The latest report from the non-partisan Congressional Budget Office paints a grim picture of the status of the Highway Trust Fund that is supposed to keep the nation’s transportation infrastructure up to date and in good repair.

Put simply, the Highway Fund is bankrupt. This means in a reality-based world that politicians eschew either an increase in taxes or cuts in spending on construction already approved – many of them pet projects of Congressmen and some in progress – or a combination of both.

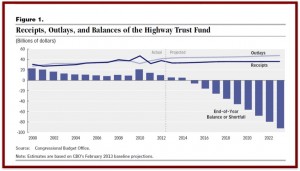

CBO projections show the revenues from existing taxes will fall “far short of covering the spending” that politicians have dictated for a variety of programs. Starting in fiscal year 2015, the Trust Fund cannot meet all of its obligations, resulting in steadily accumulating deficits.

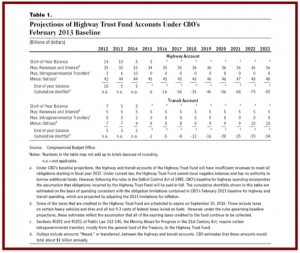

The Trust Fund is an accounting device in the federal budget of two separate categories, one for highways and one for mass transit. Revenues credited to those accounts come mostly from excise taxes on gasoline and other motor fuels. The fund also gets credit for interest on its balances.

CBO projections show the revenues from existing taxes will fall “far short of covering the spending” that politicians have dictated for a variety of programs. Starting in fiscal year 2015, the trust fund cannot meet all of its obligations, resulting in steadily increase in deficits.

The Highway Trust Fund problem has existed for decades and the political unattractiveness of either increasing taxes or cutting pork has prevented any serious attempt at resolution by elected officials – the same deadly dynamic that led to the overall budget crisis in the U.S. Elected officials simply “kick the can down the road,” in the words of President Obama, who has fully participated in the debacle along with his Republican DOT Secretary Ray LaHood.

Since 2008, the Congress has avoided the deficits by transferring $41 billion from the general fund of the Treasury to the Highway Trust Fund, robbing Peter to pay Paul, and thereby contributing to the larger deficit crisis. An additional transfer of $12.6 billion is in the law for 2014 in spite of all the blather in Washington about becoming fiscally responsible.

CBO notes that if lawmakers continue the transfers, they would have to take an additional $14 billion from the general fund to prevent the projected shortfall in 2015. The likely reason this will happen, in AutoInformed’s view, are the grim alternatives to raiding the General Fund once again – huge tax increases or cancellations of numerous projects.

The governing legislation here is the “Moving Ahead for Progress in the 21st Century,” aka MAP-21 or Public Law 112-141, the most recent Congressional authorization for highway and transit programs. By CBO’s estimates, outlays from the highway account will total $44 billion in 2013, while revenues and interest earnings will amount to only $33 billion for the year. To bridge that gap partly, MAP-21 transferred (stole?) $6 billion of general funds to the highway account in 2013.

If you want to fix the problem by cutting spending, the highway account would have to be reduced by about 25% in 2014 and in subsequent years. Cuts would be about 50% for the transit account. If lawmakers kick the can down the road again until fiscal year 2015 to reduce spending, cuts would need to total 92 % for the highway account and 100% for the transit account. Cuts in subsequent years would have to be about 25% of the amounts projected in CBO’s baseline analysis.

Another approach to bringing the trust fund’s finances into equilibrium would be to increase its revenues. Excise taxes credited to the Highway Trust Fund come primarily from an 18.4 cent-per-gallon tax on gasoline and ethanol-blended fuels, and a 24.4 cent-per-gallon tax on diesel fuels.

These taxes were last increased in 1993. (If those excise taxes are adjusted using the consumer price index, the tax on gasoline today would be about 29 cents per gallon, and the tax on diesel fuels would be about 39 cents per gallon.) The purchasing power of the excise taxes on motor fuels dedicated to the Highway Trust Fund is about 62% of what it was 20 years ago.

A one-cent increase in the taxes on motor fuels effective 1 October 1 2014 would raise about $1.5 billion annually for the trust fund over the next 10 years. If lawmakers chose to meet obligations projected for the trust fund solely by raising revenues, they would have to increase the taxes on motor fuels by about 10 cents per gallon.

The alternative is a combination of both: cut spending and increase taxes, with infinite variables possible in special interest dominated Washington. Complicating the timing, MAP-21 expires in 2015 and a new Bill or re authorization will be required to continue.