On a management pro forma basis, which includes the proportionate consolidation of results from Nissan’s joint venture Dong Feng operation in China, operating profit was ¥116.7 billion, which equates to a +1.0% operating margin, and net loss was -¥671.2 billion.

Nissan Motor Co. today posted large financial losses for the 12-month period ending March 31, 2020, aka Japanese fiscal year. The global COVID-19 pandemic substantially affected Nissan’s production, sales, and other business activities in all regions. Overall market demand decreased amid the current global environment, which has resulted in a slowdown in global total industry volume (TIV). In fiscal year 2019, the global TIV fell by 6.9% to 85.73 million units. Nissan’s sales dropped 10.6% to 4.93 million vehicles; market share maintained 5.8% as previously forecast. However, Nissan’s business and brand problems go back several years. Nissan today announced the closure of three factories in Barcelona, with the loss of 3,000 jobs and a further 20,000 jobs in the supply chain. (Renault, Nissan Motor, Mitsubishi Slice, Dice World by Brand)

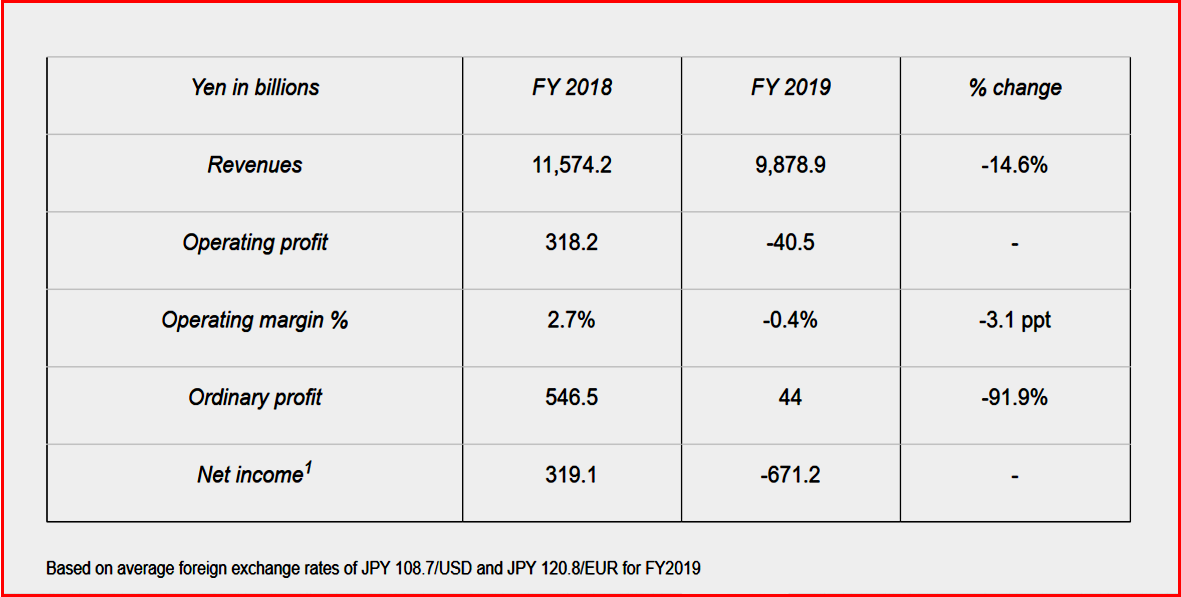

During fiscal year 2019, consolidated net revenue declined to ¥9.8789 trillion yen, resulting in an operating loss of ¥40.5 billion yen and a net loss1 of -¥ 671.2 billion. This includes costs associated with restructuring and impairments of ¥603.0 billion as Nissan tried to improve operational and efficiency improvements. Free cash flow for the automotive business was, gulp, negative -¥641.0 billion.

Nissan claims it has sufficient liquidity, which is dubious based on the large number of COVID-19 unknowns. At year-end, cash and cash equivalents for the automotive business totaled ¥1.4946 trillion. Automotive net cash was ¥1.0646 trillion. In addition, the company continues to have access to approximately ¥1.3 trillion in unused committed credit facilities. In response to the COVID-19 pandemic, Nissan raised an additional ¥712.6 billion in funding between April and May.

Full-Year Financial Results

On a management pro forma basis, which includes the proportionate consolidation of results from Nissan’s joint venture Dong Feng operation in China, operating profit was ¥116.7 billion, which equates to a +1.0% operating margin, and net loss was -¥671.2 billion.2

2020 Outlook

For fiscal year 2020, Nissan anticipates the global TIV to decline by approximately 15 to 20% compared with the previous year due to the COVID-19 pandemic. Nissan’s management continues to evaluate the impact of the pandemic on our operations and will issue the fiscal year 2020 forecast when a reasonably calculated outlook is available.

Footnotes

1 Net income or net loss attributable to owners of the parent

2 Since the beginning of fiscal year 2013, Nissan has reported figures calculated under the equity method accounting for its joint venture with Dong Feng in China. Although net income reporting remains unchanged under this accounting method, the equity-accounting income statements no longer include Dong-Feng-Nissan’s results in revenues and operating profit.

Pingback: Nissan to Keep Production and Employment in Spain | AutoInformed