Click for more information.

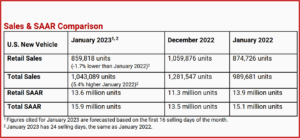

Total new-vehicle sales for January 2023, including retail and non-retail transactions, are projected to reach 1,043,100 units, a 5.4% increase from January 2022, according to a joint forecast from J.D. Power and LMC Automotive* released today. New-vehicle transaction prices continue to rise; however the rate of growth continues to relax. The average price will set a January record of $46,437, an increase of 4.2% from a year ago.

The record transaction prices means that buyers are on track to spend nearly $39.9 billion on new vehicles this month, the highest level ever for the month of January, an increase of 2.4% from January 2022 despite the Federal Reserve’s efforts to send the US into a recession. The looming Republican creation of a depression over the deficit, aka Congressional contract hit on America II, remains ominous.

“As we start 2023, supply chain disruptions continue but are becoming less severe. This is leading to an increase in the number of vehicles being delivered to dealerships and fleet customers. Retail inventory at the end of January is expected to remain above one million units for the fourth consecutive month. However, the overall volume of new vehicles being delivered to dealerships in January is still not sufficient to meet consumer demand, resulting in record transaction prices for the month,” said Thomas King, president of the data and analytics division at J.D. Power.

Several manufacturers are directing a larger portion of their increased production towards fleet customers. Fleet sales have been more heavily inventory constrained than retail sales during the past several years, resulting in significant pent-up demand. Rising production levels now allow manufacturers to shift supply to fleet customers while maintaining retail inventory levels, according to J.D. Power

“Dealer profit per unit is falling from the record highs of 2022—mostly due to a reduction in dealer addendums—but remain historically strong. Total retailer profit per unit—inclusive of grosses and finance and insurance income—is on pace to be $3,975, down 22.0% from a year ago but still more than double 2019 levels. The decline is due primarily to fewer vehicles being sold above MSRP. In January, 33% of new vehicles are being sold above MSRP, down from the high of 48% in July 2022,” said King.

Total aggregate retailer profit from new-vehicle sales for the month of January is projected to be down 23.4% from January 2022, reaching $3.4 billion for the second-best January on record. “Dealerships are still pre-selling a large proportion of their inventory allocation, but increased supply means buyers have more selection as vehicles are spending slightly more time at dealerships. This month, 44% of vehicles will be sold within 10 days of arriving at a dealership, down from a high of 57% in March 2022. The average number of days a new vehicle is in a dealer’s possession before being sold is on pace to be 27 days—up from 19 days a year ago— but still less than half the pre-pandemic average of 70 days,” said King.

Executive Summary

- The average new-vehicle retail transaction price in January is expected to reach $46,437, a 4.2% increase from January 2022. The previous high for any month—$47,362—was set in December 2022.

- Average incentive spending per unit in January is expected to reach $1,260, down from $1,355 in January 2022. Spending as a percentage of the average MSRP is expected to fall to 2.7%, down 0.4 percentage points from January 2022.

- Average incentive spending per unit on trucks/SUVs in January is expected to be $1,265, down $98 from a year ago, while the average spending on cars is expected to be $1,290, down $31 from a year ago.

- Retail buyers are on pace to spend $39.9 billion on new vehicles, up $0.9 billion from January 2022.

- Truck/SUVs are on pace to account for 78.7% of new-vehicle retail sales in January.

- Fleet sales are expected to total 183,300 units in January, up 59.4% from January 2022 on a selling day adjusted basis. Fleet volume is expected to account for 18% of total light-vehicle sales, up from 12% a year ago.

- Average interest rates for new vehicle loans are expected to increase to 6.79%, 264 basis points higher than a year ago.

EV Outlook

“In December 2022, 24.8% of new-vehicle shoppers said they were ‘very likely’ to consider purchasing an EV, which is 4 percentage points lower than November 2022. The softening correlates to gas prices dropping to the lowest levels in nearly a year,” said Elizabeth Krear, vice president, electric vehicle practice at J.D. Power.

Chevrolet again was the most-considered EV brand in December, breaking away from Tesla by 5 percentage points as Tesla saw all five models decrease in consideration. The Lexus RZ was the most-considered premium model. The affordability of EVs improved slightly during the past two months, following a four-month decline. This improvement is driven models.

“As the Inflation Reduction Act unfolds, EV affordability will differentiate by vehicle and by transaction type. Currently, only 10% of EV transactions are leases. Beginning this month, however, the rules for eligibility are far less restrictive on leasing than purchasing, and that will make the $7,500 tax incentive a good reason for many to consider leasing an EV,” noted Krear.

Global Sales Outlook

“Global light-vehicle sales in December were slightly stronger than expected with volume of 7.5 million units, an increase of 1% from December 2021.” Said Jeff Schuster, president, global forecasts, LMC Automotive. “The selling rate held at 83.5 million units, which is consistent with November and 1.3 million units stronger than a year ago. Recovery growth in Western Europe (+13%) North America (+9%) and India (+8%) drove the increase for the month. China remained a drag on the growth, posting a decline of 8% from a year ago. In addition, Eastern Europe was down, but the decline of 8% was the strongest performance since the start of the war in Ukraine,” said Schuster.

Schuster thinks January 2023 is expected to post a 6% decline from January 2022, as some negative effect in China is expected from the incentive last year that has yet to be renewed. The selling rate is forecast to improve from December to 84.1 million units, but January is usually challenging to decipher globally, given the timing of the Lunar New Year.

“This past year was certainly a challenging year, as disruption and negative variables stacked up against the prospects of a recovery during the year. December’s slightly better results did push 2022 to 81.1 million units, a decline of 0.4% from 2021.

“As disruption and economic uncertainty are expected to remain as headwinds in 2023, the outlook continues to hold an elevated level of risk. The forecast for 2023 is at 85.8 million units, an increase of 6% from 2022’s contraction. We expect more downside risk to the forecast, as affordability is a concern with many new-vehicle buyers. This risk could erode up to 2 million units of the expected recovery, cutting the growth to 3% for the year. That said, we continue to believe there is a level of unfulfilled demand that exceeds the level of production and inventory, so a path to a more pronounced recovery exists, but it may be pushed to 2024 or even 2025,” Schuster said.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global client base includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

January US Vehicle Sales Up as Transaction Prices Hit Record

Click for more information.

Total new-vehicle sales for January 2023, including retail and non-retail transactions, are projected to reach 1,043,100 units, a 5.4% increase from January 2022, according to a joint forecast from J.D. Power and LMC Automotive* released today. New-vehicle transaction prices continue to rise; however the rate of growth continues to relax. The average price will set a January record of $46,437, an increase of 4.2% from a year ago.

The record transaction prices means that buyers are on track to spend nearly $39.9 billion on new vehicles this month, the highest level ever for the month of January, an increase of 2.4% from January 2022 despite the Federal Reserve’s efforts to send the US into a recession. The looming Republican creation of a depression over the deficit, aka Congressional contract hit on America II, remains ominous.

“As we start 2023, supply chain disruptions continue but are becoming less severe. This is leading to an increase in the number of vehicles being delivered to dealerships and fleet customers. Retail inventory at the end of January is expected to remain above one million units for the fourth consecutive month. However, the overall volume of new vehicles being delivered to dealerships in January is still not sufficient to meet consumer demand, resulting in record transaction prices for the month,” said Thomas King, president of the data and analytics division at J.D. Power.

Several manufacturers are directing a larger portion of their increased production towards fleet customers. Fleet sales have been more heavily inventory constrained than retail sales during the past several years, resulting in significant pent-up demand. Rising production levels now allow manufacturers to shift supply to fleet customers while maintaining retail inventory levels, according to J.D. Power

“Dealer profit per unit is falling from the record highs of 2022—mostly due to a reduction in dealer addendums—but remain historically strong. Total retailer profit per unit—inclusive of grosses and finance and insurance income—is on pace to be $3,975, down 22.0% from a year ago but still more than double 2019 levels. The decline is due primarily to fewer vehicles being sold above MSRP. In January, 33% of new vehicles are being sold above MSRP, down from the high of 48% in July 2022,” said King.

Total aggregate retailer profit from new-vehicle sales for the month of January is projected to be down 23.4% from January 2022, reaching $3.4 billion for the second-best January on record. “Dealerships are still pre-selling a large proportion of their inventory allocation, but increased supply means buyers have more selection as vehicles are spending slightly more time at dealerships. This month, 44% of vehicles will be sold within 10 days of arriving at a dealership, down from a high of 57% in March 2022. The average number of days a new vehicle is in a dealer’s possession before being sold is on pace to be 27 days—up from 19 days a year ago— but still less than half the pre-pandemic average of 70 days,” said King.

Executive Summary

EV Outlook

“In December 2022, 24.8% of new-vehicle shoppers said they were ‘very likely’ to consider purchasing an EV, which is 4 percentage points lower than November 2022. The softening correlates to gas prices dropping to the lowest levels in nearly a year,” said Elizabeth Krear, vice president, electric vehicle practice at J.D. Power.

Chevrolet again was the most-considered EV brand in December, breaking away from Tesla by 5 percentage points as Tesla saw all five models decrease in consideration. The Lexus RZ was the most-considered premium model. The affordability of EVs improved slightly during the past two months, following a four-month decline. This improvement is driven models.

“As the Inflation Reduction Act unfolds, EV affordability will differentiate by vehicle and by transaction type. Currently, only 10% of EV transactions are leases. Beginning this month, however, the rules for eligibility are far less restrictive on leasing than purchasing, and that will make the $7,500 tax incentive a good reason for many to consider leasing an EV,” noted Krear.

Global Sales Outlook

“Global light-vehicle sales in December were slightly stronger than expected with volume of 7.5 million units, an increase of 1% from December 2021.” Said Jeff Schuster, president, global forecasts, LMC Automotive. “The selling rate held at 83.5 million units, which is consistent with November and 1.3 million units stronger than a year ago. Recovery growth in Western Europe (+13%) North America (+9%) and India (+8%) drove the increase for the month. China remained a drag on the growth, posting a decline of 8% from a year ago. In addition, Eastern Europe was down, but the decline of 8% was the strongest performance since the start of the war in Ukraine,” said Schuster.

Schuster thinks January 2023 is expected to post a 6% decline from January 2022, as some negative effect in China is expected from the incentive last year that has yet to be renewed. The selling rate is forecast to improve from December to 84.1 million units, but January is usually challenging to decipher globally, given the timing of the Lunar New Year.

“This past year was certainly a challenging year, as disruption and negative variables stacked up against the prospects of a recovery during the year. December’s slightly better results did push 2022 to 81.1 million units, a decline of 0.4% from 2021.

“As disruption and economic uncertainty are expected to remain as headwinds in 2023, the outlook continues to hold an elevated level of risk. The forecast for 2023 is at 85.8 million units, an increase of 6% from 2022’s contraction. We expect more downside risk to the forecast, as affordability is a concern with many new-vehicle buyers. This risk could erode up to 2 million units of the expected recovery, cutting the growth to 3% for the year. That said, we continue to believe there is a level of unfulfilled demand that exceeds the level of production and inventory, so a path to a more pronounced recovery exists, but it may be pushed to 2024 or even 2025,” Schuster said.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global client base includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.