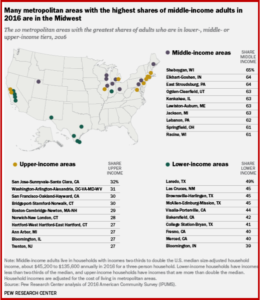

Click to Enlarge.

About half (52%) of American adults lived in middle-class households in 2016. This is virtually unchanged from the 51% who were middle class in 2011. But while the size of the nation’s middle class remained relatively stable, financial gains for middle-income Americans during this period were modest compared with those of higher-income households, causing the income disparity between the groups to grow, according to research from Pew Research Center.

The recent stability in adults living in middle-income households marks a shift from a decades-long downward trend. From 1971 to 2011, the share of adults in the middle class fell by 10 percentage points. But that shift was not all down the economic ladder. Indeed, the increase in the share of adults who are upper income was greater than the increase in the share who are lower income over that period, a sign of economic progress

Financially, middle-class households in the U.S. were better off in 2016 than in 2010. The median income of middle-class households increased from $74,015 in 2010 to $78,442 in 2016, by 6%. Upper-income households (where 19% of American adults live) fared better than the middle class, as their median income increased from $172,152 to $187,872, a gain of 9% over this period. Lower-income households (29% of adults) experienced an income gain of 5%, about the same as the middle class. (Incomes are adjusted for household size, scaled to reflect three-person households, and expressed in 2016 dollars.)

However, the median income of middle-class households in 2016 was about the same as in 2000, a reflection of the lingering effects of the Great Recession and an earlier recession in 2001. The median income of lower-income households in 2016 ($25,624) was less than in 2000 ($26,923). Only the incomes of upper-income households increased from 2000 to 2016, from $183,680 to $187,872.

The widening income gap between upper-income households and middle- and lower-income households this century is the continuation of a decades-long trend. In 1970, the first year covered by earlier Pew Research Center analyses, the median income of upper-income households was 2.2 times the income of middle-income households and 6.3 times the income of lower-income households. These income ratios increased to 2.4 and 7.3 in 2016, respectively.

A recent Pew Research Center analysis also found that the wealth gaps between upper-income families and lower- and middle-income families in 2016 were at the highest levels recorded. Although the wealth of upper-income families has more than recovered from the losses experienced during the Great Recession, the wealth of lower- and middle-income families in 2016 was comparable to 1989 levels. Thus, even as the American middle class appears not to be shrinking (for now), it continues to fall further behind upper-income households financially, mirroring the long-running rise in income inequality in the U.S. overall.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Pew: American Middle-Class Losing Financially to Upper-Income Families

Click to Enlarge.

About half (52%) of American adults lived in middle-class households in 2016. This is virtually unchanged from the 51% who were middle class in 2011. But while the size of the nation’s middle class remained relatively stable, financial gains for middle-income Americans during this period were modest compared with those of higher-income households, causing the income disparity between the groups to grow, according to research from Pew Research Center.

The recent stability in adults living in middle-income households marks a shift from a decades-long downward trend. From 1971 to 2011, the share of adults in the middle class fell by 10 percentage points. But that shift was not all down the economic ladder. Indeed, the increase in the share of adults who are upper income was greater than the increase in the share who are lower income over that period, a sign of economic progress

Financially, middle-class households in the U.S. were better off in 2016 than in 2010. The median income of middle-class households increased from $74,015 in 2010 to $78,442 in 2016, by 6%. Upper-income households (where 19% of American adults live) fared better than the middle class, as their median income increased from $172,152 to $187,872, a gain of 9% over this period. Lower-income households (29% of adults) experienced an income gain of 5%, about the same as the middle class. (Incomes are adjusted for household size, scaled to reflect three-person households, and expressed in 2016 dollars.)

However, the median income of middle-class households in 2016 was about the same as in 2000, a reflection of the lingering effects of the Great Recession and an earlier recession in 2001. The median income of lower-income households in 2016 ($25,624) was less than in 2000 ($26,923). Only the incomes of upper-income households increased from 2000 to 2016, from $183,680 to $187,872.

The widening income gap between upper-income households and middle- and lower-income households this century is the continuation of a decades-long trend. In 1970, the first year covered by earlier Pew Research Center analyses, the median income of upper-income households was 2.2 times the income of middle-income households and 6.3 times the income of lower-income households. These income ratios increased to 2.4 and 7.3 in 2016, respectively.

A recent Pew Research Center analysis also found that the wealth gaps between upper-income families and lower- and middle-income families in 2016 were at the highest levels recorded. Although the wealth of upper-income families has more than recovered from the losses experienced during the Great Recession, the wealth of lower- and middle-income families in 2016 was comparable to 1989 levels. Thus, even as the American middle class appears not to be shrinking (for now), it continues to fall further behind upper-income households financially, mirroring the long-running rise in income inequality in the U.S. overall.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.