Honda Motor today in Japan said that notwithstanding unfavorable factors such as a decrease in demand due to the impact of the COVID-19 pandemic and the impact of semi-conductor supply shortages, it made a consolidated operating profit for the fiscal year ended March 31, 2021 (FY21) of 660.2 billion yen ($6.036B). This was due “primarily to control of selling, general and administrative (SG&A) expenses and cost reduction efforts based on a review of business activities, as well as an increase in profit due to a year-on-year difference in the amount of the provision for credit losses recorded for financial services business.”

Honda Motor today in Japan said that notwithstanding unfavorable factors such as a decrease in demand due to the impact of the COVID-19 pandemic and the impact of semi-conductor supply shortages, it made a consolidated operating profit for the fiscal year ended March 31, 2021 (FY21) of 660.2 billion yen ($6.036B). This was due “primarily to control of selling, general and administrative (SG&A) expenses and cost reduction efforts based on a review of business activities, as well as an increase in profit due to a year-on-year difference in the amount of the provision for credit losses recorded for financial services business.”

Consolidated profit for the year attributable to owners of the parent company faced a year-on-year increase that amounted to 657.4 billion yen, due also to an increase in the share of profit of investments accounted for using the equity method.

Despite the impact of an increase in raw material prices and a year-on-year difference in the amount of the provision for credit losses recorded, Honda forecasts a consolidated operating profit of 660 billion yen for the fiscal year ending March 31, 2022 (FY22), equivalent to that of FY21. This will come from increasing unit sales and making progress in initiatives to solidify its existing businesses. “Although production adjustments are currently being made at some Honda production operations globally due primarily to semi-conductor supply shortages, Honda said it “will minimize the impact of such production adjustments for the full-year results.”

Quarterly dividend for the fiscal Q4 will be 54 yen per share; total dividends to be paid for the fiscal year ended March 31, 2021(FY21) will be 110 yen per share, an increase by 28 yen per share compared to the previously announced forecast. The forecast for total dividends to be paid for the fiscal year ending March 31, 2022(FY22) is 110 yen per share, equivalent to that of FY21. “With the aim to ensure stable and constant dividend distribution, the frequency of dividend payments will be changed to twice a year.” Honda said.

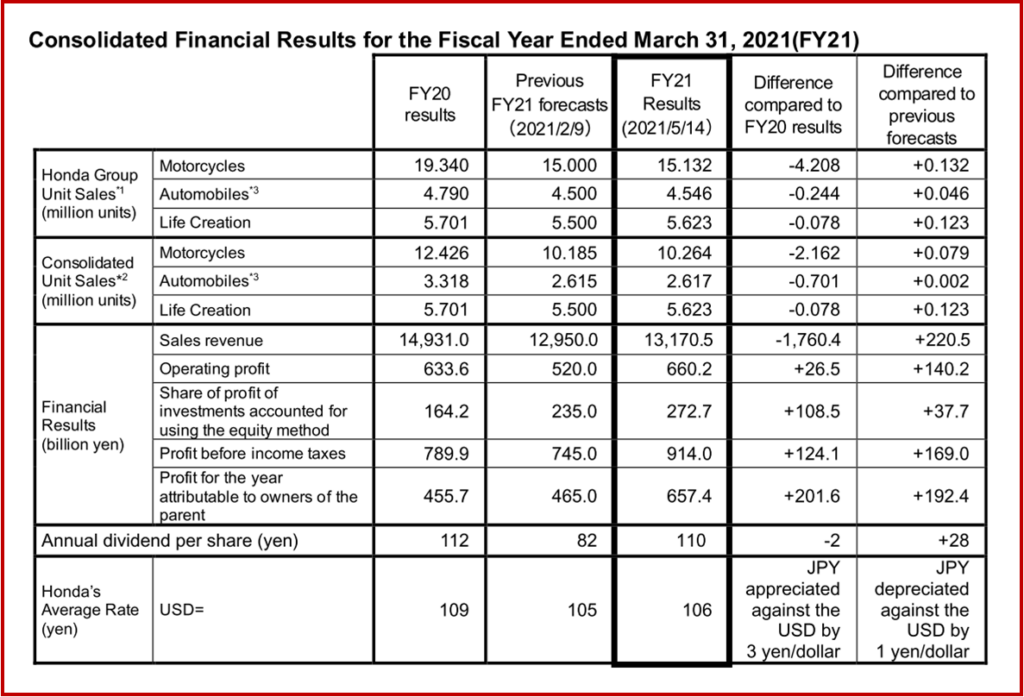

Consolidated Summary for FY 2021

- Sales revenue: 13,170.5 billion yen (a year-on-year decrease of 11.8%)

The year-on-year decrease was due to a decrease in sales revenue from all businesses due primarily to the impact of the COVID-19 pandemic.

- Operating profit: 660.2 billion yen (a year-on-year increase of 4.2%)

The year-on-year increase was due primarily to control of SG&A expenses and cost reduction efforts. This was despite a decrease in profit related to changes in sales volume and model mix.

- Profit before income taxes: 914.0 billion yen (a year-on-year increase of 15.7%)

- Profit for the year attributable to owners of the parent: 657.4 billion yen (a year-on-year increase of 44.3%)

Business-by-business results for the fiscal order gabapentin FY2021 Q4 ended 31 March 2021

- Sales revenue: 3,623.8 billion yen (a year-on-year increase of 4.8%) The increase was due to an increase in sales revenue from all businesses.

- Operating profit: 213.2 billion yen (a year-on-year increase of 218.8 billion yen)

The increase was due primarily to control of SG&A expenses and an increase in profit related to changes in sales volume and model mix.

Motorcycle business

- Sales revenue: 529.1 billion yen (a year-on-year increase of 55.5 billion yen)

The increase was due to the recovery of sales mainly in Asia.

- Operating profit: 72.2 billion yen (a year-on-year increase of 8.7 billion yen).

The increase was due primarily to an increase in profit related to changes in sales volume and model mix and cost reduction efforts.

Automobile business

- Sales revenue: 2,418.4 billion yen (a year-on-year increase of 79.6 billion yen)

The increase was due primarily to an increase in sales in Asia. This was despite a decrease in sales in some regions including the U.S. and Europe.

- Operating profit: 37.6 billion yen (a year-on-year increase of 113.3 billion yen)

The increase was due primarily to control of SG&A expenses and an increase in profit related to changes in sales volume and model mix.

Combined with operating profit from financial services business related to automobile sales, the estimated operating profit for automobile business is 140.4 billion yen.

Financial Services business

- Operating profit: 106.3 billion yen (a year-on-year increase of 83.4 billion yen)

The increase was due primarily to a year-on-year difference in the amount of the provision for credit losses recorded.

Life Creation ( aka power products) and Other businesses

- Operating loss: 3.0 billion yen (a year-on-year improvement of 13.3 billion yen)

Aircraft/aircraft engine business, which is included in “Other businesses,” accounted to an operating loss of 7.8 billion yen.

Honda Group Footnotes

- Honda Group Unit Sales is the total unit sales of completed products (motorcycles, ATVs, Side-by-Sides, automobiles, power products) of Honda, its consolidated subsidiaries and its affiliates and joint ventures accounted for using the equity method.

- Consolidated Unit Sales is the total unit sales of completed products (motorcycles, ATVs, Side-by-Sides, automobiles, power products) corresponding to consolidated sales revenue, which consists of unit sales of completed products of Honda and its consolidated subsidiaries.

- Certain sales of automobiles that are financed with residual value type auto loans by our Japanese finance subsidiaries and sold through our consolidated subsidiaries are accounted for as operating leases in conformity with IFRS and are not included in consolidated sales revenue to the external customers in our automobile business. Accordingly, they are not included in Consolidated Unit Sales, but are included in Honda Group Unit Sales of our automobile business.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Honda Motor Posts FY 2021 Operating Profit of ¥660.2 Billion

Consolidated profit for the year attributable to owners of the parent company faced a year-on-year increase that amounted to 657.4 billion yen, due also to an increase in the share of profit of investments accounted for using the equity method.

Despite the impact of an increase in raw material prices and a year-on-year difference in the amount of the provision for credit losses recorded, Honda forecasts a consolidated operating profit of 660 billion yen for the fiscal year ending March 31, 2022 (FY22), equivalent to that of FY21. This will come from increasing unit sales and making progress in initiatives to solidify its existing businesses. “Although production adjustments are currently being made at some Honda production operations globally due primarily to semi-conductor supply shortages, Honda said it “will minimize the impact of such production adjustments for the full-year results.”

Quarterly dividend for the fiscal Q4 will be 54 yen per share; total dividends to be paid for the fiscal year ended March 31, 2021(FY21) will be 110 yen per share, an increase by 28 yen per share compared to the previously announced forecast. The forecast for total dividends to be paid for the fiscal year ending March 31, 2022(FY22) is 110 yen per share, equivalent to that of FY21. “With the aim to ensure stable and constant dividend distribution, the frequency of dividend payments will be changed to twice a year.” Honda said.

Consolidated Summary for FY 2021

The year-on-year decrease was due to a decrease in sales revenue from all businesses due primarily to the impact of the COVID-19 pandemic.

The year-on-year increase was due primarily to control of SG&A expenses and cost reduction efforts. This was despite a decrease in profit related to changes in sales volume and model mix.

Business-by-business results for the fiscal order gabapentin FY2021 Q4 ended 31 March 2021

The increase was due primarily to control of SG&A expenses and an increase in profit related to changes in sales volume and model mix.

Motorcycle business

The increase was due to the recovery of sales mainly in Asia.

The increase was due primarily to an increase in profit related to changes in sales volume and model mix and cost reduction efforts.

Automobile business

The increase was due primarily to an increase in sales in Asia. This was despite a decrease in sales in some regions including the U.S. and Europe.

The increase was due primarily to control of SG&A expenses and an increase in profit related to changes in sales volume and model mix.

Combined with operating profit from financial services business related to automobile sales, the estimated operating profit for automobile business is 140.4 billion yen.

Financial Services business

The increase was due primarily to a year-on-year difference in the amount of the provision for credit losses recorded.

Life Creation ( aka power products) and Other businesses

Aircraft/aircraft engine business, which is included in “Other businesses,” accounted to an operating loss of 7.8 billion yen.

Honda Group Footnotes

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.