Click for more information.

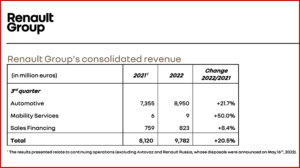

Renault Group (Euronext: RNO) posted a revenue increase today of €9.8 billion, up 20.5% compared to 2021 Q3. Automotive revenue reached €9 billion, up 21.7%1 based on global sales of 481,000 vehicles, down 2.4% compared to 2021 Q3. The E-tech range (electric and hybrid) accounted for 38% of Renault passenger car sales in Europe during the first 9 months, up 12 points compared to the first 9 months of 2021.

The Group’s orders in Europe remains at an historic level – the same in volume compared to the end of June. Renault Group also confirmed its 2022 financial outlook*, which will probably meet with analyst skepticism given the ongoing economic crisis in Europe and the negative global effects of Putin’s war against Ukraine. Balancing this is a renegotiation of the Alliance with Nissan, which could bring Renault ~$3.3 billion if it cuts it stake to 15% from 43%.

Click for more information.

“The growth of the activity in the 3rd quarter continues to reflect our commercial policy focused on value, improvement of the pricing policy, optimization of commercial discounts and priority to the most profitable channels. The Group is also beginning to benefit from the renewal of the range with the promising start of Renault Megane E-tech Electric and the successful launch of Dacia Jogger. Renault Austral, which is currently being launched, reinforces the Group’s return to the C segment. These are all levers that improve the Group’s competitiveness and will enable us to achieve our 2022 objectives while waiting to unveil new mid-term ambition during our Capital Market Day on November 8th,” said Thierry Piéton, Chief Financial Officer of Renault Group.

Renault Group Claimed Q3 Highlights

- Renault Megane E-tech Electric has a promising start with more than 37,000 orders since its launch in Q2, including 75% on the higher trim versions and 85% on the most powerful engine.

- Renault Arkana had more than 60,000 orders in 2022, of which 60% were in E-tech version and 60% retail.

- Renault Austral, sales are just underway, return, the band to the highest volume C-SUV segment.

- Dacia Jogger had more than 65,000 orders in 2022 and a mix of 60% on the higher trim versions in Europe and more than 50% in LPG3 version and in 7-seater version.

- Dacia Sandero remains the best-selling vehicle to retail customers in Europe.

- With more than 45,000 orders in Europe in 2022, Dacia Spring 100% electric is the 3rd best-selling electric vehicle to retail customers in Europe.

- The E-tech range (electric and hybrid) accounted for 38% of Renault passenger car sales in Europe during the first 9 months, up 12 points compared to the first 9 months of 2021

Renault Footnotes

- 2021 adjusted to reflect the disposal of AVTOVAZ and Renault Russia

- France, Germany, Spain, Italy, United Kingdom

- LPG: Gas of liquefied petroleum

*Renault Group 2022 FY financial outlook

- Group operating margin superior to 5%.

- an Automotive operational free cash flow superior to €1.5 billion.

Click for more information.

Renault Group

Renault Group, aside from its alliance with Nissan and Mitsubishi Motors, comprises 4 brands – Renault, Dacia, Alpine and Mobilize Established ~130 countries, the Group sold 2.7 million vehicles in 2021. It employs ~111,000 people. Renault Group claims it is committed to an ambitious transformation that will generate value. This is centered on the development of new technologies and services, and a new range of electrified vehicles. In line with environmental challenges, the Group’s ambition is to achieve carbon neutrality in Europe by 2040. There are rumblings in the media that Renault is considering cutting its 43% stake in the Alliance.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Renault Group Q3 – 20% Increase in Revenue at €9.8B

Click for more information.

Renault Group (Euronext: RNO) posted a revenue increase today of €9.8 billion, up 20.5% compared to 2021 Q3. Automotive revenue reached €9 billion, up 21.7%1 based on global sales of 481,000 vehicles, down 2.4% compared to 2021 Q3. The E-tech range (electric and hybrid) accounted for 38% of Renault passenger car sales in Europe during the first 9 months, up 12 points compared to the first 9 months of 2021.

The Group’s orders in Europe remains at an historic level – the same in volume compared to the end of June. Renault Group also confirmed its 2022 financial outlook*, which will probably meet with analyst skepticism given the ongoing economic crisis in Europe and the negative global effects of Putin’s war against Ukraine. Balancing this is a renegotiation of the Alliance with Nissan, which could bring Renault ~$3.3 billion if it cuts it stake to 15% from 43%.

Click for more information.

“The growth of the activity in the 3rd quarter continues to reflect our commercial policy focused on value, improvement of the pricing policy, optimization of commercial discounts and priority to the most profitable channels. The Group is also beginning to benefit from the renewal of the range with the promising start of Renault Megane E-tech Electric and the successful launch of Dacia Jogger. Renault Austral, which is currently being launched, reinforces the Group’s return to the C segment. These are all levers that improve the Group’s competitiveness and will enable us to achieve our 2022 objectives while waiting to unveil new mid-term ambition during our Capital Market Day on November 8th,” said Thierry Piéton, Chief Financial Officer of Renault Group.

Renault Group Claimed Q3 Highlights

Renault Footnotes

*Renault Group 2022 FY financial outlook

Click for more information.

Renault Group

Renault Group, aside from its alliance with Nissan and Mitsubishi Motors, comprises 4 brands – Renault, Dacia, Alpine and Mobilize Established ~130 countries, the Group sold 2.7 million vehicles in 2021. It employs ~111,000 people. Renault Group claims it is committed to an ambitious transformation that will generate value. This is centered on the development of new technologies and services, and a new range of electrified vehicles. In line with environmental challenges, the Group’s ambition is to achieve carbon neutrality in Europe by 2040. There are rumblings in the media that Renault is considering cutting its 43% stake in the Alliance.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.