Click for more.

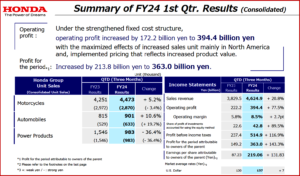

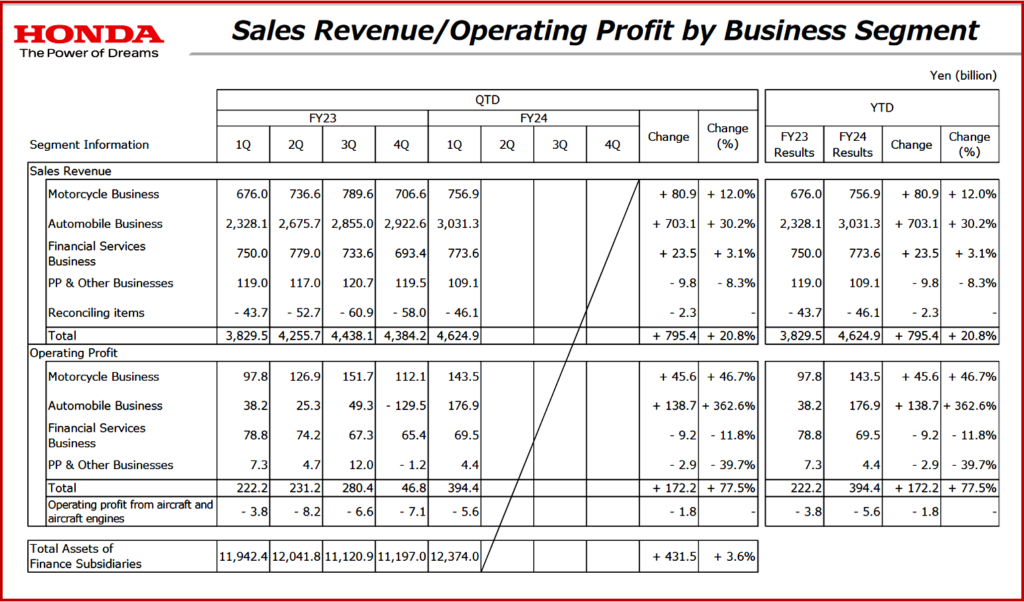

Honda Motor (7267.T) more than doubled sales in North America during Q1 of the 2024 Japanese fiscal year as it posted an operating profit of ¥394.4 billion (~$2.76 billion – Q1 2023 ¥222.2 b) in three months through June, with an Operating Margin of 8.5%.

The sales increase in North America boosted revenues in the automobile business by~26% as the Biden Administration economic recovery continued in the US for all automakers.* (AutoInformed: GM Posts Strong Q2 Results with $3.2B in Earnings; Toyota Posts Strong FY 2024 Q1 Results – $9.2 Billion Net; US Sales Lengthen Bidenomics Growth Streak in July)

Click for more.

A 3-for-1 stock split effective September 30th has been approved by management. Calculating on the current number of shares (~165,000,000) , the year-end dividend and the total annual dividend for fiscal 2024 are forecast at ¥75/share and ¥150/share. In current Tokyo trading the stock is up ~6% within ¥30 to its all-time (¥4,723) high posted in 2006.

At the end of Q1, consolidated cash and cash equivalents were at ¥4.08 trillion (~$28.25 billion). Long-term debt was ¥4.89 trillion (~$33.85 billion) up from ¥4.37 trillion as of 31 March 2023.

Honda Forecast

- Motorcycle, Automobile and Power Products sales at 19.18 million units, 4.35 million units and 4.75 million units in fiscal 2024, respectively. This compares with fiscal 2023 volumes of 18.75 million units, 3.68 million units and 5.64 million units, respectively.

- Revenues fiscal 2024 of ¥18.2 trillion, ~ +7.6% year-over-year.

- Operating profit at ¥1 trillion, or an increase of 28.1% year-over-year.

- Pretax profit of ¥1.185 billion, +34.7% year-over-year.

*”I expect that the unemployment rate will rise above 4% next year, but I can’t say with any conviction how much will that need to happen,” said John Williams, President and CEO of the Federal Reserve Bank of New York this week. “It will depend on how all the pieces come together, how much inflation continues to come down because of the reversal of some of the factors that drove it up – like the pandemic-related factors, Russia’s war in Ukraine, all of the other things… We have a path forward, where the economy continues to grow below trend and unemployment edges up somewhat, and inflation comes back down – exactly what that means for the employment rate, I can’t say with any certainty. My own view is that the unemployment rate, in order to achieve all of that, may rise to something like 4% to 4.5%, but we’ll have to see. Which is still, by historical standards, a very, very low unemployment rate.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Honda Q1 FY2024 Profits Double – Stock Split Coming

Click for more.

Honda Motor (7267.T) more than doubled sales in North America during Q1 of the 2024 Japanese fiscal year as it posted an operating profit of ¥394.4 billion (~$2.76 billion – Q1 2023 ¥222.2 b) in three months through June, with an Operating Margin of 8.5%.

The sales increase in North America boosted revenues in the automobile business by~26% as the Biden Administration economic recovery continued in the US for all automakers.* (AutoInformed: GM Posts Strong Q2 Results with $3.2B in Earnings; Toyota Posts Strong FY 2024 Q1 Results – $9.2 Billion Net; US Sales Lengthen Bidenomics Growth Streak in July)

Click for more.

A 3-for-1 stock split effective September 30th has been approved by management. Calculating on the current number of shares (~165,000,000) , the year-end dividend and the total annual dividend for fiscal 2024 are forecast at ¥75/share and ¥150/share. In current Tokyo trading the stock is up ~6% within ¥30 to its all-time (¥4,723) high posted in 2006.

At the end of Q1, consolidated cash and cash equivalents were at ¥4.08 trillion (~$28.25 billion). Long-term debt was ¥4.89 trillion (~$33.85 billion) up from ¥4.37 trillion as of 31 March 2023.

Honda Forecast

*”I expect that the unemployment rate will rise above 4% next year, but I can’t say with any conviction how much will that need to happen,” said John Williams, President and CEO of the Federal Reserve Bank of New York this week. “It will depend on how all the pieces come together, how much inflation continues to come down because of the reversal of some of the factors that drove it up – like the pandemic-related factors, Russia’s war in Ukraine, all of the other things… We have a path forward, where the economy continues to grow below trend and unemployment edges up somewhat, and inflation comes back down – exactly what that means for the employment rate, I can’t say with any certainty. My own view is that the unemployment rate, in order to achieve all of that, may rise to something like 4% to 4.5%, but we’ll have to see. Which is still, by historical standards, a very, very low unemployment rate.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.