U.S. auto sales slowed in July, but most automakers recorded overall gains, which, arguably, maintained a strong industry heading into the second half of the year. The debate centers around whether this is the peak or another cyclical decline is about to begin.

U.S. auto sales slowed in July, but most automakers recorded overall gains, which, arguably, maintained a strong industry heading into the second half of the year. The debate centers around whether this is the peak or another cyclical decline is about to begin.

Consider major automakers: Ford Motor total U.S. sales were 216,479, down 3%, with fleet up 6% and retail down 6% during July. GM sales at 267,258 dropped -1.9%. Toyota at 214,233 units, posted a decrease of 1.4%. FCA was flat.

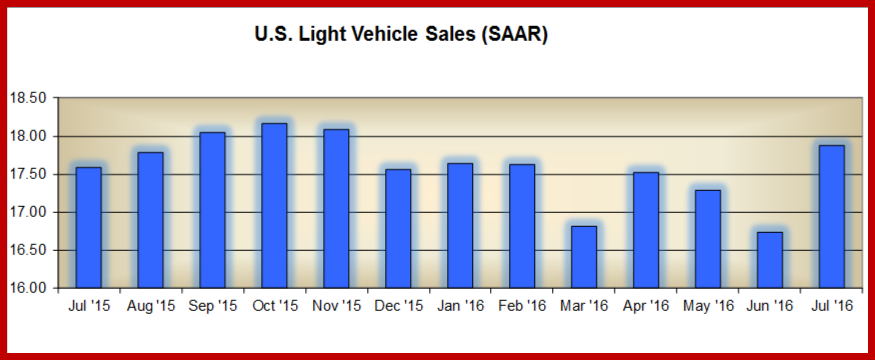

Industry analyst estimates say seasonally adjusted annual selling rate (SAAR) for light vehicles in July was 17.9 million units. This is actually a strong performance. Year to date, industry sales at 10,167,064 are up 1.3%, compared to 2015. Pickups and crossovers accounted for 60% of all sales last month, up 8.4% from June 2015, while passenger car sales were down 9% from a year ago to 40% of all sales.

“If automakers expect to outperform last year’s record-breaking sales, they’re going to have to lean more heavily on creating and promoting attractive financing offers to lure new buyers into showrooms,” claimed Edmunds Executive Director of Industry Analysis, Jessica Caldwell. “Zero percent financing deals were much more common last year summer than they are now: 12.9% of new car loans in July of 2015 were zero%, while only 10.2% of loans were 0% this July.”

Really?

Domestic brands finished the month with 43.6% of the U.S. market, down from 45.7 % last month, and sales of 663,756 units. Asian brands reported an increase in market share, capturing 47.5 % by selling 722,377 vehicles in July. Both figures were an increase over June when they held 45.5% of the market and sold 688,417 units. They were also improved over July 2015 when they held 46.8% of the market and sold 707,243 vehicles. July sales figures for Asian brands included 265,687 North American-sourced cars and 244,739 North American-sourced trucks and are up 2.1% over last July and 2.1% for the year-to-date.

Worrying at Ford Motor is that fleet sales – sales to large companies, government and rental car companies – were up 6% at 55,321 sold. More profitable retail sales were down -6%, with 161,158 sold. As a result, Ford stock is hovering due to a skeptical Wall Street at just barely over $12 a share.

Several offshore brands enjoyed record sales in July, including Hyundai (75,003), Kia (59,969), and Mercedes Benz (31,795), which continues to lead fellow luxury manufacturers in U.S. sales this year.

European brands sold 136,164 vehicles in July for an 8.9% share of the market—up from 8.8% last month when they sold 133,585 vehicles. July sales for European brands were also up from July 2015 when they occupied 8.8% of the market and sold 132,748 vehicles. Overall sales for the month included 21,852 North American-sourced cars and 13,603 North American-sourced trucks. They were up 2.6% over last July, but down 3.1% for the year overall.

Top Ten

Offshore nameplates represented seven of the Top Ten selling vehicles in July. With demand for SUVs rising, the Honda CR-V was the most popular international vehicle on dealer lots last month. In fourth place behind the Ford F-Series, Chevrolet Silverado, and Ram pickups, CR-V sold 36,017 units and saw a sales increase of 13.3% over last July. Toyota Camry was fifth, albeit with an 11% decline. Nissan Rogue, took sixth place with sales up 32.8%. The Honda Civic once again joined July’s most popular cars in seventh place with sales up 5.8%. It was followed by the Honda Accord in eighth. Toyota RAV4 finished the month in ninth place with sales up 19.3%. Toyota Corolla was in tenth place.

Despite some economic and political uncertainty ahead with the upcoming elections, the National Automobile Dealers Association (NADA) is holding steady its sales forecast of 17.7 million new cars and light trucks for 2016.

“We’ve had six straight years of steadily rising sales, which has been a fantastic period of growth, and vehicles per household have returned to the same level prior to the Great Recession,” said NADA Chief Economist Steven Szakaly. “But most pent up demand has been satisfied. For 2017, we expect new-vehicle sales to reach 17.1 million units.”

Szakaly added that rising employment and leasing remain big positives that will continue to grow and drive sales, as well as low gasoline and diesel prices, which allow consumers to spend more on vehicles, and continue the trend of higher light truck sales compared to cars.

“For 2016, light trucks will account for about 59 percent of the new-vehicle sales market and cars will account for 41 percent,” he said. “Leases are increasing, which now accounts for more than 34 percent of the market.”

Interest rates on auto loans are expected to rise modestly by about 50 basis points, Szakaly added, but “consumers will not feel the pinch of rising interest rates because automakers will roll out additional financial incentives,” he said.

While the success of Honda trucks, including an all-time July record for CR-V last month, reflects the market’s shift to SUVs and trucks, our passenger car sales continue to buck that trend with Civic and Accord as the two most popular cars in America this year, up 18% and 6%, respectively, in a market that is down 8% for cars.

Honda also is outpacing all other major automakers in retail sales in 2016 while, at the same time, maintaining the lowest incentive spending among that group. This speaks to the fundamental value of our products as determined by individual customers voting with their own hard-earned dollars.