Sales reporting day for most automakers in North America saw GM Chief Economist Elaine Buckberg say industry light vehicle volumes will grow this year and top 2021 levels, thanks to a strong labor market, higher vehicle production and pent-up demand.

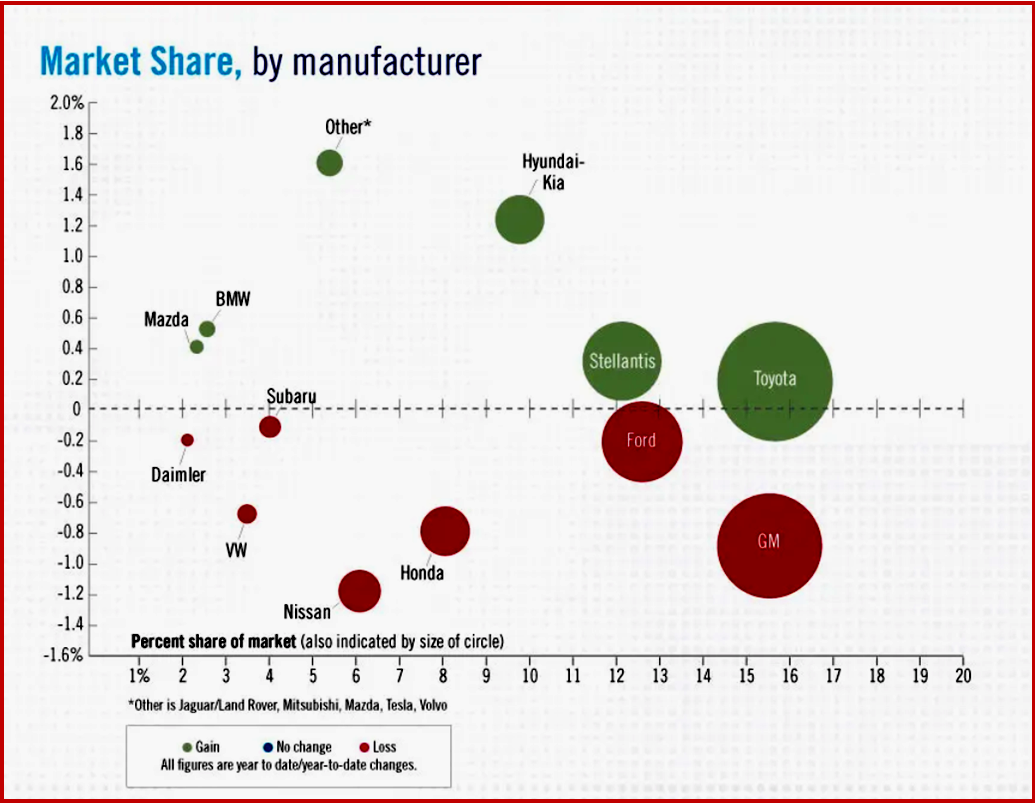

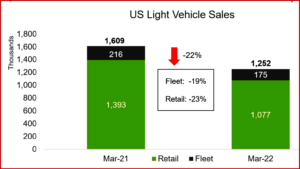

But that didn’t reflect the immediate quarter, especially the month of March. Wards Intelligence, notes the average capacity utilization rate in a North American assembly plants during Q4 2021 was 70.3%, down from 85.4% in Q4 2020. The SAAR appears to be 13.3 million units, down from 14 million in February and a drop of 24.4% from March 2021’s SAAR of 17.6 million. Simply put the supply chain is a mess, and with Putin’s war on Ukraine it remains chaotic. Following the jump are the preliminary results from firms that reported. The rest of the results will trickle in next week.

The unemployment rate in the U.S. transportation sector was 5.1% (not seasonally adjusted) in March 2022 according to Bureau of Labor Statistics (BLS) data recently updated. The March 2022 unemployment rate fell 3.8 percentage points year-over-year from 8.9% in March 2021 and was 0.3 percentage points below the 5.4% of both February 2022 and March 2020 – the month during which the World Health Organization (WHO) declared COVID-19 a pandemic. Unemployment in the transportation sector reached its highest level during the COVID-19 pandemic (15.7%) in May and July 2020 under the Trump mis-adminstration.

J.D. Power says average transaction prices likely will achieve a March record of $43,737, up 17.4% compared with 2021.

The transportation sector unemployment rate is above the overall unemployment rate for the third consecutive month. Seasonally adjusted, the U.S. unemployment rate in March 2022 was 3.6%. U.S. employers added 431,000 jobs. The unemployment rate continued its decline, and at 3.6%, it is just a tad more than it was before the pandemic. The economy has recovered more than 90% of the 22 million jobs lost in the spring of 2020. Thus the Biden economic recovery continues is spite of near universal Republican opposition to all of his increasingly effective recovery plans.

BMW of North America today reported Q1 sales results. BMW brand sales in the U.S. totaled 73,714 vehicles, a -3.2% increase from the 71,433 vehicles sold in the first quarter of 2021. BMW Sports Activity Vehicles built at the company’s U.S. plant in Spartanburg, South Carolina (X3, X4, X5, X6 and X7) performed particularly well in Q1, accounting for 57% of total sales. MINI brand sales in the U.S. totaled 6,876 vehicles in the first quarter of 2022, an increase of 9.4% vs the 6,285 vehicles sold in the first quarter of 2021.

FCA US had sales of 405,221 vehicles in the first quarter. Overall, total U.S. and retail sales for the first quarter declined -14% and -13% respectively, outperforming the industry. Jeep® brand retail sales were even versus same quarter last year. Grand Cherokee notched its best-ever Q1 total and retail sales, with total sales up 36% and retail sales up 44%. Total U.S. sales for the Compass rose 22% while retail sales increased 23% year over year. The Jeep Wrangler 4xe, the best-selling plug-in vehicle in the U.S, accounted for 8,346 (18%) of total Wrangler sales. Pacifica Hybrid accounted for 4,164 (16%) of total Chrysler Pacifica sales. Ram brand recorded its best Q1 retail sales year ever for the ProMaster Van, with sales up 27% versus the previous first quarter. The brand’s total commercial shipments are up a combined 7% versus the previous first quarter.

General Motors Co. (NYSE: GM) sold 512,846 vehicles in the United States in the first quarter of 2022, with improved semiconductor supplies supporting higher production and market share in key truck segments. In Canada, Chevrolet, Buick, GMC and Cadillac dealers delivered 47,699 vehicles in the first quarter of 2022. That is down -24% compared with the first quarter of 2021, and up 21% over the fourth quarter of 2021.

GM Chief Economist Elaine Buckberg observed industry light vehicle volumes will grow this year and top 2021 levels, thanks to a strong labor market, higher vehicle production and pent-up demand. “Ordinarily, a U.S. economy this strong would translate into light vehicle sales in the 17-million range,” she said. “Improvements in the supply chain should lift auto sales as the year progresses, despite headwinds from higher inflation and fuel prices.”

NADA says its 2022 forecast of 15.4 million new light-vehicle sales remains unchanged from the start of the quarter. However, “there are downside risks to our forecast from ongoing supply chain issues, global conflicts and pandemic-related impacts.”

Hyundai Motor America reported record-breaking Q1 retail sales of 159,676 units, a 1.4% increase compared with 2021’s Q1 retail record of 157,470 units. Electrified vehicle retail sales increased 241% in Q1 on a tiny base. Total Q1 sales declined -4%. Hyundai had no fleet sales in Q1 2022. Hyundai sold 59,380 units in March 2022, resulting in the third best March retail month in the company’s history. Month over month retail and total sales were up 13%. Hyundai electrified vehicle retail sales grew 179% year over year, while Elantra Hybrid and Nexo established all-time monthly retail and total sales records.

Kia America posted March sales of 59,524 units, capping the brand’s second highest total through the first three months of the year at 151,194. With 3,156 all-electric EV6 models sold in March, Kia’s electrified models had their best-ever monthly and quarterly sales.

Mazda North American Operations (MNAO) total March sales of 33,023 vehicles, an increase of 3.2% compared to March 2021. Year-to-date sales totaled 82,268 vehicles; a decrease of 1.2% compared to the same time last year. With 27 selling days in March, compared to 26 the year prior, the company posted a decrease of 0.6% on a Daily Selling Rate (DSR) basis. Mazda Canada (MCI) reported March sales of 5,810 vehicles, a decrease of -15.7% compared to March last year. Year-to-date sales decreased -14.1%, with 12, 919 vehicles sold.

Nissan Group announced total U.S. first-quarter (January – March) sales for 2022 of 201,081 units, a decrease of –29.6% versus 2021. Nissan Division Q1 2022 highlights: Sales of the new 2022 Leaf were 4,371, +49.4% in the first quarter over the previous year. Sales of the 2022 Nissan Altima were 38,295, up 19.65% in the first quarter over the previous year. Sales of the all-new Nissan Frontier were 22,405, up 107.8% in the first quarter over the previous year. Infiniti USA reported deliveries of 11,246 vehicles in Q1 a drop of -41%.

Subaru of America, (SOA) today reported 43,322 vehicle sales for March 2022, a -34.1% decrease compared with March 2021 (65,726). The automaker also reported year-to-date sales of 132,346, a -17.5% decrease compared with Q1 in 2021. Subaru’s vehicle supply continues to be affected by microchip shortages and supply chain issues impacting “much of the industry.” In March, Outback and Crosstrek were the top performing vehicles by volume with 13,808 and 13,460 sales respectively. Legacy sales for March 2022 increased 12.3%, while BRZ sales increased 20.7% compared to March 2021.

Toyota Motor North America (TMNA) today posted Q1 sales of 514,592 vehicles, down -14.7% on a volume basis and down -15.8% on a Daily Selling Rate (DSR) basis versus March 2021. Sales of electrified vehicles for Q1 totaled 132,938, representing nearly 25.8% of TMNA’s total volume, up from 22.9% during the same period last year. During Q1 Toyota division reported sales of 450,227 vehicles, down -14.9% on a volume basis and down 16.0% on a DSR basis. For the quarter, Lexus reported sales of 64,365 vehicles, down 13.3% on a volume basis and down 14.5% on a DSR basis.

Pingback: Ford Motor Q1 and March Sales off -17% and -26%. Cars Dying | AutoInformed