RumbleOn (NASDAQ: RMBL), the e-commerce company that claims to simplify how dealers and consumers buy, sell, trade or finance pre-owned vehicles, today announced financial results -ma net loss of -$22 million for the three months ended March 31, 2020. This calculates to a net loss per share was of -$10.77 for the stock that is touted by some traders as disruptive of the dealership centered automotive universe. RMBL is currently trading at ~$9:70/share. Even disruptive tech companies though are vulnerable to the harsh realities of the ongoing and spreading Covid 19 pandemic in the U.S. (RumbleOn Posts 2019 Loss. Cancels Guidance)

Theories in business, science, politics and life can be crude or elegant, but they are subject to correction or questioning by data. The e-commerce RumbleOn touts using innovative technology to simplify how dealers and consumers buy, sell, trade or finance used vehicles. As such, it’s one of a growing number of companies that were catching analyst and day trader enthusiasm because they are “disruptive” to the ruling business order.

Well, so is COVID-19, which is ideologically atheistic about class, party, economic theories and Wall Street fads. The question here goes far beyond RumbleOn’s strategy and management to the still unknown COVID-19 plague effects going forward. This is a stock for the brave…(AutoInformed has no position in the stock)

DATA – Q1 2020 Financial Results

- Total vehicle unit sales of 7,420

- Total revenue was $144.4 million, up 13.8% from Q4 of 2019

- Powersports revenue was $23.1 million, up 39.2% from Q4 of 2019

- Automotive revenue was $114.2 million, up 8.6% from Q4 of 2019

- Transportation revenue was $7.1 million, up 37.4% from Q4 of 2019

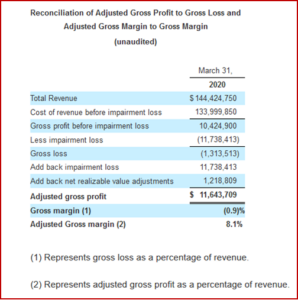

- Gross profit was $(1.3) million or (0.9%), net of $11.7 million non-cash inventory impairment loss, and $1.2 million for net realizable value adjustments for inventory. Gross profit for Q4 of 2019 was $9.0 million. See the section titled “Impairment and Net Realizable Value Adjustments” below for additional details.

- Adjusted gross profit was $11.6 million, excluding the $12.9 million in impairment and net realizable value adjustments for inventory. Adjusted gross margin was 8.1%.

- Gross margin on vehicles sold was 6.8%

- Powersports gross profit per vehicle sold was $1,039, a 13.8% increase from Q4 of 2019 and up 8.2% from Q1 2019

- Automotive gross profit per vehicle sold was $1,379, a 11.3% increase from Q4 of 2019 and up 28.7% from Q1 2019

- Sales, general and administrative expenses were $18.1 million, a decrease of 18.5% from $22.2 million in Q4 of 2019

- Operating loss was $19.9 million

- Net Loss was $22.0 million

- Adjusted EBITDA loss of $6.5 million

Net loss per share was ($10.77) based on 2,046,423 basic and fully diluted Class B shares. On May 20, 2020, RumbleOn effected a one-for-twenty reverse stock split of its issued and outstanding Class A Common Stock and Class B Common Stock. Following a reverse stock split, the Company has outstanding 50,000 shares of Class A Common Stock and approximately 2,162,696 shares of Class B Common Stock. See http://www.rumbleon.com.

“Consistent with the goals we outlined last fall, we have taken prescriptive measures to drive gross margin expansion, gross profit per unit improvements and reduce operating expenses. We had a strong start to the year, with January and February tracking in line with our expectations as our initiatives, including opportunistically building inventory in Q4 for the anticipated acceleration in sales in 2020, began to pay off. Beginning in March, the industry – and our business – experienced imbalances in both supply and demand. We were decisive and quick to take action to protect our business through prudent management of our financial resources from the onset of the pandemic,” commented RumbleOn CEO Marshall Chesrown.

“We are seeing a rebound in demand, consistent with others in our industry. While we anticipate significant improvements from the low volume experienced industry wide in April and May, we expect continued fluctuations in market trends and will maintain our conservative approach to sales volume while closely monitoring market conditions.

“Looking ahead, we are focused on the successful launch of the third generation of RumbleOn.com in Q3, which will improve powersport dealers’ ability to compete in a meaningful manner in online-only transactions while expanding RumbleOn’s opportunities for monetization, and furthering our advanced discussions with potential strategic alliances. RumbleOn is still in its early days, and we look forward to years of innovation ahead of us.”

Chesrown continued, “Our nimble business model enabled us to make operational changes necessary to withstand the deepest demand slowdown the vehicle market has probably ever seen, and we believe that the actions we took during this time will enable us to emerge in as strong a position as ever. We are committed to making sustainable improvements to SG&A and GPU as we execute on our strategy to become the first online vehicle provider to achieve profitability.”

Q2 2020 Commentary and Outlook

RumbleOn says it experienced the bottom of the downturn in mid-April, with the largest unit sales decline and its lowest level of inventory acquisition during the quarter. By the end of April conditions began improving slowly, ramping up more quickly as the month of May progressed. Total unit sales for the month of April were down 66% from January levels.

“The velocity of the rebound in May and thus far through June has been higher than expected and with the return of demand, our acquisition of inventory has accelerated. In May, unit sales increased more than 22% from April’s lows, and based on initial June month-to-date results the Company is expecting a 26% increase in month-over-month unit sales in June as compared to April,” claimed Chesrown.

However, current monthly unit volumes are still below January and February, but Chesrown says preliminary results for the month of June show the highest gross margin on units sold in the Company’s history and significant operating income improvement from prior periods.

Impairment and Net Realizable Value Adjustments

The $12.9 million impairment and net realizable value adjustments to the 31 March 2020 inventory include:

(i) The $11.7 million non-cash inventory impairment loss which included $4.5 million of cost for vehicles that were a total loss and $7.3 million for loss in value of vehicles partially damaged and subject to repair. Under ASC 330 the impairment loss is reported in cost of revenue in the March 31, 2020 condensed consolidated statements of operations. The Company has not recorded any recoveries that are expected to be received from the insurance carrier since the final amount and timing of the recovery has not been determined. Any such recovery would be reported as a separate component of income from continuing operations in the period in which such recovery is recognizable. The Company maintains insurance coverage for damage to its facilities and inventory, as well as business interruption insurance. The Company continues in the process of reviewing damages and coverages with its insurance carriers.

(ii) The $1.2 million for the write down of vehicle inventory to the lower of cost or net realizable value at March 31, 2020. The write down included $878,542 of adjustments for automotive and $340,268 for adjustments for powersports and resulted from the negative impact on our sales channels from COVID-19 and related effects of sheltering-in-place and significantly reduced commercial activity.

Non-GAAP Financial Measures

As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this release. Non-GAAP financial measures for the three months ended March 31, 2020 used in this release include: adjusted gross profit, adjusted gross margin and adjusted EBITDA.

Adjusted gross profit, adjusted gross margin, and adjusted EBITDA is a non-GAAP financial measure and should not be considered as an alternative to operating income or net income as a measure of operating performance or cash flows or as a measure of liquidity. Non-GAAP financial measures are not necessarily calculated the same way by different companies and should not be considered a substitute for or superior to U.S. GAAP.

Adjusted gross profit is defined as gross profit adjusted to add back non-cash impairment loss on damage sustained on automotive inventory and the write down of inventory at March 31, 2020 to net realizable value due to the adverse impacts of the COVID-19 pandemic resulting from practices implemented to combat COVID-19, such as social distancing and shelter-in-place policies, as these charges are not considered a part of our core business operations and are not an indicator of ongoing, future company performance. Adjusted gross margin represents adjusted gross profit as a percentage of revenue.

Adjusted EBITDA is defined as net loss adjusted to add back interest expense including debt extinguishment and depreciation and amortization, and certain charges and expenses, such as non-cash compensation costs, acquisition related costs, derivative income, financing activities, litigation expenses, severance, new business development costs, technology implementation costs and expenses, and facility closure and lease termination costs, as these charges and expenses are not considered a part of our core business operations and are not an indicator of ongoing, future company performance.

Adjusted gross profit, adjusted gross margin and adjusted EBITDA is one of the primary metrics used by management to evaluate the financial performance of our business.

#We present adjusted gross profit, adjusted margin, and adjusted EBITDA because we believe it is frequently used by analysts, investors and other interested parties to evaluate companies in our industry. Further, we believe it is helpful in highlighting trends in our operating results, because it excludes, among other things, certain results of decisions that are outside the control of management, while other measures can differ significantly depending on long-term strategic decisions regarding capital structure and capital investments,” said Chesrown.

Pingback: RumbleOn Posts Q2 Profit of $8.5m, 10.0% of Revenue | AutoInformed