Despite unfavorable factors such as a decrease in automobile production and unit sales due to the impact of the semiconductor supply shortage and an increase in the cost of raw materials, Honda Group*1 profit was ¥453.4B. This was a year-on-year increase of ¥11.2B. This was due primarily to increased pricing, a reduction of incentives, an increase in motorcycle sales and favorable currency effects, Honda said.

Consolidated profit for the fiscal first half (6 months) attributable to owners of the parent company amounted to ¥338.5B, a year-on-year drop of ¥50.6B due primarily to a decrease in the share of profit of investments accounted for using the equity method.

Click for more information.

“Despite the impact of a decrease in automobile unit sales and the forecast continuation of upward pressure on costs, the previously announced forecast for consolidated operating profit for the current fiscal year ending 31 March 2023 (FY23) was revised upward by ¥40B to ¥870B, reflecting an increase in motorcycle unit sales in some countries such as India and Vietnam and recent currency effects,” Honda said. The previously announced forecast for profit for the fiscal year attributable to owners of the parent was revised upward by 15B to 725B.

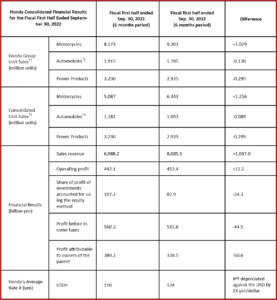

Consolidated financial summary and business results for the fiscal first half (6 months) ended 30 September 30 2022

- Sales revenue: ¥ 8,085.3B (a year-on-year increase of 15.7%) due primarily to higher motorcycle sales and favorable currency effects.

- Operating profit: ¥ 453.4B (a year-on-year increase of 2.5%)

- Profit for the period attributable to owners of the parent: ¥ 338.5B, (a year-on-year decrease of 13.0%).

Motorcycle business

- Sales revenue: ¥1,412.6B (a year-on-year increase of 38.0%) due primarily to higher sales in Asia and favorable currency effects.

- Operating profit: ¥224.7B (a year-on-year increase of 51.7%) due primarily to an increase in profit attributable to higher sales volume, price and cost impacts, and favorable currency effects.

Automobile business

- Sales revenue: ¥5,003.9B (a year-on-year increase of 12.8%) Although sales decreased mainly in North America, sales revenue experienced a year-on-year increase due primarily to favorable currency effects.

- Operating profit: ¥63.5B (a year-on-year decrease of 45.7%) due to a decrease in profit attributable to lower sales volume.

- Combined with operating profit from financial services business related to automobile sales, the estimated operating profit for automobile business is 211.3B .

Financial Services business

- Operating profit: ¥153.0B (a year-on-year decrease of 13.4%)

Power Product and Other businesses

- Operating profit: ¥12.0B (a year-on-year increase of ¥11.9B )

Aircraft/aircraft engine business, which is included in “Other businesses,” accounted for an operating loss of ¥12.0B.

Forecasts for the Fiscal Year Ending 31 March 2023 (FY23)

- Sales revenue: ¥17,400B , an upward revision of the previously announced forecast by ¥650B .

- Operating profit: ¥870B , an increase in the previously announced forecast by ¥40B

- Profit for the fiscal year attributable to owners of the parent: 7¥25B an upward revision of the previously announced forecast by ¥15B.

Inevitable Honda Footnotes

*1 Honda Group Unit Sales is the total unit sales of completed products (motorcycles, ATVs, Side-by-Sides, automobiles, power products) of Honda, its consolidated subsidiaries and its affiliates and joint ventures accounted for using the equity method.

*2 Consolidated Unit Sales is the total unit sales of completed products (motorcycles, ATVs, Side-by-Sides, automobiles, power products) corresponding to consolidated sales revenue, which consists of unit sales of completed products of Honda and its consolidated subsidiaries.

*3 Certain sales of automobiles that are financed with residual value type auto loans and others by our Japanese finance subsidiaries and provided through our consolidated subsidiaries are accounted for as operating leases in conformity with IFRS and are not included in consolidated sales revenue to the external customers in our automobile business. Accordingly, they are not included in Consolidated Unit Sales, but are included in Honda Group Unit Sales of the automobile business.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Honda Posts a Profit of ¥453.4B for First Half FY Results

Despite unfavorable factors such as a decrease in automobile production and unit sales due to the impact of the semiconductor supply shortage and an increase in the cost of raw materials, Honda Group*1 profit was ¥453.4B. This was a year-on-year increase of ¥11.2B. This was due primarily to increased pricing, a reduction of incentives, an increase in motorcycle sales and favorable currency effects, Honda said.

Consolidated profit for the fiscal first half (6 months) attributable to owners of the parent company amounted to ¥338.5B, a year-on-year drop of ¥50.6B due primarily to a decrease in the share of profit of investments accounted for using the equity method.

Click for more information.

“Despite the impact of a decrease in automobile unit sales and the forecast continuation of upward pressure on costs, the previously announced forecast for consolidated operating profit for the current fiscal year ending 31 March 2023 (FY23) was revised upward by ¥40B to ¥870B, reflecting an increase in motorcycle unit sales in some countries such as India and Vietnam and recent currency effects,” Honda said. The previously announced forecast for profit for the fiscal year attributable to owners of the parent was revised upward by 15B to 725B.

Consolidated financial summary and business results for the fiscal first half (6 months) ended 30 September 30 2022

Motorcycle business

Automobile business

Financial Services business

Power Product and Other businesses

Aircraft/aircraft engine business, which is included in “Other businesses,” accounted for an operating loss of ¥12.0B.

Forecasts for the Fiscal Year Ending 31 March 2023 (FY23)

Inevitable Honda Footnotes

*1 Honda Group Unit Sales is the total unit sales of completed products (motorcycles, ATVs, Side-by-Sides, automobiles, power products) of Honda, its consolidated subsidiaries and its affiliates and joint ventures accounted for using the equity method.

*2 Consolidated Unit Sales is the total unit sales of completed products (motorcycles, ATVs, Side-by-Sides, automobiles, power products) corresponding to consolidated sales revenue, which consists of unit sales of completed products of Honda and its consolidated subsidiaries.

*3 Certain sales of automobiles that are financed with residual value type auto loans and others by our Japanese finance subsidiaries and provided through our consolidated subsidiaries are accounted for as operating leases in conformity with IFRS and are not included in consolidated sales revenue to the external customers in our automobile business. Accordingly, they are not included in Consolidated Unit Sales, but are included in Honda Group Unit Sales of the automobile business.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.