If you want a case study of our dysfunctional and irresponsible elected leaders then look at Michigan Proposal 1 that is on the ballot this May.

Prop 1 is being promoted as a way to fix our crumbling roads, but instead of a bill that simply increases the gasoline and diesel fuel taxes and stipulates that the revenue raised goes to fixing roads and other transportation matters, special interests are getting a lot of the loot while – in effect – heavy users of the rotten roads are subsidized.

A clean road repair bill – one not wallowing in the mud like pigs that want to feed at the public trough – would say that the more fuel you use, the more you pay. That would be a direct and fair tax, and proper use of government authority. This is or could/should be a simple solution to a problem that lawmakers have been ignoring for decades.

Michigan governors Rick Snyder (R, who cut taxes for the Rich including the fuel tax on private jets while increasing them for the middle class and blue collar retirees), Jennifer Granholm (D, which to some people means Dumb because she didn’t know how a bill could be advanced in the legislature when and after being elected, according to her party leaders) and John Engler (R, who went on in the scandalous Revolving door way of American politics after three terms as governor to become the highly paid CEO of the National Association of Manufacturers – a group whose work uses and abuses roads – kicked the crumbling Michigan pavement pieces and the shredded tire treads from overweight, overloaded trucks down the road.

However, only the simpletons in Michigan government do not understand the reasoning for a straight up tax on the people and firms that use and ultimately wear out the roads. For craven political reasons these so-called public servants (they are in our view the Private Servants of special interests) are now pretending that they do not understand the taxpayer outrage over the complicated package of laws replete with earmarks and a constitutional amendment that they proposed during last December’s lame duck session.

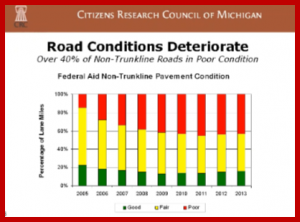

Proposal 1, if passed, allegedly, would raise an additional $2.1 billion in the 2015-16 fiscal year, but not all of that would go to roads. A Michigan House Fiscal Agency study says that in the first two years, $1.3 billion would go to paying down debt the state incurred when it borrowed to finance road repairs following a 1997 attempt to deal with the problem that clearly failed, which you should be reminded of every time – kaplunk, thunk, bam – you hit a pothole if you have the misfortune of driving in Michigan. (Also see the website of the Citizens Research Council of Michigan http://www.crcmich.org/)

What is actually going on right now in the Michigan legislature – before the Prop 1 voting on 5 May – are proposed bills that would see transportation budget appropriations cut by about $69 million in the $3.6 billion House transportation budget or almost $90 million in Senate version of the bill. AutoInformed is not making this up, although it reads like a Terry Southern satire.

AutoInformed thinks that Proposal 1 should be called Prostitution 1 because almost half of the money generated would go to other interest groups and not to fixing roads. Proposal 1 would increase the sales and use tax on non-fuel items from 6% to 7%, a whopping 17% increase while the Michigan economy is still in the Great Recession.

Right now, the Michigan sales tax on fuel provides a significant portion of sales tax revenue, so this gigantic proposed tax increase is intended to offset revenue losses to schools and municipalities, which depend on sales and use tax revenue. Hence the large public support of the proposal by elected state and local officials who have not dealt with fundamental problems with the schools, taxes or fixing the roads going back to the last century.

Ask yourself what does money for public school districts via a burdensome 7% sales tax – among the highest in the nation – while prohibiting public universities from receiving money from the state’s School Aid Fund have to do with potholes and frost heaves?

Consider that this tax increase for all citizens no matter how much they drive comes after the Republicans running Michigan started to tax pension benefits of blue-collar retirees while decreasing corporate taxes to the lowest level – by far – in the region. Republican Governor Snyder – about to go out junketing on taxpayer funds to promote his next job with Republicans since he is term limited – reduced the corporate tax in Michigan from 26% to 6%.

This occurred while the Republican-controlled legislature increased Michigan’s state budget by $4.7 billion during the last four years. The sales tax jump is projected to take in $1.9 billion. Do the math: Raising the sales tax only pays for part of the ongoing expansion of government spending as our third world roads continue to deteriorate. The problem – it’s clear to AutoInformed – is too much additional spending, far too little concern for drivers.

Simply put, this is a $2 billion tax increase that only, maybe, eventually will see 60% spent on transportation, and almost none of the money raised during the first year or two will go toward fixing roads. If Prostitution 1 passes, an average Michigan household will spend an additional $500 in state taxes next year, according to a non-partisan Michigan government study at http://www.house.mi.gov/hfa/

The official ballot reads:

A proposal to amend the State Constitution to increase the sales/use tax from 6% to 7% to replace and supplement reduced revenue to the School Aid Fund and local units of government caused by the elimination of the sales/use tax on gasoline and diesel fuel for vehicles operating on public roads, and to give effect to laws that provide additional money for roads and other transportation purposes by increasing the gas tax and vehicle registration fees.

The proposed constitutional amendment would:

• Eliminate sales / use taxes on gasoline / diesel fuel for vehicles on public roads.

• Increase portion of use tax dedicated to School Aid Fund (SAF).

• Expand use of SAF to community colleges and career / technical education, and prohibit use for 4-year colleges / universities.

Give effect to laws, including those that:

• Increase sales / use tax to 7%, as authorized by constitutional amendment.

• Increase gasoline / diesel fuel tax and adjust annually for inflation, increase vehicle registration fees, and dedicate revenue for roads and other transportation purposes.

• Expand competitive bidding and warranties for road projects.

• Increase earned income tax credit

Should this proposal be adopted?

AutoInformed votes NO, with the expletives deleted on both ends of the NO – prefixes and suffixes.

I want the roads repaired and am willing to be taxed for that but this piece of legislation is unacceptable. Tell the lawmakers they missed the mark by not making this a single issue item.

This subject feels like it’s been worked over pretty well here but after hearing this group’s point of view I wanted to pass their web address onto you.

Obviously I have my own opinion and will be voting no. This group is not pro Prop 1 so if you’ve had enough save your time.

http://saynotohighertaxes.org/

I will say at its core the issue I have with Prop 1, beyond all my other comments is this: We are being asked to approve a plethora of changes that alter our state constitution. These are not temporary in any way.

The people asking us to agree and pay for these changes are very clear; the monies we pay can’t be diverted to any thing but what it’s collected for.

But…. they are the very same people who moved previous tax monies around and caused the mess in the first place.

So to recap this is what Prop 1 is really saying: As your public servants we can not be trusted. To that end we made this tax increase untouchable by law, so we can not divert the money to other things. We do this because we are not able to keep our promises. In order to get this proposal to this point we made deals with our peers so everyone has a piece of the pie which you will have to pay for. Sorry it’s so long and detailed that it can’t be fully explained on the ballot.

All you need to know is what we’ve put into the commercials. Trust us on the rest.

If you thought Granholm was a spend & tax mor-on, it seems Snyder is even far worse. He will guarantee a dimocrat will be elected governor next round. Meanwhile, the legislature should be sent home, their pay cut, & take some time to think about what their responsibility is in all of this. The so-called tea party was NOT about republican taliban issues, but everyday, regular people fed up with self-serving big government that is screwing the middle class, hence Taxed Enough Already! is what it really means. We have to start recalling & unelecting these government sycophants & looters, putting some people in there that get it! Take the $5B budget increase out, take the INCREASE of over $4B in revenue the state has gotten, cut the pay & time of the pols and do the right thing!