Penske Automotive Group, Inc. (NYSE: PAG) today said it set all-time record quarterly earnings during Q2 of 2022 as earnings before taxes increased 8% to $500 million. Income From Continuing Operations increased 10% to $374 million. Earnings per share increased 17% to $4.93.

“I am pleased to report that our diversified business delivered all-time record quarterly earnings for the second quarter of 2022, including a sequential improvement in earnings before taxes, income from continuing operations, and earnings per share when compared to the first quarter of 2022. Despite the supply constraints that continue to impact inventory availability, demand remains strong, and we continue to benefit from the diversification of our operations,” said Chair and CEO Roger Penske.*

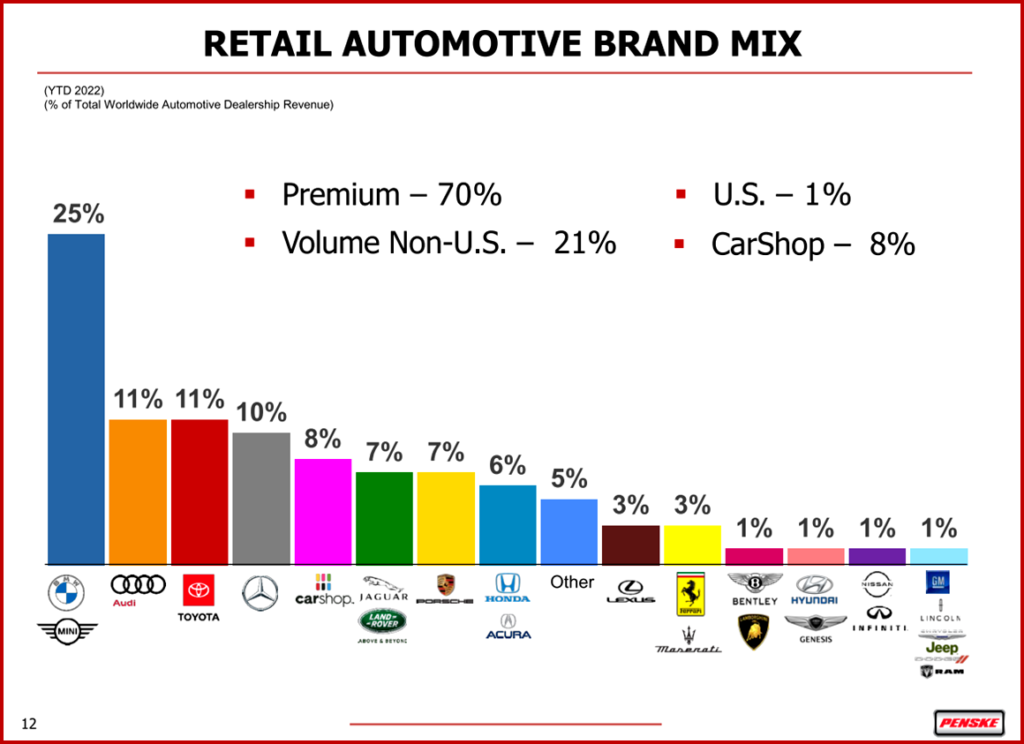

Click to Enlarge.

For the quarter, revenue decreased 1% to $6.9 billion. Foreign currency exchange negatively impacted revenue by $245.2 million. Excluding the impact from foreign currency exchange, revenue would have increased by 2%. Income from continuing operations attributable to common stockholders increased 10% to $374.0 million, and related earnings per share increased 17% to $4.93. Foreign currency exchange negatively impacted earnings per share by $0.11.

For the three months that ended June 30, 2021, income from continuing operations attributable to common stockholders was $338.8 million and related earnings per share was $4.20, and as shown in the attached non-GAAP reconciliation schedules, adjusted income from continuing operations was $360.2 million and related adjusted earnings per share was $4.47, reflecting increases of 4% and 10%, respectively.

Q2 2022 Operating Highlights Compared to Q2 2021

(Percentage Change Excluding Foreign Currency Exchange Shown in Parenthesis)

- Retail Automotive Same-Store Revenue – decreased 8% (-3%)

-

- New Vehicle -18% (-15%); Used Vehicle -2% (+4%); Finance & Insurance +1% (+5%); Service & Parts +4% (+8%)

- Retail Automotive Same-Store Gross Profit – decreased 3% (+2%)

-

- New Vehicle +7% (+11%); Used Vehicle -23% (-19%); Finance & Insurance +1% (+5%); Service & Parts +2% (+6%)

- Retail Automotive Same-Store Variable Gross Profit Per Unit Retailed – increased $841/unit, or 16% (+21%), to $5,999

- Retail Commercial Truck Same-Store Revenue – increased 11%

Retail Automotive Dealerships

For the three months ended June30, 2022, total retail automotive revenue decreased 3% to $6.0 billion, including an 8% decrease on a same-store basis when compared to the same period last year. Total retail automotive gross profit increased 2% to $1.1 billion, including a 3% decrease on a same-store basis. Gross margin increased 90 basis points to 17.7% as variable gross profit per unit retailed increased 16%, or $809, to $5,964 and return on sales was 5.0%. Excluding foreign currency exchange impacts, total retail automotive revenue remained flat and total retail automotive gross profit increased 5%.

CarShop Used Vehicle Centers

As of June 30, 2022, we operated 21 CarShop used vehicle locations. For the three months ended June 30, 2022, retail unit sales increased by 7% to 20,124 while total revenue increased by 15% to $468.0 million, including an increase of 6% on a same-store basis. For the six months ended June 30, 2022, retail unit sales increased by 32% to 39,647 while total revenue increased by 51% to $983.9 million, including an increase of 37% on a same-store basis. For the three and six months ended June 30, 2022, losses before taxes were of $1.5 million and $2.7 million, respectively, due to the increased cost of acquiring used vehicles resulting from the lower supply of new vehicles available for sale and higher reconditioning costs.

Retail Commercial Truck Dealerships

As of June30, 2022, we operated 39 North American commercial truck locations under the Premier Truck Group name which offer new and used trucks for sale, a full range of parts, maintenance and repair services, collision centers, and finance and insurance options. For the three months ended June 30, 2022, earnings before taxes increased 32% to $52.3 million compared to $39.7 million in the same period last year, and return on sales was 6.8%. For the six months ended June 30, 2022, earnings before taxes increased 65% to $110.8 million compared to $67.2 million in the same period last year, and return on sales was 7.1%.

Penske Australia

Penske Australia is the exclusive importer and distributor of certain heavy- and medium-duty trucks and buses and refuse collection vehicles, together with associated parts, across Australia, New Zealand, and portions of the Pacific and is a leading distributor of diesel and gas engines and power systems. For the three months ended June 30, 2022, revenue decreased 14% to $140.9 million compared to $164.6 million in the same period last year. However, earnings before taxes increased 5% to $8.8 million compared to $8.4 million in the same period last year, and return on sales was 6.2%. For the six months ended June 30, 2022, revenue decreased 1% to $294.8 million compared to $296.8 million in the same period last year. However, earnings before taxes increased 34% to $19.3 million compared to $14.4 million in the same period last year, and return on sales was 6.5%. Excluding foreign currency exchange impacts for the three and six months ended June 30, 2022, revenue decreased 7% and increased 7%, respectively.

Penske Transportation Solutions Investment

Penske Transportation Solutions (“PTS”) is a leading provider of full-service truck leasing, truck rental, contract maintenance, and logistics services. Penske Automotive Group has a 28.9% ownership interest in PTS and accounts for its ownership interest using the equity method of accounting. For the three and six months ended June 30, 2022, the Company recorded $136.6 million and $255.1 million in earnings compared to $102.5 million and $156.2 million for the same periods last year, representing increases of 33% and 63%, respectively. The increase was principally driven by increased demand for PTS’s full-service leasing, rental, logistics services, and remarketing of used trucks, which resulted in a 14% return on sales for PTS during the second quarter 2022.

Corporate Development and Capital Allocation

Year-to-date, the Company has added approximately $745 million in annualized revenue through acquisitions and open points. The acquisitions consist of four commercial truck dealerships located in Ontario, Canada and ten retail automotive franchises, consisting of six in the U.K. and four in the U.S. We also opened two retail automotive franchises that we were awarded in the U.S. Additionally, the Company has signed an agreement to acquire five Mercedes-Benz dealerships and three aftersales locations in North London, United Kingdom, from Mercedes-Benz Retail Group U.K. The dealerships and aftersales locations subject to the acquisition are expected to generate revenue of approximately $550 million for the full year of 2022. Closing of the transaction is expected to occur during the third quarter of 2022, subject to the satisfaction or waiver of customary conditions.

*Inevitable Footnote

Based on the Company’s strong earnings and cash flow, the Board of Directors has increased the quarterly dividend three times in 2022 from $0.46 per share to $0.53 per share. During the six months ended June 30, 2022, PAG also repurchased 2.7 million shares of common stock for approximately $275.4 million under its securities repurchase program and acquired 148,440 shares of PAG common stock for $17.2 million from employees in connection with a net share settlement feature of employee equity awards. From July 1, 2022, through July 26, 2022, PAG repurchased an additional 0.8 million shares for an aggregate purchase price of $87.3 million under our securities repurchase program. In July 2022, the Board of Directors increased the authority delegated to management to repurchase our outstanding securities by $250 million. As of July 26, 2022, the Company’s total available repurchase authority is $330.6 million.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Penske Automotive Group: Record Q2 Earnings of $500 Million

Penske Automotive Group, Inc. (NYSE: PAG) today said it set all-time record quarterly earnings during Q2 of 2022 as earnings before taxes increased 8% to $500 million. Income From Continuing Operations increased 10% to $374 million. Earnings per share increased 17% to $4.93.

“I am pleased to report that our diversified business delivered all-time record quarterly earnings for the second quarter of 2022, including a sequential improvement in earnings before taxes, income from continuing operations, and earnings per share when compared to the first quarter of 2022. Despite the supply constraints that continue to impact inventory availability, demand remains strong, and we continue to benefit from the diversification of our operations,” said Chair and CEO Roger Penske.*

Click to Enlarge.

For the quarter, revenue decreased 1% to $6.9 billion. Foreign currency exchange negatively impacted revenue by $245.2 million. Excluding the impact from foreign currency exchange, revenue would have increased by 2%. Income from continuing operations attributable to common stockholders increased 10% to $374.0 million, and related earnings per share increased 17% to $4.93. Foreign currency exchange negatively impacted earnings per share by $0.11.

For the three months that ended June 30, 2021, income from continuing operations attributable to common stockholders was $338.8 million and related earnings per share was $4.20, and as shown in the attached non-GAAP reconciliation schedules, adjusted income from continuing operations was $360.2 million and related adjusted earnings per share was $4.47, reflecting increases of 4% and 10%, respectively.

Q2 2022 Operating Highlights Compared to Q2 2021

(Percentage Change Excluding Foreign Currency Exchange Shown in Parenthesis)

Retail Automotive Dealerships

For the three months ended June30, 2022, total retail automotive revenue decreased 3% to $6.0 billion, including an 8% decrease on a same-store basis when compared to the same period last year. Total retail automotive gross profit increased 2% to $1.1 billion, including a 3% decrease on a same-store basis. Gross margin increased 90 basis points to 17.7% as variable gross profit per unit retailed increased 16%, or $809, to $5,964 and return on sales was 5.0%. Excluding foreign currency exchange impacts, total retail automotive revenue remained flat and total retail automotive gross profit increased 5%.

CarShop Used Vehicle Centers

As of June 30, 2022, we operated 21 CarShop used vehicle locations. For the three months ended June 30, 2022, retail unit sales increased by 7% to 20,124 while total revenue increased by 15% to $468.0 million, including an increase of 6% on a same-store basis. For the six months ended June 30, 2022, retail unit sales increased by 32% to 39,647 while total revenue increased by 51% to $983.9 million, including an increase of 37% on a same-store basis. For the three and six months ended June 30, 2022, losses before taxes were of $1.5 million and $2.7 million, respectively, due to the increased cost of acquiring used vehicles resulting from the lower supply of new vehicles available for sale and higher reconditioning costs.

Retail Commercial Truck Dealerships

As of June30, 2022, we operated 39 North American commercial truck locations under the Premier Truck Group name which offer new and used trucks for sale, a full range of parts, maintenance and repair services, collision centers, and finance and insurance options. For the three months ended June 30, 2022, earnings before taxes increased 32% to $52.3 million compared to $39.7 million in the same period last year, and return on sales was 6.8%. For the six months ended June 30, 2022, earnings before taxes increased 65% to $110.8 million compared to $67.2 million in the same period last year, and return on sales was 7.1%.

Penske Australia

Penske Australia is the exclusive importer and distributor of certain heavy- and medium-duty trucks and buses and refuse collection vehicles, together with associated parts, across Australia, New Zealand, and portions of the Pacific and is a leading distributor of diesel and gas engines and power systems. For the three months ended June 30, 2022, revenue decreased 14% to $140.9 million compared to $164.6 million in the same period last year. However, earnings before taxes increased 5% to $8.8 million compared to $8.4 million in the same period last year, and return on sales was 6.2%. For the six months ended June 30, 2022, revenue decreased 1% to $294.8 million compared to $296.8 million in the same period last year. However, earnings before taxes increased 34% to $19.3 million compared to $14.4 million in the same period last year, and return on sales was 6.5%. Excluding foreign currency exchange impacts for the three and six months ended June 30, 2022, revenue decreased 7% and increased 7%, respectively.

Penske Transportation Solutions Investment

Penske Transportation Solutions (“PTS”) is a leading provider of full-service truck leasing, truck rental, contract maintenance, and logistics services. Penske Automotive Group has a 28.9% ownership interest in PTS and accounts for its ownership interest using the equity method of accounting. For the three and six months ended June 30, 2022, the Company recorded $136.6 million and $255.1 million in earnings compared to $102.5 million and $156.2 million for the same periods last year, representing increases of 33% and 63%, respectively. The increase was principally driven by increased demand for PTS’s full-service leasing, rental, logistics services, and remarketing of used trucks, which resulted in a 14% return on sales for PTS during the second quarter 2022.

Corporate Development and Capital Allocation

Year-to-date, the Company has added approximately $745 million in annualized revenue through acquisitions and open points. The acquisitions consist of four commercial truck dealerships located in Ontario, Canada and ten retail automotive franchises, consisting of six in the U.K. and four in the U.S. We also opened two retail automotive franchises that we were awarded in the U.S. Additionally, the Company has signed an agreement to acquire five Mercedes-Benz dealerships and three aftersales locations in North London, United Kingdom, from Mercedes-Benz Retail Group U.K. The dealerships and aftersales locations subject to the acquisition are expected to generate revenue of approximately $550 million for the full year of 2022. Closing of the transaction is expected to occur during the third quarter of 2022, subject to the satisfaction or waiver of customary conditions.

*Inevitable Footnote

Based on the Company’s strong earnings and cash flow, the Board of Directors has increased the quarterly dividend three times in 2022 from $0.46 per share to $0.53 per share. During the six months ended June 30, 2022, PAG also repurchased 2.7 million shares of common stock for approximately $275.4 million under its securities repurchase program and acquired 148,440 shares of PAG common stock for $17.2 million from employees in connection with a net share settlement feature of employee equity awards. From July 1, 2022, through July 26, 2022, PAG repurchased an additional 0.8 million shares for an aggregate purchase price of $87.3 million under our securities repurchase program. In July 2022, the Board of Directors increased the authority delegated to management to repurchase our outstanding securities by $250 million. As of July 26, 2022, the Company’s total available repurchase authority is $330.6 million.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.