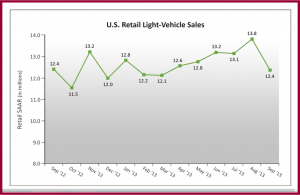

Coming off several strong spring and summer months, as well as a good year to date, the pace of U.S. auto sales is slowing to the same level as September 2012, according to the latest monthly forecast. Compared to a robust seasonally adjusted annualized rate of more than 16 million units in August, September is running at a 15.2 million SAAR. Leaving fleet sales aside, the retail SAAR in September is expected to be 12.4 million or 933,400 cars and trucks.

While a total September sales forecast of 1,132,800, if accurate, represents a mere 2% increase from September 2012, a calendar issue with Labor Day has negatively biased the month. The auto industry reports sales on a sales month basis rather than a calendar month basis. Historically, Labor Day falls in the September sales month. Not in 2013 though, it fell in the August sales month. This means that sales delivered over the holiday weekend were counted in August sales rather than September. (Asian Brands Dominate U.S. August Sales and Chrysler, Ford, GM Post Double Digit August Sales Gains)

“Although the year-over-year sales gain in September is smaller than has been observed in recent months, it’s important to recognize that September reported sales are being heavily influenced by a quirk on the industry sales calendar,” said John Humphrey, at J.D. Power, the source of the sales soothsaying.

He said that due to this difference in the sales reporting calendar in 2013, it makes sense to evaluate August and September sales in combination.

“When combined, August and September retail sales are expected to be up 10.6%, compared with August and September 2012, which underscores the continued positive trajectory in growth and overall health of the industry,” said Humphrey.

Higher fleet sales compared to August are also a factor that will hurt automaker profits. Fleet share is projected at 18%, up from 11% in August at close 200,000 units for what are lower margin deals. At the current pace, though, fleet sales should account for less than 18% of the market in 2013. This a healthy improvement for much higher fleet rates in recent years, particularly at Chrysler, Ford and GM.

LMC Automotive is holding its 2013 forecast for total light-vehicle sales at 15.6 million – a number that AutoInformed thinks is low. LMC admits that retail light-vehicle sales are tracking slightly ahead of its expectations with the total year now expected to come in at 12.9 million units, an increase from the previous forecast of 12.8 million units.

LMC’s forecast for 2013 North American production holds at 16.0 million units, a 4% increase from 2012. Looking ahead, its 2014 production forecast is currently at 16.5 million units, up 3% from 2013. Volume is expected to increase from a higher level of demand, and from the introduction of new vehicles, including the BMW X4, Ford Transit, Honda Fit, Mazda3 and Mercedes-Benz C-Class. In addition, 28 redesigned models are expected to come to market in 2014, up from nine in 2013.