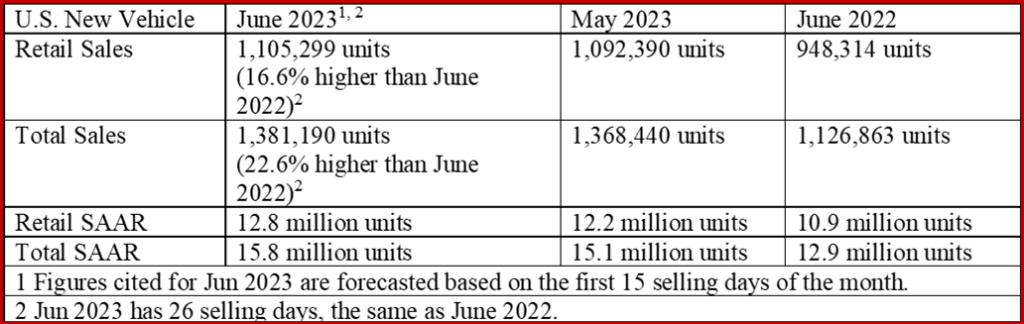

Total new-vehicle sales for June 2023, including retail and non-retail transactions, are forecast to reach 1,381,200 units, a 22.6% increase from June 2022, according to a joint forecast from J.D. Power and GlobalData.* June 2023 has 26 selling days, the same as June 2022. New-vehicle retail sales for June 2023 are projected to grow when compared with June 2022, reaching 1,105,300 units, a 16.6% increase from June 2022, according to the respected consultancies. New-vehicle retail sales for the first six months 2023 are projected to reach 6,161,400 units, a 6.0% increase from the first six months of 2022 on the same number of selling days. Thus the Biden Administration economic recovery continues.

“The 2023 theme of strong sales growth, enabled by increased vehicle production and pent-up demand, is continuing in June. On a volume basis, June year-to-date total sales will be just more than 7.6 million units – an increase of 13.6% – but still below pre-pandemic sales levels which were north of 8 million, said Thomas King, president of the data and analytics division at J.D. Power, which is part of GlobalData.

Click for more data.

“Volume growth is being complemented by further increases in transaction prices which are trending towards being up 3% for the first half of 2023 despite increases in OEM incentives and declines in dealer grosses. As a result, it’s anticipated that consumers will spend nearly $281.4 billion on the purchase of new vehicles in the first half of 2023, a noteworthy 8% growth from the same period a year ago,” said King.

“Sales to fleet customers are rising faster as manufacturers leverage higher vehicle production to allocate more vehicles to those fleet customers. Fleet sales are projected to increase 54.5% from June 2022,” said King. “The increased vehicle supply and elevated interest rates have led to a decline in dealer profits – but those profits still exceed pre-pandemic levels. The total retailer profit per unit, which includes grosses, finance and insurance income – is expected to reach $3,692 in June. While this is 26.7% lower than a year ago, it is still more than double the amount in June 2019. The primary reason for the decline in profit is that fewer vehicles are being sold for prices higher than the manufacturer’s suggested retail price (MSRP). This month, only 30% of new vehicles are projected to be sold above MSRP, which is down from a high of 49% in July 2022.”

While new-car dealer retailer profit from new-vehicle sales for this month is projected to be down 16.2% from June 2022, reaching $3.8 billion that will be the third-highest June on record if the forecast holds. Power noted that automaker discounts in June have remained relatively consistent compared with May but have increased substantively from a year ago. The average incentive spend per vehicle has risen 95.9% from June 2022 and is currently on track to reach $1798. Expressed as a percentage of MSRP, incentive spending is at 3.7%, an increase of 1.7 percentage points from June 2022.

“A key factor influencing the relatively lower incentives compared to historical levels is the decreased amount of discounts provided for leased vehicles. However, it is noteworthy that discounts on leased vehicles have risen in recent months. This month, leasing is expected to account for 21% of retail sales, up significantly from the low of 16% in September 2022, but still well below June 2019 when leased vehicles made up nearly 30% of all new-vehicle retail sales,” said J.D. Power.

Details at a Glance

- The average new-vehicle retail transaction price in June is expected to reach $45,978, flat from June 2022. The previous high for any month at $47,362was in December 2022.

- Average incentive spending per unit in June is expected to reach $1798, up from $918 in June 2022. Spending as a percentage of the average MSRP is expected to increase to 3.7%, up 1.7 percentage points from June 2022.

- Average incentive spending per unit on trucks/SUVs in June is expected to be $1,649, up $949 from a year ago, while the average spending on cars is expected to be $1,393, up $597 from a year ago.

- Retail buyers are likely to spend $47.9 billion on new vehicles, up $6 billion from June 2022.

- Truck/SUVs will account for 77.7% of new-vehicle retail sales in June.

- Fleet sales are expected to total 275,900 units in June, up 54.5% from June 2022 on a selling day adjusted basis. Fleet volume is expected to account for 20% of total light-vehicle sales, up from 16% a year ago.

- Average interest rates for new-vehicle loans are expected to increase to 7.0%, 194 basis points higher than a year ago.

EV Outlook

Elizabeth Krear, vice president, electric vehicle practice at J.D. Power: “There have been sizable shifts this year, up and down, in the individual factors of the J.D. Power EV Index, revealing vulnerability in the transition from gas-powered vehicles to EVs. The three factors of interest, availability and affordability have increased, but the other three factors of adoption, infrastructure and experience have declined. The EV Index score of 49, on a 100-point scale, remains unchanged, and that might be concerning to some in the industry.

“EVs from perennial mass-market brands continue to yield high interest upon introduction, including the Honda Prologue, which debuted in May as the most-considered EV. As the industry waits for new products, monthly price mix dynamics are at play at vehicle trim levels. Driven by the Inflation Reduction Act, pricing adjustments and model mix, the affordability factor increased notably to 94 in April 2023 from 82 in December 2022. Pricing improvements increase affordability across a variety of models, including Tesla’s with price cuts.

“With Tesla charging network collaborations on the horizon, Ford, GM and Rivian buyers will benefit. However, charging installation growth continues to lag the growth of EVs on the road, further straining already-limited infrastructure. One of the top reasons rejecters say they’re not likely to purchase an EV is range. Among Compact SUVs, EV ranges are just 65% of gas-powered counterparts, but EV owners say that’s nearly sufficient for them to not change their driving behaviors – another advantage for the Tesla, Ford, GM and Rivian alliance.”

*GlobalData

J.D. Power is part of GlobalData. GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

June US New-Vehicle Sales Forecast Up Again

Total new-vehicle sales for June 2023, including retail and non-retail transactions, are forecast to reach 1,381,200 units, a 22.6% increase from June 2022, according to a joint forecast from J.D. Power and GlobalData.* June 2023 has 26 selling days, the same as June 2022. New-vehicle retail sales for June 2023 are projected to grow when compared with June 2022, reaching 1,105,300 units, a 16.6% increase from June 2022, according to the respected consultancies. New-vehicle retail sales for the first six months 2023 are projected to reach 6,161,400 units, a 6.0% increase from the first six months of 2022 on the same number of selling days. Thus the Biden Administration economic recovery continues.

“The 2023 theme of strong sales growth, enabled by increased vehicle production and pent-up demand, is continuing in June. On a volume basis, June year-to-date total sales will be just more than 7.6 million units – an increase of 13.6% – but still below pre-pandemic sales levels which were north of 8 million, said Thomas King, president of the data and analytics division at J.D. Power, which is part of GlobalData.

Click for more data.

“Volume growth is being complemented by further increases in transaction prices which are trending towards being up 3% for the first half of 2023 despite increases in OEM incentives and declines in dealer grosses. As a result, it’s anticipated that consumers will spend nearly $281.4 billion on the purchase of new vehicles in the first half of 2023, a noteworthy 8% growth from the same period a year ago,” said King.

“Sales to fleet customers are rising faster as manufacturers leverage higher vehicle production to allocate more vehicles to those fleet customers. Fleet sales are projected to increase 54.5% from June 2022,” said King. “The increased vehicle supply and elevated interest rates have led to a decline in dealer profits – but those profits still exceed pre-pandemic levels. The total retailer profit per unit, which includes grosses, finance and insurance income – is expected to reach $3,692 in June. While this is 26.7% lower than a year ago, it is still more than double the amount in June 2019. The primary reason for the decline in profit is that fewer vehicles are being sold for prices higher than the manufacturer’s suggested retail price (MSRP). This month, only 30% of new vehicles are projected to be sold above MSRP, which is down from a high of 49% in July 2022.”

While new-car dealer retailer profit from new-vehicle sales for this month is projected to be down 16.2% from June 2022, reaching $3.8 billion that will be the third-highest June on record if the forecast holds. Power noted that automaker discounts in June have remained relatively consistent compared with May but have increased substantively from a year ago. The average incentive spend per vehicle has risen 95.9% from June 2022 and is currently on track to reach $1798. Expressed as a percentage of MSRP, incentive spending is at 3.7%, an increase of 1.7 percentage points from June 2022.

“A key factor influencing the relatively lower incentives compared to historical levels is the decreased amount of discounts provided for leased vehicles. However, it is noteworthy that discounts on leased vehicles have risen in recent months. This month, leasing is expected to account for 21% of retail sales, up significantly from the low of 16% in September 2022, but still well below June 2019 when leased vehicles made up nearly 30% of all new-vehicle retail sales,” said J.D. Power.

Details at a Glance

EV Outlook

Elizabeth Krear, vice president, electric vehicle practice at J.D. Power: “There have been sizable shifts this year, up and down, in the individual factors of the J.D. Power EV Index, revealing vulnerability in the transition from gas-powered vehicles to EVs. The three factors of interest, availability and affordability have increased, but the other three factors of adoption, infrastructure and experience have declined. The EV Index score of 49, on a 100-point scale, remains unchanged, and that might be concerning to some in the industry.

“EVs from perennial mass-market brands continue to yield high interest upon introduction, including the Honda Prologue, which debuted in May as the most-considered EV. As the industry waits for new products, monthly price mix dynamics are at play at vehicle trim levels. Driven by the Inflation Reduction Act, pricing adjustments and model mix, the affordability factor increased notably to 94 in April 2023 from 82 in December 2022. Pricing improvements increase affordability across a variety of models, including Tesla’s with price cuts.

“With Tesla charging network collaborations on the horizon, Ford, GM and Rivian buyers will benefit. However, charging installation growth continues to lag the growth of EVs on the road, further straining already-limited infrastructure. One of the top reasons rejecters say they’re not likely to purchase an EV is range. Among Compact SUVs, EV ranges are just 65% of gas-powered counterparts, but EV owners say that’s nearly sufficient for them to not change their driving behaviors – another advantage for the Tesla, Ford, GM and Rivian alliance.”

*GlobalData

J.D. Power is part of GlobalData. GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.