Stellantis N.V. (NYSE / MTA / Euronext Paris: STLA), the mega merger of FCA and Peugeot, posted record profitability during the first half or 2020 because of increasing sales of low emission vehicles (LEV), which include battery electric (BEV), plug-in hybrid (PHEV) and fuel cell electric vehicles. Stellantis said it ranked second in the EU30 market for BEV and LEV sales, and third in the U.S. market for LEV sales.. Stellantis’ global BEV sales were up nearly 50% y-o-y to 136,000 units in H1. The company now offers 20 BEVs, with an additional 28 BEVs to be launched through 2024.

“In a demanding global context, we continue to ‘Dare Forward,’ delivering an outstanding performance and executing our bold electrification strategy. Together with our employees’ resiliency, agility and entrepreneurial mindset, and our innovative partners, we are shaping Stellantis into a sustainable mobility tech company that’s fit for the future. I would like to express my sincere appreciation to all Stellantis employees for their commitment and their contribution to these results,” said Carlos Tavares, CEO. (AutoInformed: Dare Forward 2030 – Stellantis Survival Plan Unveiled)

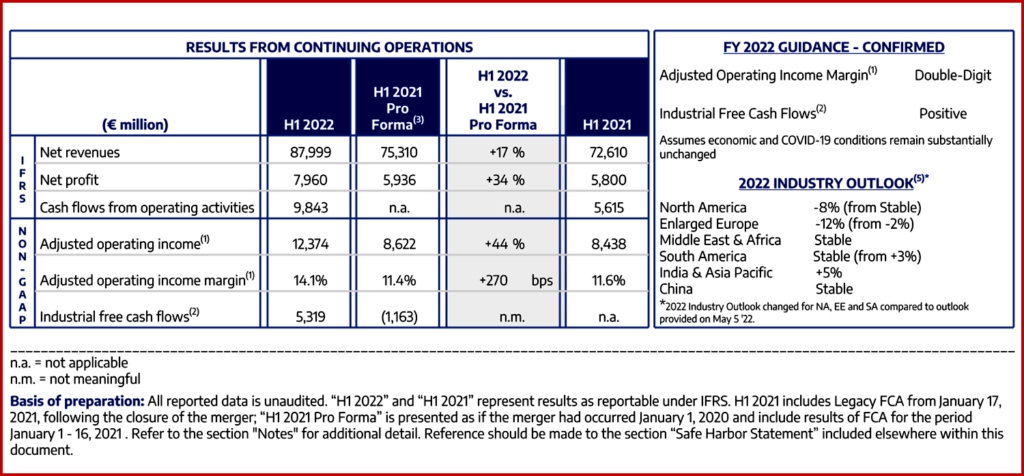

Click to Enlarge.

North America: Set record profitability, with Adjusted Operating Income (AOI) margin of 18.1%; market share was up 40 bps y-o-y to 11.3%, with U.S. share up 50 bps to 11.7%. Jeep® Wrangler 4xe remains the best-selling PHEV in the U.S.(6) with 19,000 units sold in H1, up 55% y-o-y. The all-new Jeep Grand Cherokee 4xe is arriving in dealerships, to be followed by the all-new Wagoneer L and Grand Wagoneer L in late 2022.

Enlarged Europe: Achieved AOI margin of 10.4% up 160 bps, EU30 market share at 21.2%, down 190 bps. The Fiat New 500 was the number one selling BEV in Germany and Italy and the Peugeot e-208 was the best-selling BEV in France. Jeep Compass and Renegade were the number one and number two best-selling LEVs in Italy. Peugeot 208, Opel Corsa, Citroën C3, Fiat Panda and Fiat 500 represented five of the EU30 top 10 selling vehicles.

Other Regions: All three regions achieved double-digit AOI margins.

- South America: more than tripled AOI to €1.0 billion, with 13.9% margin. Market leader in the region with 23.5% share. Fiat was the top-selling brand in the region and Jeep top-selling SUV brand in Brazil.

- Middle East & Africa: record AOI margin of 15.5% up 580 bps and AOI of €472 million; market share up 20 bps to 11.9%.

- China and India & Asia Pacific: AOI margin of 13.4%, with AOI up 40% to €289 million. The all-new Jeep Meridian and Citroën C3 launched in India and deliveries began in June and July, respectively.

Maserati: On the path to double-digit profitability, with AOI margin of 6.6%, up 330 bps. AOI more than doubled to €62 million. All-new MC 20 Cielo unveiled in May; launched all-new Grecale with first deliveries in Europe at the end of June and unveiled limited edition Supercar in July.

First Half 2022 at a Glance in Stellantis’ view

- Net revenues of €88.0 billion, up 17% compared to H1 2021 Pro Forma reflecting strong net pricing, favorable vehicle mix and positive FX translation effects.

- Adjusted operating income of €12.4 billion, up 44% compared to H1 2021, with margin at 14.1%; all five regions with double-digit margins.

- Net profit of €8.0 billion, up 34% compared to H1 2021.

- Industrial free cash flows of €5.3 billion, up €6.5 billion compared to H1 2021.

- Strong Industrial available liquidity at €59.7 billion.

- Stellantis ranked second in BEV sales and LEV sales in EU30 market; third in the U.S. market for LEV sales.

- Global BEV sales up nearly 50% y-o-y to 136,000 units.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Stellantis: Record First Half 2022 at €8.0 Billion Net Profit

Stellantis N.V. (NYSE / MTA / Euronext Paris: STLA), the mega merger of FCA and Peugeot, posted record profitability during the first half or 2020 because of increasing sales of low emission vehicles (LEV), which include battery electric (BEV), plug-in hybrid (PHEV) and fuel cell electric vehicles. Stellantis said it ranked second in the EU30 market for BEV and LEV sales, and third in the U.S. market for LEV sales.. Stellantis’ global BEV sales were up nearly 50% y-o-y to 136,000 units in H1. The company now offers 20 BEVs, with an additional 28 BEVs to be launched through 2024.

“In a demanding global context, we continue to ‘Dare Forward,’ delivering an outstanding performance and executing our bold electrification strategy. Together with our employees’ resiliency, agility and entrepreneurial mindset, and our innovative partners, we are shaping Stellantis into a sustainable mobility tech company that’s fit for the future. I would like to express my sincere appreciation to all Stellantis employees for their commitment and their contribution to these results,” said Carlos Tavares, CEO. (AutoInformed: Dare Forward 2030 – Stellantis Survival Plan Unveiled)

Click to Enlarge.

North America: Set record profitability, with Adjusted Operating Income (AOI) margin of 18.1%; market share was up 40 bps y-o-y to 11.3%, with U.S. share up 50 bps to 11.7%. Jeep® Wrangler 4xe remains the best-selling PHEV in the U.S.(6) with 19,000 units sold in H1, up 55% y-o-y. The all-new Jeep Grand Cherokee 4xe is arriving in dealerships, to be followed by the all-new Wagoneer L and Grand Wagoneer L in late 2022.

Enlarged Europe: Achieved AOI margin of 10.4% up 160 bps, EU30 market share at 21.2%, down 190 bps. The Fiat New 500 was the number one selling BEV in Germany and Italy and the Peugeot e-208 was the best-selling BEV in France. Jeep Compass and Renegade were the number one and number two best-selling LEVs in Italy. Peugeot 208, Opel Corsa, Citroën C3, Fiat Panda and Fiat 500 represented five of the EU30 top 10 selling vehicles.

Other Regions: All three regions achieved double-digit AOI margins.

Maserati: On the path to double-digit profitability, with AOI margin of 6.6%, up 330 bps. AOI more than doubled to €62 million. All-new MC 20 Cielo unveiled in May; launched all-new Grecale with first deliveries in Europe at the end of June and unveiled limited edition Supercar in July.

First Half 2022 at a Glance in Stellantis’ view

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.