U.S. Auto sales of light vehicles declined in September for the first time in three years, as a calendar quirk and weakening of Asian brand vehicles displaced strong growth at the Detroit Three. AutoData said the seasonally adjusted annual rate or SAAR was 15.28 million units, versus 14.78 million units a year ago and 16.09 million units in August. Sales for all brands, unadjusted for business days, were down 4% from September 2012 and 24% from August 2013.

Consumer confidence also hit a five-month low in September against the backdrop of Republican Tea Party terrorism, which is currently holding the U.S. government and its taxpayers hostage. Compared to the fiasco in Washington, though, the automobile business even with a slight drop in sales remains a responsible, job and wealth-creating segment of American society.

“In order to regain sales momentum in the last quarter, dealers are hopeful that economic and political stability can be established to reassure skittish consumers,” said AIADA President Cody Lusk.

With two fewer selling days in month due to an August Labor Day weekend, the Japanese Three all posted declines. Toyota sales dipped 4.3%. Honda sales were down 8.7%. Nissan sales were down 5.6%, according to AutoData. Subaru swam upstream with 31,755 units sold for a 14.7% in an overall market that grew

Offshore brands continued to hold a majority of the U.S. auto market at 54.9%, down from 56.1% last month and 57% in July. This translates to sales of 625,593 vehicles, down from 843,588 in August and 750,254 in July.

Asian brands occupied 44.6% of the auto market, down from 47.3% last month. Together, they sold 508,213 units, down from 711,041 units last month. European brands gained in September, capturing 10.3% of the market and selling 117,380 vehicles. Last month, they held 8.8% of the market and sold 132,547 units.

The Detroit Three finished the month with a 45.1% share of the market and sales of 513,457 units. In September, they held a 43.9% share of the market and sold 581,591 vehicles showing remarkable strength in truck segments.

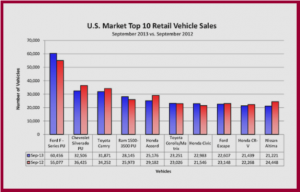

Offshore brands took six of the top ten selling vehicle slots in September down from seven in August. Ford F-Series once again was indisputably in first place. The Toyota Camry, which unseated the Chevrolet Silverado to move into second place in August, finished September in third place as Chevy pickup outsold it by fewer than 1,000 vehicles. Fourth place belonged to Ram pickup, a spot it is likely to hold for the balance of the year – if it does not knock off the Camry. Honda Accord was the second best-selling car as it occupied Fifth place. The compact Toyota Corolla/Matrix and Honda Civic occupied sixth and seventh places, while the Honda CR-V crossover and Nissan Altima sedan rounded out the list in ninth and tenth places, respectively.

Offshore brands continued to increase their North American manufacturing operations, producing more vehicles than ever. Asian brands sold 200,465 vehicles from North American production facilities, representing 35% of all cars sold in the U.S. last month. Asians also sourced 139,653 of their trucks from North America, totaling 24.4% of all trucks sold in the U.S.

European brands sourcing 19,055 of their cars and 12,403 of their trucks that were sold in the U.S. from their North American facilities in September, a smaller portion at 26% of the 117,380 vehicles sold.