The UK automotive industry is today calling on government to allow the country’s 4900 new car showrooms to reopen “as a matter of urgency,” as new calculations from the Society of Motor Manufacturers and Traders (SMMT) reveal a £61 million daily cost to the Treasury of keeping dealerships closed.

The UK automotive industry is today calling on government to allow the country’s 4900 new car showrooms to reopen “as a matter of urgency,” as new calculations from the Society of Motor Manufacturers and Traders (SMMT) reveal a £61 million daily cost to the Treasury of keeping dealerships closed.

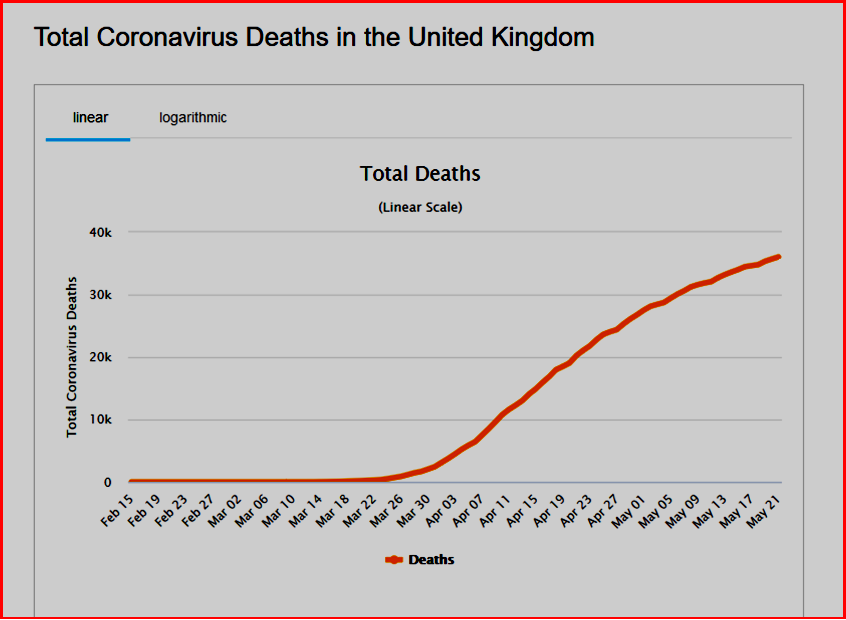

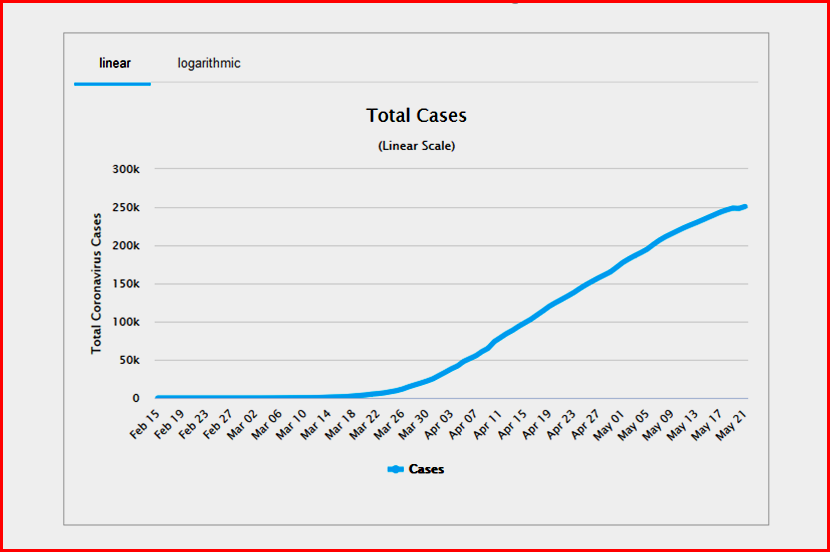

The move at first glance appears to a bad one given the scope of the COVID-19 crisis in the UK and the ineptness of the response from 10 Downing street. Coronavirus Cases are currently listed at 254,195, with 36,393 Deaths. These numbers are most assuredly understated given the disarray of policy, confusing government briefings, complications at the National Health Service, and perhaps political interference in the reporting system – a global problem. (Government scientist admits March halt on community testing and tracing for coronavirus was due to limited capacity)

The annual taxes harvested from VAT, VED and other taxes on new car sales to private buyers alone amounts to some £5.4 billion. However, lock-down restrictions that forced showrooms to shut up shop will, by the end of the month, have cut this figure by almost a quarter (23%), with every additional day of closure costing £20 million.1 So there is substantial economic pressure to put a price on a human life. UK automotive retail employs 590,000, who together work to drive a sector worth £200 billion.

The annual taxes harvested from VAT, VED and other taxes on new car sales to private buyers alone amounts to some £5.4 billion. However, lock-down restrictions that forced showrooms to shut up shop will, by the end of the month, have cut this figure by almost a quarter (23%), with every additional day of closure costing £20 million.1 So there is substantial economic pressure to put a price on a human life. UK automotive retail employs 590,000, who together work to drive a sector worth £200 billion.

In addition, furloughing the retail sector’s 590,000 workers under the Job Retention Scheme, which has provided a lifeline to many during the crisis, is costing an estimated £41 million a day2 – a bill that could be reduced if retailers were able to start to bring staff back to work.

The news comes as SMMT launches a new 10 reasons to #unlockukauto campaign, which sets out the benefits of allowing UK dealerships to reopen to kick-start the market, which fell by a devastating -97.3% in April.3 Car showrooms, which are generally large spaces, lend themselves more readily to social distancing, and manufacturers and retailers have been working hard to implement comprehensive measures to ensure the safety of customers and staff during every interaction, from browsing and vehicle demos, to test drives and transactions.

As the UK returns to work, getting the new car market moving again will help take pressure off public transport, kick-start the economy and boost the UK’s £82 billion automotive manufacturing sector, which has already been hit by losses of more than £8 billion.4 Although production lines are gradually beginning to roll again, with almost half of the country’s car and engine plants set to be operating by the end of May, output is at a much slower pace as manufacturers enforce strict social distancing measures and market demand remains subdued.

Mike Hawes, SMMT Chief Executive, said, “Government measures to support the critical automotive industry during the crisis have provided an essential lifeline, and the sector is now ready to return to work to help the UK rebuild. Car showrooms, just like garden centers, are spacious and can accommodate social distancing easily, making them some of the UK’s safest retail premises.

“Allowing dealers to get back to business will help stimulate consumer confidence and unlock recovery of the wider industry, boosting tax revenue and reducing the burden on government spending. Unlike many other retail sectors, car sales act as the engine for manufacturing and reopening showrooms is an easy and relatively safe next step to help get the economy restarted. With every day of closure another day of lost income for the industry and Treasury, we see no reason for delay,” claimed Hawes.

UK Automotive signaled its readiness to restart vehicle sales, with the publication last week of best practice guidance to ensure showrooms are safe spaces for customers and staff.5 Compiled by SMMT in partnership with the National Franchised Retailers Association (NFDA) and with input from major manufacturers and dealer groups, “the advice is designed to complement government rules on social distancing and hygiene measures for the overall retail sector.”

Footnotes

- Calculation based on VAT, first year VED and IPT on new cars registered to private buyers in the UK using average vehicle price, applied to year-on-year market losses during lockdown period

- Estimate based on assumed 80% of UK auto retail workforce furloughed under the CJRS at 80% of wages, and average sector wage (ONS data)

- SMMT data: new car registrations for April

- Independent forecast by Auto Analysis April 2020 – £8.2bn value of lost production at OEMs between March shutdowns and plants re-opening in mid-May.

- The NFDA and SMMT automotive retail guidance and best practice is designed to complement official advice and will be updated to reflect any changes over time

- Recent surveys from Auto Trader, Ebay and What Car?

Pingback: COVID-nomics – Plague Meets the Dreary Science | AutoInformed