As is our annual predilection, here comes AutoInformed on the Top Auto Stories of 2013. As always, these are presented with our wry awareness that opining columnists conduct their education in public as we most certainly did last year – with both commendable and laughable results on our views of significant industry developments. We will continue to do so during 2014.

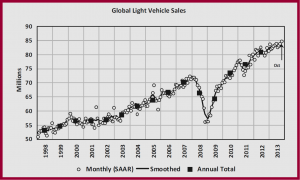

In terms of business significance, there are several candidates in the running for Top Auto Stories of 2013. Our pick is the expanding growth rate of global auto sales, which are increasing to pre-2007 Great Recession levels, with 2013 projected at an all-time record of more than 85 million vehicles.

North American markets also remained solid even though the Republican shutdown of the U.S. federal government for the first two weeks of October spooked consumers, causing a temporary halt in vehicle sales and costing the economy an estimated $25 billion.

However, during November, the US SAAR or seasonally adjusted annualized selling rate was at more than 16 million cars and light trucks. This is back to the healthier levels last seen before the Bush Great Recession years took hold after 2007. The human and economic tragedies that resulted from reckless Republican deregulation, allowing corrupt ratings agencies, banks and Wall Street firms to speculate until the bubble burst is still ongoing, but the auto business is once again creating wealth, paying taxes and generating jobs even if this is disproportionately distributed.

Automakers offered incentives averaging $2,500 per vehicle in November, up from November 2012, but down 2% from October 2013.

While the Detroit Three are enjoying the resurgence in sales of pickup trucks – the last segment that they clearly dominate – offshore nameplates once again proved that their tenacious hold on large chunks of the market is not slipping. On the contrary, offshore brands gained share at 56.4% of the U.S. market in November.

The Detroit Three built inventory rapidly late in 2013, and their combined days’ supply climbed from 87 days at the beginning of November to 93 days at month end. Optimism?

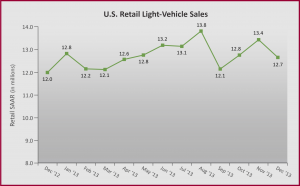

The December seasonally adjusted annualized rate (SAAR) for U.S. retail sales is projected at 12.7 million, a slight decline from 13.4 million in November, but this is 660,000 stronger (+5.5%) than December 2012. (December U.S. Vehicle Sales Projected at a +4% Increase, Holiday Shoppers Boost November U.S. Auto Sales and China Pulls October Global Vehicle Sales to All-Time Record, General Motors Sells Record 3 Million Vehicles in China)

Average U.S. new-vehicle retail transaction prices in December are expected to reach $30,500, up $500 (+2%) from a year ago, a likely record. The corresponding positive effect on the profits of the Detroit Three is another top story as manufacturing continues to be a bright spot in the slowly recovering U.S. economy. Chrysler Group, General Motors and Ford Motor are all now solidly profitable, reinvesting in new products and creating jobs, albeit the Detroit Three remain a mere shadow of their former selves in terms of total union and white collar employment. A story to watch in 2014 will be the UAW’s attempt to organize workers at the Volkswagen assembly complex in Tennessee. (Chrysler Group Up, General Motors Down in Q3 Earnings, Ford Motor Posts Q3 Profits of $2.6 Billion but Income Off, GM to Invest More than $1 Billion on Five U.S. Plant Upgrades, Toyota Quadruples Q3 Earnings despite Yen, China Woes. Raises Forecast, Toyota World’s Largest Automaker trailed by GM, VW)

Executive transitions also loomed large in 2013. Due to tragic personal circumstances caused by the serious illness of his long time wife, The CEO of GM pulled ahead his retirement, and in an unprecedented move the Board of Directors elected a 51-year-old female engineer as his replacement.

Mary Barra is a competent automotive executive who has proven herself repeatedly. She came up through the GM manufacturing ranks — “a difficult way to climb the corporate ladder for anyone, but especially for women,” Michelle Krebs a veteran Detroit-based auto journalist tells AutoInformed. We agree and wish Mary all the best. The good news is that Barra takes over General Motors at a time when sales are increasing; the product lineup is the best in my memory, and the balance sheet strong and getting stronger every day.

A strong supporting story here is the U.S. Treasury recouped a total of $39 billion from the original GM investment. You might recall that taxpayers in 2009 gave GM $49.5 billion in loans ($50 billion including loans for the Supplier and Warranty Programs) in exchange for $2.1 billion in preferred stock and a 60.8% equity stake in the reorganized company. While we lost $10 billion from what we say was a premature sale, letting GM and the auto industry flounder could have cost the broader economy more than one million jobs, billions in lost personal savings, and significantly reduced economic production. As a result of Obama Administration efforts, which built on those of the previous hapless Bush Administration, more than 370,000 new auto jobs have been created, and all three U.S. automakers are, arguably competitive, and growing.

A more sophisticated look at the politicized auto bailouts by the Center for Automotive Research, aka CAR, says that the actions conducted during the 2009 by the U.S. federal government saved more than 4 million jobs. It also saved U.S. taxpayers or avoided the loss of $105.3 billion in transfer payments and the loss of personal and social insurance tax collections – or 768% of the net investment of the thus far $11.8 billion.(Mary Barra to become GM CEO when Dan Akerson Retires, Treasury No Longer Owns GM Common Stock, Economist Says Auto Bailouts Saved More than 4 Million Jobs)

Ford CEO Mulally, who restored the stock dividend to the delight of the non-working Ford family, has a job for life, but only if he doesn’t leave for the Microsoft top spot.

The other succession story in Michigan has yet to play out. The Ford Motor Company held an extremely unusual December Board meeting, presumably to sort out what will happen if CEO Alan Mulally departs the Number Two US automaker for Microsoft as rumored. Even though Ford is also in the best shape in recent memory, except for the moribund Lincoln brand, the stock price is taking a pounding due to the uncertainty, and the fear that the family will reassert itself even though outsiders do a demonstrably better job managing the Dearborn-based firm.

There was also Ford’s frank admission earlier this month that while it will have a great year when it posts 2013 results, badly needed product revisions and expansion next year will hurt 2014 results. Whether this stark profit warning is needlessly conservative and designed to clear the way for a Mulally successor – in essence giving him (likely not her) a clear slate and now where to go but up – remains to be seen. (Ford Cuts 2014 Earnings Outlook. Warranty Costs Hurt 2013)

Unfortunately, in the ongoing quality wars, the Detroit Three, while building the best vehicles in my memory, remain so-so, la-la compared to their offshore competitors, particularly the Japanese. The largest U.S. reliability study (that is publicly released by Consumer Reports) shows that infotainment system continue to have high failure rates – as many as 15% do not work properly. Moreover, unlike infant mortality in other consumer electronic products there are growing failure rates with age. This does not bode well, to put it politely. The audio, navigation, communication, and connected systems in newer cars, aside from enabling deadly distracted driving, are now clearly a major source of owner discontent as they become more profitable for automakers. In-car electronics generated more complaints from owners of 2013 models than in any of the other 16 categories.

In many cases, the CR survey revealed touch-screen infotainment systems are buggy, with frustrating screen freezes, touch-control lag, or a reluctance to recognize a cell phone, an MP3 device, or a voice command. The problems clearly go far beyond complicated systems that younger buyers demand, and older buyers often dislike. (Infotainment Defects Grow in Latest Auto Reliability Data, Infotainment Systems Transform Instrument Panels)

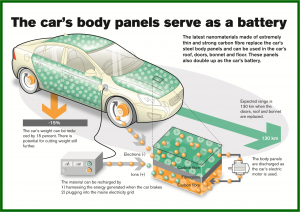

A blend of carbon fibers and polymer resin is being tested that – it’s claimed – can store and recharge faster than conventional batteries.

While the road to claimed technical innovations in the auto business is littered with road kill (remember Ballard?), we think that a Volvo car announcement about batteries this year is significant. Volvo says it has developed a lightweight battery that is molded to fit around a car’s door panels, trunk lid and wheel housings. Aside from substantially saving space, the Chinese-owned automaker claims that this reduces the heavy weight, large size and high costs associated with the batteries used in hybrids and electric vehicles today, while maintaining power and performance. The research project was funded as part of a European Union program that included Imperial College London as the academic lead along with eight other participants. Volvo was the only automaker in the project that took place over 3.5 years. The results are combination battery and car panels used in a Volvo S80 experimental car. Two pieces are currently under testing – the trunk lid and a plenum cover. The potential battery breakthrough is made possible from the use of a combination of carbon fibers and a polymer resin, creating an advanced nano-material, and structural super capacitors.

Sadly, several significant stories this year involved criminal or fraudulent behavior. In an ongoing Department of Justice investigation of price fixing in the U.S. auto supplier business a veritable “who’s who” of Japanese companies and their executives have been charged and convicted of violations of the Sherman Antitrust Act. Twenty-three corporations have now been charged in the department’s investigation into bid rigging in the auto parts industry. Those companies have agreed to pay a total of over $1.8 billion in fines. Additionally, 26 individuals have been charged. More incitements are on the way. (More Japanese Price Fixing from Stanley Electric, Japanese Price Fixing Scandal Expands Again. Now Toyo, Japanese Price Fixing Scandal Expands with Two More Indictments and Prison Sentences for Three Takata Executives. Nine Japanese Auto Parts Firms Guilty of Price Fixing, Panasonic Exec Indicted in Toyota Price Fixing Scam)

Moreover, it is not just the Japanese who were forced into expensive legal settlements for flouting U.S. regulations this year. Sister Korean brands Hyundai and Kia were just forced into an expensive class action settlement for an EPA mileage rating fraud that was revealed in November of 2012 after being caught by the EPA for falsely inflating mileage claims. The fraud produced mileage claims that could be as much as 6 mpg higher than EPA tests showed. About 900,000 vehicles are affected in the largest mileage fraud in history, including the best-selling Kia Optima and Hyundai Elantra sedans. Both makers heavily advertise and promote fuel economy as cornerstones of their brands, of course. EPA’s audit testing occasionally uncovers individual vehicles whose label values are incorrect and requires the manufacturer re-label the vehicle. EPA said this is the first time where a large number of vehicles from the same manufacturer have deviated so significantly. (Hyundai Cops Plea on Mileage Fraud Class Action, John Krafcik out as Hyundai President and CEO, Hyundai and Kia Caught in EPA Mileage Rating Fraud)

The Gulf oil spill pumped at least 5 billion gallons of crude oil into the Gulf of Mexico because of the negligence of BP and Halliburton.

Then there is the worst environmental disaster in U.S. history. BP Exploration and Production was sentenced last January to pay $4 billion in criminal fines and penalties for its conduct that led to the Deepwater Horizon oil spill.It was the largest criminal case in US history.

Nevertheless, the penalty remains a small fraction of the actual damage caused by pumping at least 5 billion gallons of crude oil into the Gulf of Mexico. This means that BP is paying less than $1 a gallon for the criminal spill and destruction of the environment.

Earlier this month, Kurt Mix, a former engineer for BP, was convicted of intentionally destroying evidence requested by federal criminal authorities investigating the Deepwater Horizon oil spill.Mix, 52, of Katy, Texas, was convicted by a federal jury in the Eastern District of Louisiana of one count of obstruction of justice and was acquitted on a second count of obstruction of justice. He faces a maximum penalty of 20 years in prison when sentenced on 26 March 2014. According to court documents and evidence at the trial, on 20 April 2010 the Deepwater Horizon rig experienced an uncontrolled blowout and related explosions while closing the Macondo well. The catastrophe killed 11 men on board and resulted in the largest environmental disaster in U.S. history. (BP Engineer Guilty of Obstruction of Justice in Deepwater Horizon Spill and BP Sentenced to Pay $4 Billion for Deepwater Horizon Oil Spill Crimes)

Finally, a story that AutoInformed remains mystified about. Tesla’s unexpected and unpredicted success with its EV has us almost speechless, or as speechless as pundits ever get, which is to say not much. Tesla is the latest example of how much money has been made in the auto business and the stock market – convincing buyers and analysts that it is reasonable to pay a lot of money for what is not very much car when objectively analyzed. We remain skeptical and predict limited success in 2014 and more woes for the EV maker, which has only made a profit in one quarter since its founding. At the highest point of the Tesla stock market bubble, it was selling a valuation greater than the capitalization of Mazda Motor based on the sales of 20,000 Model S EVs. Madness. As we said at the outset, we continue to conduct out education in public so you can be AutoInformed. (NHTSA Opens Tesla Model S Battery Fire Probe, Third Tesla Model S Fire in Two Months, Tesla Signs Battery Deal. Second Model S Fire Reported, Cadillac ELR debuts in January at $75,995. Tesla Killer?, Testosterone and Tesla – Men Love Them, Tesla Motors Delivers First Model S EVs at $100,000)