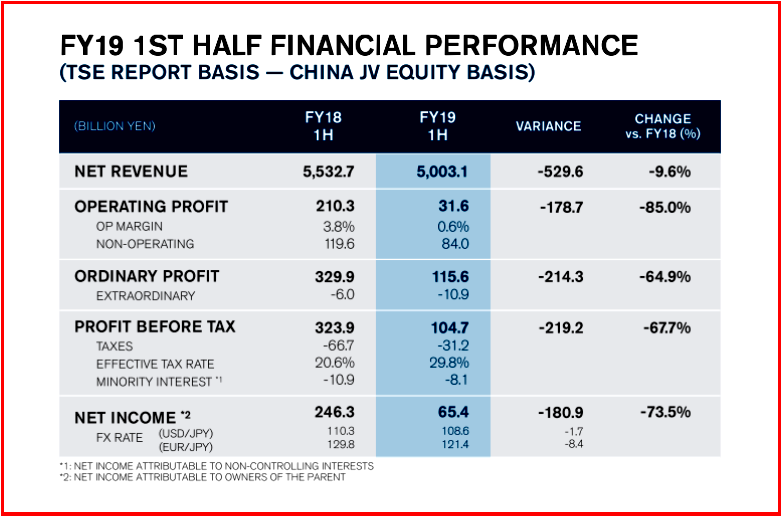

Nissan Motor Co. today announced financial results for the six-month period ending September 30, 2019 that showed consolidated net revenue of 5.00 trillion yen, consolidated operating profit was 31.6 billion yen, with an operating profit margin of 0.6%. The Renault Nissan Alliance remains in turmoil over issues surrounding the Carlos Ghosn departure. (Nissan CEO Hiroto Saikawa Forced Out Over Ghosn Matter)

First half net income1 decreased by, gulp, 73.5% to 65.4 billion yen. The board of directors today set an extraordinary meeting of shareholders to be held in February 2020 to consider proposals for current directors leaving their positions and for new director nominees. The committee took into consideration candidate recommendations from Nissan (Makoto Uchida and Jun Seki), Renault (Pierre Fleuriot), and Nissan and Renault jointly (Ashwani Gupta).

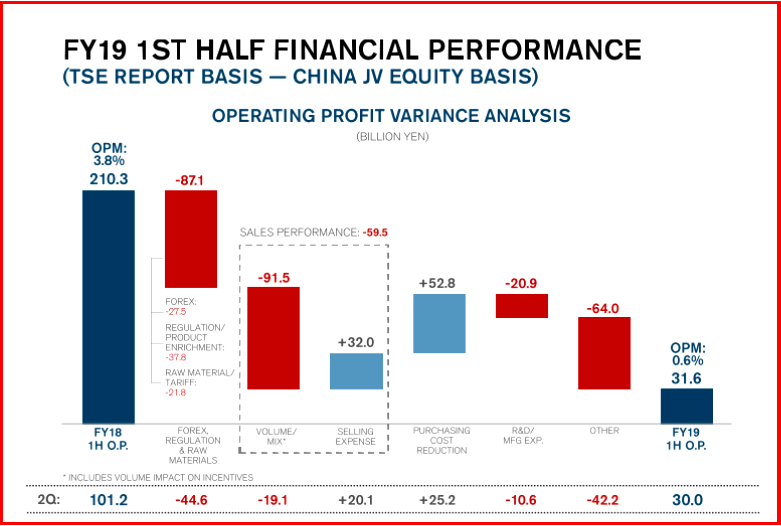

During Q2 of the fiscal year, consolidated net revenue was 2.63 trillion yen, consolidated operating profit was 30.0 billion yen, with an operating profit margin of 1.1%. Second quarter net income1 decreased by 54.8% to 59.0 billion yen. Nissan claimed factors in the decrease were external, such as exchange rate fluctuations, regulatory compliance expenses, and increased raw material costs, combined with increased quality-related costs.

The Nissan Board of Directors voted an interim dividend of 10 yen per share, given the slower-than-expected progress of results in the first six months of the year and the downward revision of the earnings fiscal year forecast. Although the current full-year plan is for a dividend of 40 yen, Nissan plans to propose a dividend following internal discussion of the dividend plan and the midterm business plan.

In the first half of fiscal year 2019, global total industry volume decreased 5.9% to 43.85 million units, while Nissan’s global unit sales decreased 6.8% to 2.50 million units.

In Japan, Nissan’s sales decreased 1.3% to 281,000 units. The all-new Nissan Dayz continued to sell well, and the new Skyline launched in September, which features the world-first advanced driver support technology ProPILOT 2.0 and performance-enhanced turbo engine, has also been well received.

In China, where Nissan reports figures on a calendar-year basis, total industry volume decreased by 12.8%. Nissan’s sales were 718,000 units, roughly equal with the same period of the previous year, and market share increased 0.8 percentage points to 6.2%. This was helped by continued strong sales of core models including the Sylphy sedan and the Qashqai and X-Trail crossovers.

In the U.S., due to an aged product portfolio and continuing efforts to “normalize sales without ruinous incentves, sales decreased 4.3% to 679,000 units.

Nissan sales in Europe, including Russia, decreased by 19.7% to 265,000 units, amid ongoing changes in environmental regulations and an aged model portfolio.

In other markets, including Asia and Oceania, Latin America, the Middle East and Africa, Nissan’s sales decreased 11.4% to 360,000 units.

Fiscal Year 2019 Full-year Forecast

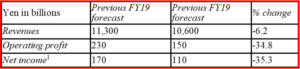

Operating profit for the first half is behind the announced plan. In addition, the yen has strengthened against Nissan’s original assumption of 110 yen to the U.S. dollar set at the beginning of the financial year. Nissan also predicts ongoing economic uncertainties and slowdown in total industry volume so it has revised its forecast for the full fiscal year.

For the 2019 full fiscal year, Nissan has reduced its global vehicle sales forecast by 5.4% from the initial to 5.24 million units.

Nissan has filed fiscal year forecast revisions with the Tokyo Stock Exchange. Calculated under the equity accounting method for Nissan’s joint venture in China.

Nissan Financial Footnotes

- Net income attributable to owners of the parent

- Since the beginning of fiscal year 2013, Nissan has reported figures calculated under the equity method accounting for its joint venture with Dong Feng in China. Although net income reporting remains unchanged under this accounting method, the equity-accounting income statements no longer include Dong-Feng-Nissan’s results in revenues and operating profit

- Regional operating profit based on geographical segmentation

Pingback: Nissan Scandal – a Gift That Keeps on Giving – Executive Officer and Vice COO Jun Seki Unexpectedly Resigns | AutoInformed

Nissan Motor Co., Ltd. today announced the following senior management appointments, effective December 1, 2019.

Shohei Yamazaki, currently corporate vice president, Nissan Purchasing and Alliance Global VP, has been appointed senior vice president. Yamazaki will chair the company’s China Management Committee and report to COO Ashwani Gupta. Yamazaki has also been appointed president of Dongfeng Motor Co., Ltd.

Hiroki Hasegawa, currently VP, Common Purchasing Organization and Alliance Global Director, Asia Regional Purchasing Head, has been appointed corporate vice president, Nissan Purchasing and Alliance Global VP. Hasegawa will head Nissan Purchasing and will report to COO Ashwani Gupta.

Sadayuki Hamaguchi, currently VP and head of Nissan’s global communications, has been appointed corporate vice president. Hamaguchi will continue to head global communications and will report to CEO Makoto Uchida.