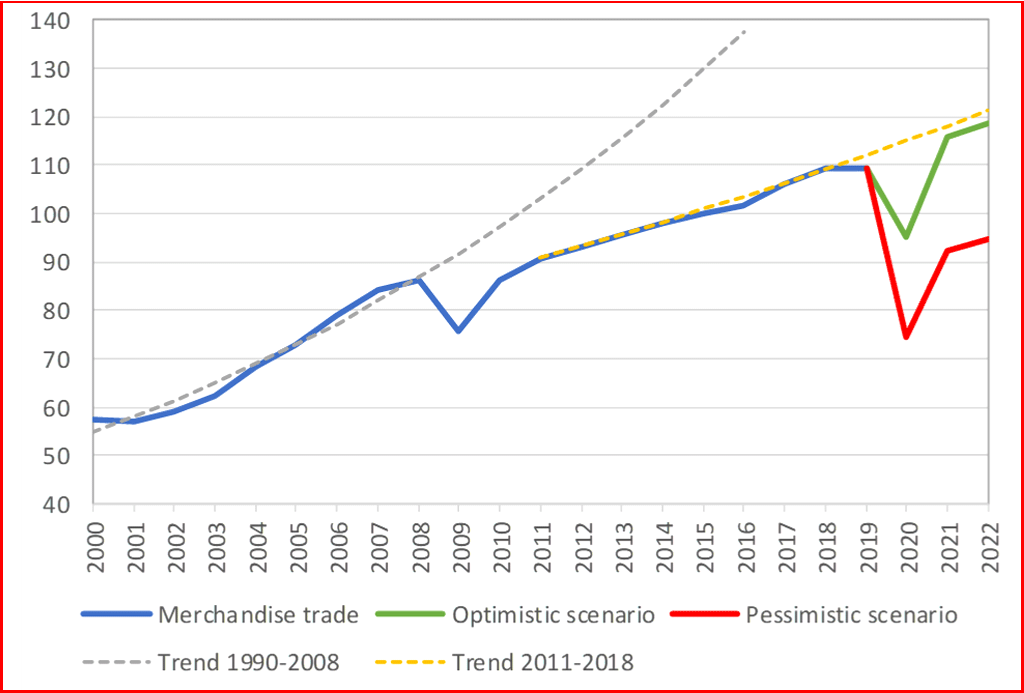

World trade is expected to fall by between 13% and 32% in 2020 as the COVID-19 pandemic disrupts normal economic activity and life around the world, according to the World Trade Organization. WTO said today that the wide range of possibilities for the predicted decline is explained by the unprecedented nature of this health crisis and the uncertainty around its precise economic impact.

World trade is expected to fall by between 13% and 32% in 2020 as the COVID-19 pandemic disrupts normal economic activity and life around the world, according to the World Trade Organization. WTO said today that the wide range of possibilities for the predicted decline is explained by the unprecedented nature of this health crisis and the uncertainty around its precise economic impact.

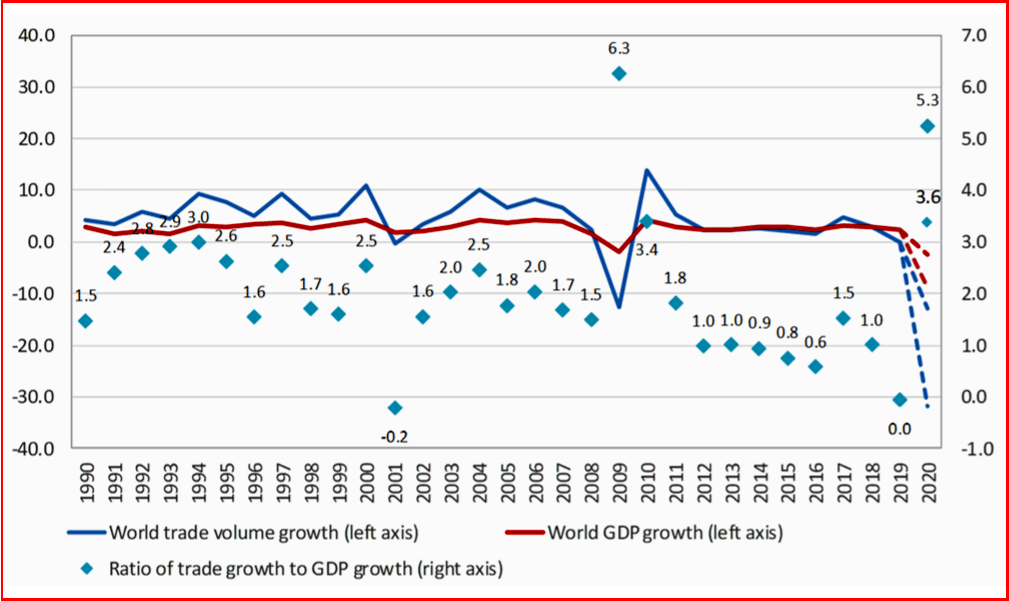

The response of political leadership can also have a big impact in the outcome. But WTO economists believe the decline will likely exceed the trade slump brought on by the global financial crisis of 2008‑09 (Chart above). Estimates of the expected recovery in 2021 are equally uncertain, with outcomes depending largely on the duration of the outbreak and the effectiveness of the policy responses.

“This crisis is first and foremost a health crisis which has forced governments to take unprecedented measures to protect people’s lives,” said WTO Director-General Roberto Azevêdo.

“The unavoidable declines in trade and output will have painful consequences for households and businesses, on top of the human suffering caused by the disease itself,” observed Azevêdo.

Kristalina Georgieva, Managing Director of the International Monetary Fund echoed the grim message. “We are still faced with extraordinary uncertainty about the depth and duration of this crisis. It is already clear, however, that global growth will turn sharply negative in 2020. In fact, we anticipate the worst economic fallout since the Great Depression. Just three months ago, we expected positive per capita income growth in over 160 of our member countries in 2020. Today, that number has been turned on its head: we now project that over 170 countries will experience negative per capita income growth this year,” said Georgieva.

What to Do?

“The immediate goal is to bring the pandemic under control and mitigate the economic damage to people, companies and countries. But policymakers must start planning for the aftermath of the pandemic,” Azevêdo said.

“These numbers are ugly – there is no getting around that. But a rapid, vigorous rebound is possible. Decisions taken now will determine the future shape of the recovery and global growth prospects. We need to lay the foundations for a strong, sustained and socially inc

In his widely-shared view trade will be an important ingredient here, along with fiscal and monetary policy. Keeping markets open and predictable, as well as fostering a more generally favorable business environment, will be critical to create the renewed investment needed. A much faster recovery will occur with global actions rather than if each country acts alone.

Trade, of course was already slackening in 2019 before the virus struck, because of trade tensions (Trump’s tariff wars are notable here – editor) and slowing economic growth. World merchandise trade registered a slight decline for the year of ‑0.1% in volume terms after rising by 2.9% in the previous year. Meanwhile, the dollar value of world merchandise exports in 2019 fell by -3% to $18.89 trillion.

Trade, of course was already slackening in 2019 before the virus struck, because of trade tensions (Trump’s tariff wars are notable here – editor) and slowing economic growth. World merchandise trade registered a slight decline for the year of ‑0.1% in volume terms after rising by 2.9% in the previous year. Meanwhile, the dollar value of world merchandise exports in 2019 fell by -3% to $18.89 trillion.

In contrast, world commercial services trade increased in 2019, with exports in dollar terms rising by 2% to $6.03 trillion. The pace of expansion was slower than in 2018, when services trade increased by 9% though. Facts on merchandise and commercial services trade developments are presented in Appendix Tables 1 through 4 and can be downloaded from the WTO Data Portal at data.wto.org.

Stuttgart, 16 April 2020. Porsche Automobil Holding SE, Stuttgart (Porsche SE), withdraws its forecast for the group result after tax for the fiscal year 2020. The result of the Porsche SE Group is significantly influenced by the at-equity result attributable to Porsche SE and thus by the earnings situation of the Volkswagen Group. Volkswagen AG has announced that it withdraws the outlook for the fiscal year 2020 due to the impact from the Covid-19 pandemic on the business of the Volkswagen Group.

The executive board of Volkswagen AG currently assumes that the previous expectations for the fiscal year 2020 as published in the annual report 2019 can no longer be achieved given the ongoing Covid-19 pandemic and its significant impact on the business of the Volkswagen Group. It is currently not foreseeable for Volkswagen AG when a new forecast for the current financial year is possible. Therefore, also for the executive board of Porsche SE it is not possible to make a new forecast for the time being.

According to the current assessment, the previous forecast of the Porsche SE Group’s net liquidity remains unaffected by this development. Without taking further investments into account it lies in a corridor of EUR 0.4 to 0.9 billion as of 31 December 2020.

On Friday, April 3, the U.S. Bureau of Labor Statistics released its monthly employment situation summary, based on surveys the agency conducted in March. News outlets across the country are taking the 4.4% — up from 3.5% in February — and blasting it across headlines and chyrons.

This particular jobs report is getting massive media attention because the coronavirus pandemic shut down much of the U.S. economy in March. Last month’s report showed 5.8 million unemployed Americans in February. But a record 6.6 million workers filed for unemployment insurance for the week ending March 28, on top of 3.3 million new claims from the week prior, according to the Department of Labor. The Congressional Budget Office expects the unemployment rate will surpass 10% during the spring.

To find out more about the April jobs report, I called former BLS Commissioner Erica Groshen to get the scoop on what journalists should look for in the employment situation summary. With newsrooms across the country putting all hands on deck to cover the pandemic, Groshen’s advice will be especially useful for reporters who don’t usually cover economics or the labor beat.

Here are big takeaways from our conversation:

Wait until the May report, which will capture data from April, for a clearer picture of how the pandemic has affected unemployment.

Look to the April report for subtle indicators of how the labor market is faring, like whether people were laid off permanently or temporarily and if employers are starting to cut hours and temporary workers.

Know that unemployment insurance claims are not a proxy for the number of unemployed workers. Under normal circumstances some three-fourths of unemployed people don’t use unemployment benefits, according to the BLS.

Will the April jobs report capture how the pandemic has hurt U.S. workers? Not entirely. For a fuller understanding of how the new coronavirus has hurt U.S. workers, journalists and policymakers will have to wait until the May 8 release. The reason is that monthly jobs reports show changes from roughly mid-month to mid-month. That means the April report will cover about mid-February to mid-March.