Click to Enlarge.

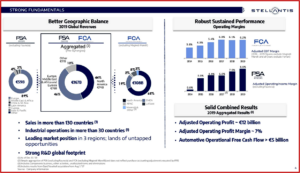

Today Stellantis officially announced its Executive Team along with the 9 dedicated committees* covering enterprise-wide performance and strategy for running the merged FCA and PSA companies. It is the latest merger in the capital-destroying automotive industry that seeks to pursue scale where the promise of synergies will – it is hoped – result in competitive rates of return, along with a sustainable business. (see AutoInformed on Bye Bye FCA and PSA. Hello Stellantis)

Carlos Tavares, CEO of Stellantis, said at its inaugural press conference: “This highly competitive, committed and well-balanced team will leverage its combined skills and diverse backgrounds to guide Stellantis to become a great company.” He claimed that this was not a defensive merger. (Stellantis means “brightens with stars”; from the Latin verb stello.)

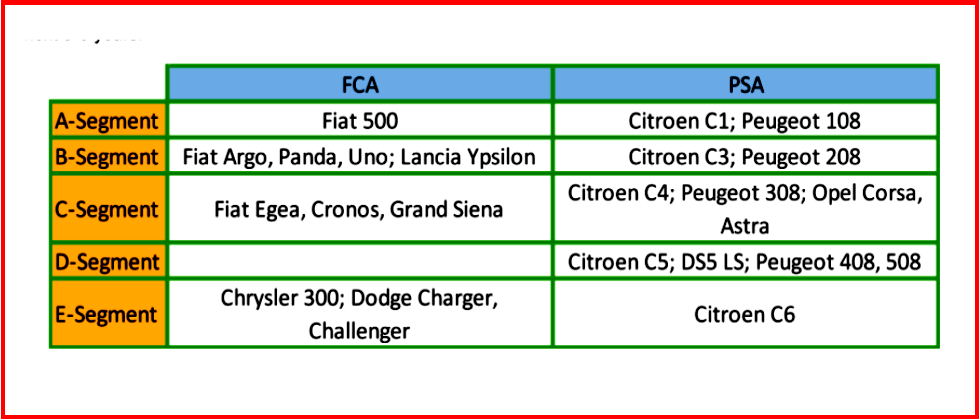

The Stellantis name will be used exclusively at the Group level, as a corporate brand. The names and the logos of the Stellantis Group’s basic 14 brands remain unchanged. What actually happens to the brands is an entirely different matter. AutoInformed readers likely realized that such mergers are difficult, and the road – looking backward – is littered with abandoned or failed promises of synergies and sales from such ventures. (FCA + PSA = Massive Job Losses, FCA-PSA Merger – Surviving Platforms and Powertrains)

Some detailed assembly and execution required…

For enthusiasts as well as workers there are other threats. How about a spin-off FCA’s expensive low-return Alfa Romeo/Maserati operation? Simple math here: It would provide funds for the new FCA-PSA group while improving its utilization rate.

The proposed combination has the capability to be an industry leader with “the management, capabilities, resources and scale to successfully capitalize on the opportunities presented by the new era in sustainable mobility.” More than two-thirds of run rate volumes will be concentrated on 2 platforms, with approximately 3 million cars per year on each of a small p and a compact/mid-size platform.

The exorbitantly expensive world of developing clean vehicles is on view at FCA-PSA. The business case is simply put as a way to spread costs as a consolidation results in the FCA-PSA meld emerging as the fourth-largest Global Automaker. It could compete with the current Global Big Three – Volkswagen Group, Toyota, and Renault-Nissan-Mitsubishi.

*Strategy Council, Business Review, Global Program Committee, Industrial Committee, Allocations Committee, Region Committee, Brand Committee, Styling Review, Brand Review

Stellantis Chief Executive Officer: Carlos TAVARES

Strategic and Performance

- Head of Americas: Mike MANLEY

- Global Corporate Office: Silvia VERNETTI

- Chief Performance Officer: Emmanuel DELAY

- Chief Software Officer: Yves BONNEFONT

- Chief Affiliates Officer: Philippe de ROVIRA(*)

(*) Sales Finance, Used Cars, Parts and Service, Retail Network

Regional Chief Operating Officers

- Enlarged Europe: Maxime PICAT

- Deputy: Davide MELE

- Eurasia: Xavier DUCHEMIN

- North America: Mark STEWART

- South America: Antonio FILOSA

- Middle East & Africa: Samir CHERFAN

- China: Grégoire OLIVIER Interim, in charge of DPCA

- India and Asia Pacific: Carl SMILEY

Brand Chief Executive Officers

- Global SUV

- Jeep: Christian MEUNIER Synergies Referent

- American Brands

- Chrysler:Timothy KUNISKIS Interim

- Dodge:Timothy KUNISKIS Synergies Referent

- RAM: Mike KOVAL

- Core

- Citroën:Vincent COBEE

- Fiat & Abarth: Olivier FRANCOIS Synergies Referent & Global Chief Marketing Officer

- Upper mainstream

- Opel & Vauxhall:Michael LOHSCHELLER

- Peugeot:Linda JACKSON Synergies Referent

- Premium

- Alfa Romeo: Jean-Philippe IMPARATO Synergies Referent

- DS: Béatrice FOUCHER

- Lancia: Luca NAPOLITANO

- Luxury

- Mobility

- Free2Move: Brigitte COURTEHOUX

- Leasys:Giacomo CARELLI

Global Function Chief Officers

- Finance: Richard PALMER

- Human Resources & Transformation: Xavier CHEREAU

- General Counsel: Giorgio FOSSATI

- Planning: Olivier BOURGES

- Purchasing & Supply Chain: Michelle WEN

- Manufacturing: Arnaud DEBOEUF

- Design:

- Ralph GILLES (CHRYSLER / DODGE / JEEP / RAM / MASERATI / FIAT Latin America)

- Jean-Pierre PLOUE(ABARTH / ALFA ROMEO / CITROEN / DS / FIAT Europe / LANCIA/ OPEL /PEUGEOT / VAUXHALL)

- Engineering: Harald WESTER

- Deputy: Patrice LUCAS Cross car line and project engineering

- Deputy: Nicolas MOREL

- CTO: To be announced

- Sales & Marketing: Thierry KOSKAS

- Customer Experience:Richard SCHWARZWALD

- Deputy: Jean-Christophe QUEMARD

Communication & CSR: Bertrand BLAISE

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Stellantis – a Mega Merger of Auto Companies Names Execs

Click to Enlarge.

Today Stellantis officially announced its Executive Team along with the 9 dedicated committees* covering enterprise-wide performance and strategy for running the merged FCA and PSA companies. It is the latest merger in the capital-destroying automotive industry that seeks to pursue scale where the promise of synergies will – it is hoped – result in competitive rates of return, along with a sustainable business. (see AutoInformed on Bye Bye FCA and PSA. Hello Stellantis)

Carlos Tavares, CEO of Stellantis, said at its inaugural press conference: “This highly competitive, committed and well-balanced team will leverage its combined skills and diverse backgrounds to guide Stellantis to become a great company.” He claimed that this was not a defensive merger. (Stellantis means “brightens with stars”; from the Latin verb stello.)

The Stellantis name will be used exclusively at the Group level, as a corporate brand. The names and the logos of the Stellantis Group’s basic 14 brands remain unchanged. What actually happens to the brands is an entirely different matter. AutoInformed readers likely realized that such mergers are difficult, and the road – looking backward – is littered with abandoned or failed promises of synergies and sales from such ventures. (FCA + PSA = Massive Job Losses, FCA-PSA Merger – Surviving Platforms and Powertrains)

Some detailed assembly and execution required…

For enthusiasts as well as workers there are other threats. How about a spin-off FCA’s expensive low-return Alfa Romeo/Maserati operation? Simple math here: It would provide funds for the new FCA-PSA group while improving its utilization rate.

The proposed combination has the capability to be an industry leader with “the management, capabilities, resources and scale to successfully capitalize on the opportunities presented by the new era in sustainable mobility.” More than two-thirds of run rate volumes will be concentrated on 2 platforms, with approximately 3 million cars per year on each of a small p and a compact/mid-size platform.

The exorbitantly expensive world of developing clean vehicles is on view at FCA-PSA. The business case is simply put as a way to spread costs as a consolidation results in the FCA-PSA meld emerging as the fourth-largest Global Automaker. It could compete with the current Global Big Three – Volkswagen Group, Toyota, and Renault-Nissan-Mitsubishi.

*Strategy Council, Business Review, Global Program Committee, Industrial Committee, Allocations Committee, Region Committee, Brand Committee, Styling Review, Brand Review

Stellantis Chief Executive Officer: Carlos TAVARES

Strategic and Performance

(*) Sales Finance, Used Cars, Parts and Service, Retail Network

Regional Chief Operating Officers

Brand Chief Executive Officers

Global Function Chief Officers

Communication & CSR: Bertrand BLAISE

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.