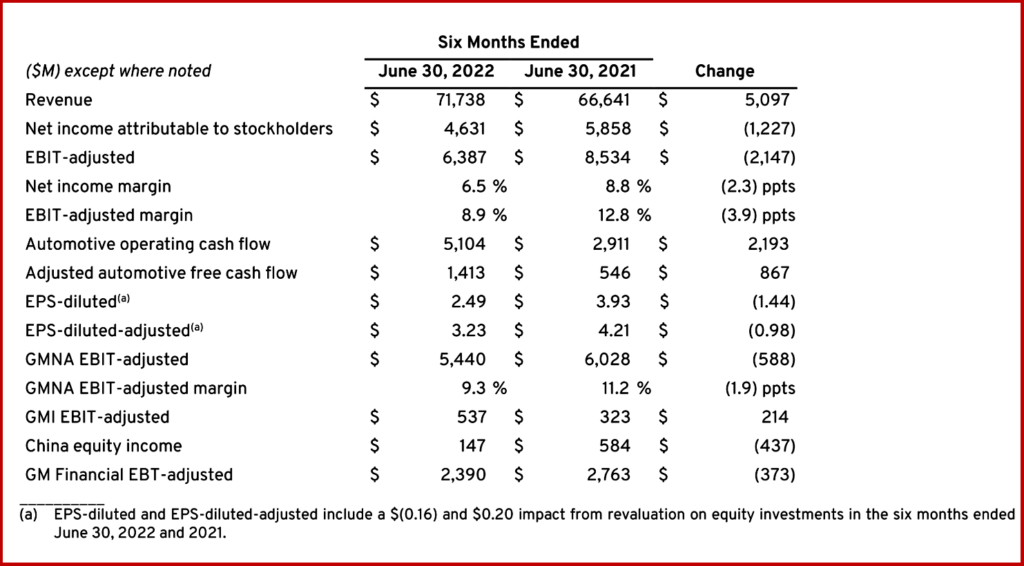

GM continues to expect to meet its full-year earnings guidance of between $9.6 billion and $11.2 billion, and EBIT-adjusted of between $13.0 billion and $15.0 billion. GM also forecasts full-year EPS-diluted of between $5.76 and $6.76, and EPS-diluted-adjusted of between $6.50 and $7.50.

GM continues to expect to meet its full-year earnings guidance of between $9.6 billion and $11.2 billion, and EBIT-adjusted of between $13.0 billion and $15.0 billion. GM also forecasts full-year EPS-diluted of between $5.76 and $6.76, and EPS-diluted-adjusted of between $6.50 and $7.50.

In her letter to shareholders GM chair and CEO Mary Barra referred to a news releases just issued: “GM has also done something unique in the industry to help secure our future EV production. We have binding agreements securing all battery raw material to support our plan for 1 million units of annual EV capacity in North America in 2025. (Three EV programs are slated to start next year in North America with annual volumes of 125,000 each and more after 2025 – Autocrat.) These are commitments with strategic partners for key materials like lithium, cobalt and nickel. This includes new multi-year agreements announced today by Livent Corp., for lithium, and LG Chem, for cathode material,” Barra said. (AutoInformed: GM and LG Chem Have Deal on Battery Materials; GM: Virtual EV Specialists Available for Free Consult)

Then Barra got to the crux of the matter. “We have been operating with lower volumes due to the semiconductor shortage for the past year, and we have delivered strong results despite those pressures. There are concerns about economic conditions, to be sure. That’s why we are already taking proactive steps to manage costs and cash flows, including reducing discretionary spending and limiting hiring to critical needs and positions that support growth. We have also modeled many downturn scenarios and we are prepared to take deliberate action when and if necessary. Going forward, we will continue to mitigate risk and drive down costs to help us deliver $90 billion of annual EV revenue by 2030, Barra said. However, Battery EVs are about $7000 more expensive than the internal combustion vehicles that are killing us.

Then Barra got to the crux of the matter. “We have been operating with lower volumes due to the semiconductor shortage for the past year, and we have delivered strong results despite those pressures. There are concerns about economic conditions, to be sure. That’s why we are already taking proactive steps to manage costs and cash flows, including reducing discretionary spending and limiting hiring to critical needs and positions that support growth. We have also modeled many downturn scenarios and we are prepared to take deliberate action when and if necessary. Going forward, we will continue to mitigate risk and drive down costs to help us deliver $90 billion of annual EV revenue by 2030, Barra said. However, Battery EVs are about $7000 more expensive than the internal combustion vehicles that are killing us.

GM is looking at a “moderate” and a more “severe” downturn in its planning. It will be helped here by the ~$4.5 billion in costs it shed during 2018-2020. It’s also helped by its Ultium platform. However, like all major automakers, GM’s future will be significantly affected by its suppliers and the government policies they operate under, as well as impediments or assistance by the governments where GM does business, say dysfunctional federal and state governments in the US and the severe economic contraction in China as two significant wild cards. Then there’s inflation: On commodities, GM says about 33% of its pricing is indexed; with the balance under multi-year pricing agreements. The US Department of Energy has granted GM and LG Energy Solutions a $2.5 billion loan to Ultium Cells LLc for another battery plant. GM just needs to close it.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

GM Q2 Earnings at $2.3B Off -$1.1B YoY

General Motors Co. (NYSE: GM) today reported second-quarter net income attributable to stockholders of $1.7 billion and EBIT-adjusted of $2.3 billion, in line with the earnings update the company issued on July 1.

This was a significant drop of $1.1 billion in a year-over year comparison as net pricing increases, strong demand and more upscale vehicle sales were more than offset by disrupted production, increased costs and lost sales (90,000 built but not complete?) from lean inventories especially in June. In a word – semiconductors.

In her letter to shareholders GM chair and CEO Mary Barra referred to a news releases just issued: “GM has also done something unique in the industry to help secure our future EV production. We have binding agreements securing all battery raw material to support our plan for 1 million units of annual EV capacity in North America in 2025. (Three EV programs are slated to start next year in North America with annual volumes of 125,000 each and more after 2025 – Autocrat.) These are commitments with strategic partners for key materials like lithium, cobalt and nickel. This includes new multi-year agreements announced today by Livent Corp., for lithium, and LG Chem, for cathode material,” Barra said. (AutoInformed: GM and LG Chem Have Deal on Battery Materials; GM: Virtual EV Specialists Available for Free Consult)

GM is looking at a “moderate” and a more “severe” downturn in its planning. It will be helped here by the ~$4.5 billion in costs it shed during 2018-2020. It’s also helped by its Ultium platform. However, like all major automakers, GM’s future will be significantly affected by its suppliers and the government policies they operate under, as well as impediments or assistance by the governments where GM does business, say dysfunctional federal and state governments in the US and the severe economic contraction in China as two significant wild cards. Then there’s inflation: On commodities, GM says about 33% of its pricing is indexed; with the balance under multi-year pricing agreements. The US Department of Energy has granted GM and LG Energy Solutions a $2.5 billion loan to Ultium Cells LLc for another battery plant. GM just needs to close it.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.