General Motors (NYSE: GM) said today it sold 582,401 vehicles in the United States in the second quarter of 2022 and the company increased its sales and market share sequentially for the third consecutive quarter. GM’s second quarter sales were down -15% year over year, but market share was up 1 point to an estimated 16.3% , according to J.D. Power PIN data. GM does not report monthly sales data. Based on preliminary data, it looks like industry wide sales will decline ~-20%. (US June Vehicle Sales Forecast is Down on Record Prices)

However, GM outsold Toyota year-to-date at 1,095,247 vehicles to Toyota’s 1,045,697. Toyota is struggling with production because of chip shortages and COVID shut downs, particularly in China. (Toyota Motor North America June US Sales Down -17.9%)

“GM’s sales and market share have grown each of the last three quarters, even with lingering supply chain disruptions,” said Steve Carlisle, GM executive vice president and president, North America. “Our long-term momentum will continue to build thanks to the launches of groundbreaking new EVs like the GMC HUMMER EV and Cadillac LYRIQ, and the tremendous customer response to the Chevrolet Silverado and GMC Sierra,” claimed Carlisle.

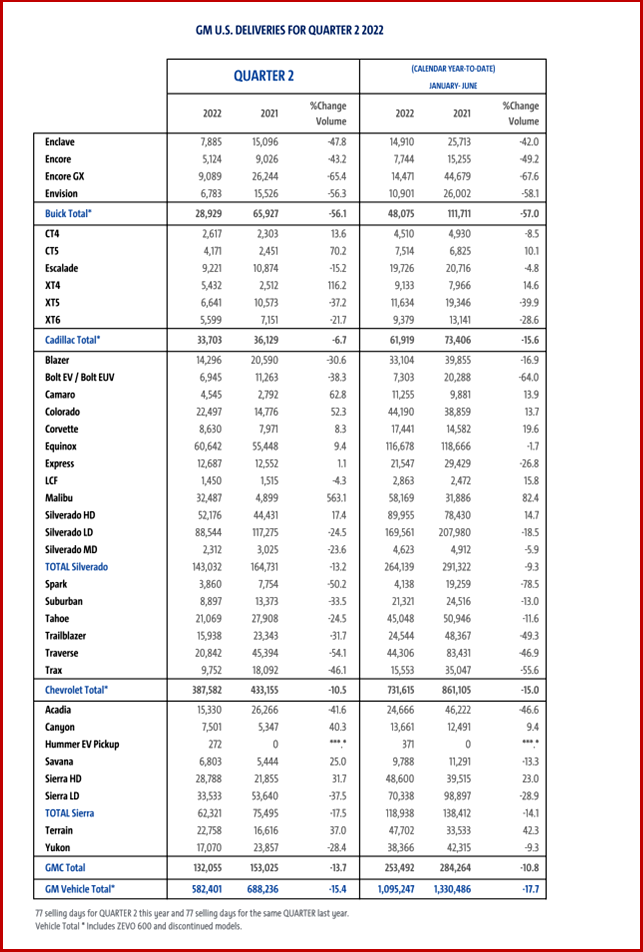

Click to Enlarge.

GM vehicle production was strong during the second quarter and the company finished the month with 247,839 vehicles in dealer inventory, including units in-transit to dealers. However, GM’s second quarter vehicle wholesale volumes were impacted by the ongoing semiconductor supply shortage and other supply chain disruptions mostly in June.

As a result, GM will hold about 95,000 vehicles manufactured without certain components in company inventory until they are completed and will recognize revenue when they are sold to dealers, which is expected to happen throughout the second half of 2022. The impact of these events, which is not expected to impact GM’s full-year earnings guidance, is discussed in an SEC Form 8-K filed today.

“We appreciate the patience and loyalty of our dealers and customers as we strive to meet significant pent-up demand for our products, and we will work with our suppliers and manufacturing and logistics teams to deliver all the units held at our plants as quickly as possible,” said Carlisle.

GM Q2 at a Glance

- GM extended its leadership in full-size pickup truck retail market share for the 13th consecutive quarter, despite very low inventory, with 203,041 combined total sales of the Chevrolet Silverado and GMC Sierra. Their estimated retail market share was 44%. The Chevrolet Silverado remains the fastest growing full-size pickup truck in the industry (J.D. Power PIN), with Silverado HD recording its best first half in retail sales since 2007.

- Pent-up demand and improved availability helped drive large year-over-year increases in deliveries of the Chevrolet Camaro, up 63%; Chevrolet Colorado, up 52%; Chevrolet Malibu, up 563%; Cadillac XT4, up 116%; and Cadillac CT5, up 70%.

- GMC delivered its best-ever first half retail market share (J.D. Power PIN). Total sales of the GMC Canyon grew 40% and GMC Terrain grew 37% in the quarter. The GMC Sierra HD, which was up 31% in the quarter, delivered its best second quarter and first half on record.

- GM’s commercial, government and daily rental deliveries were up a combined 29%, with each category posting double-digit growth as customers took advantage of improved availability to refresh and expand their fleets, which reflects strong employment and the recovery in the travel and leisure industries. Sales to commercial and government customers were 73% of the fleet sales mix.

- Commercial demand was especially strong for full-size vans, up 12%; full-size pickups, up 14%; medium-duty trucks, up 13%; and midsize pickups up 65%.

- Electric vehicle sales were over 7,300 units, including some of the first deliveries of the BrightDrop Zevo 600 and GMC HUMMER EV Pickup, as well as the resumption of Chevrolet Bolt EV and Bolt EUV production.

- Cadillac LYRIQ production is accelerating, with initial deliveries in process. Orders for the 2023 model year sold out within hours and pre-orders for the 2024 model opened on June 22.

- GM will gradually increase production of the Cadillac LYRIQ and GMC HUMMER EV Pickup in the second half of 2022. Ultium Cells LLC begins producing cells in Ohio to support expanded EV manufacturing starting in August.

- GM’s sales incentives remained near record lows in the quarter at 2.3% of average transaction prices, according to J.D. Power PIN estimates.

- The second quarter SAAR was an estimated 13.4 million light vehicles compared to 17 million a year ago.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

GM Q2 US Sales Down -15%

General Motors (NYSE: GM) said today it sold 582,401 vehicles in the United States in the second quarter of 2022 and the company increased its sales and market share sequentially for the third consecutive quarter. GM’s second quarter sales were down -15% year over year, but market share was up 1 point to an estimated 16.3% , according to J.D. Power PIN data. GM does not report monthly sales data. Based on preliminary data, it looks like industry wide sales will decline ~-20%. (US June Vehicle Sales Forecast is Down on Record Prices)

However, GM outsold Toyota year-to-date at 1,095,247 vehicles to Toyota’s 1,045,697. Toyota is struggling with production because of chip shortages and COVID shut downs, particularly in China. (Toyota Motor North America June US Sales Down -17.9%)

“GM’s sales and market share have grown each of the last three quarters, even with lingering supply chain disruptions,” said Steve Carlisle, GM executive vice president and president, North America. “Our long-term momentum will continue to build thanks to the launches of groundbreaking new EVs like the GMC HUMMER EV and Cadillac LYRIQ, and the tremendous customer response to the Chevrolet Silverado and GMC Sierra,” claimed Carlisle.

Click to Enlarge.

GM vehicle production was strong during the second quarter and the company finished the month with 247,839 vehicles in dealer inventory, including units in-transit to dealers. However, GM’s second quarter vehicle wholesale volumes were impacted by the ongoing semiconductor supply shortage and other supply chain disruptions mostly in June.

As a result, GM will hold about 95,000 vehicles manufactured without certain components in company inventory until they are completed and will recognize revenue when they are sold to dealers, which is expected to happen throughout the second half of 2022. The impact of these events, which is not expected to impact GM’s full-year earnings guidance, is discussed in an SEC Form 8-K filed today.

“We appreciate the patience and loyalty of our dealers and customers as we strive to meet significant pent-up demand for our products, and we will work with our suppliers and manufacturing and logistics teams to deliver all the units held at our plants as quickly as possible,” said Carlisle.

GM Q2 at a Glance

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.