A bizarre accounting rule allows Highway Trust Fund programs “to skirt budgetary control mechanisms.” It makes understanding the budgetary implications of associated legislation more difficult.

The US federal government spends more than $50 billion per year on surface transportation programs, mostly in the form of grants to state and local governments. Much of this spending is for highways and mass transit programs financed through the Highway Trust Fund. However, the latest report from the Congressional budget office says that a “unique budgetary classification” as discretionary limits the effectiveness of budgetary controland is one of the primary reasons why the deficit is growing.

The Highway Trust Fund report is unwelcome news for politicians of both parties who have refused to act on the problem for a decade or more, showing particular reluctance to raise taxes as the nation’s infrastructure crumbles. HTF revenues come from excise taxes on the sale of motor fuels, trucks and trailers, and truck tires, and from taxes on the use of certain kinds of vehicles.

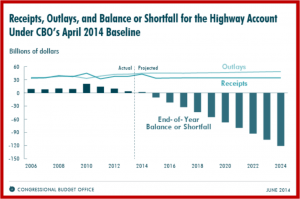

During the past 10 years, outlays from the Highway Trust Fund have exceeded revenues by more than $52 billion. Outlays will exceed revenues by an estimated $167 billion over the 2015–2024 period if obligations from the fund continue at the 2014 rate (with adjustments for future inflation) and the expiring taxes on fuels and heavy vehicles are extended at their current rates, says CBO.

Since 2008, lawmakers have addressed shortfalls by transferring $54 billion, mostly from the general fund of the Treasury, to the Highway Trust Fund. Under current law, the trust fund cannot incur negative balances, nor can it borrow to cover unmet obligations.

Since 1988, for the surface transportation programs examined in the CBO report, the budget authority has been classified as mandatory while the outlays are classified as discretionary.

Therefore, most procedures for controlling federal spending do not apply to spending for surface transportation. Reclassifying transportation programs would then allow standard budgetary controls to apply, which might be the reason the system exists the way it is now and won’t be fixed by politicians anytime soon. (*1 below)

“To match the trust fund’s resources with its spending, lawmakers could choose to authorize additional transfers, reduce spending for surface transportation programs, boost the fund’s revenues, or adopt some combination of those approaches,” CBO says.

CBO: “The processes that the Congress uses to manage the budget—procedural points of order and other Congressional rules designed to control budget deficits—are largely designed to monitor either a program’s mandatory outlays or its discretionary budget authority. But, with mandatory budget authority and discretionary outlays, surface transportation programs funded from the Highway Trust Fund are generally not subject to the processes that control spending for most other programs:

• Spending for mandatory programs is usually subject to certain reductions—mostly across-the-board cuts—under budget rules. However, outlays for the trust fund’s surface transportation programs are not subject to those rules because they are considered discretionary.

• Spending for most discretionary programs is controlled by statutory caps on discretionary budget authority. However, outlays for the trust fund’s surface transportation programs are not constrained by those caps because the budget authority for those programs is considered mandatory.

That split budgetary treatment allows programs funded by the Highway Trust Fund to skirt budgetary control mechanisms and makes understanding the potential budgetary implications of legislation more difficult for policymakers and transportation stakeholders.” (How CBO displays transportation funding in its cost estimates is explained in Anatomy of a Cost Estimate for Legislation Funding Transportation Programs, June 2014.)

(*1 CBO) “Federal programs obtain the authority to incur financial obligations (referred to as budget authority) either in permanent law or in annual appropriation acts; the spending to pay for those obligations is recorded as outlays in the budget. Budget authority and outlays derived from annual appropriation acts are usually classified as discretionary, and those derived from other laws are labeled mandatory. Generally, the budget authority and outlays of a federal program are both classified in the federal budget as either mandatory or discretionary.”