Treasury has now received $211.5 billion from its CPP investments, exceeding the $204.9 billion it had disbursed. Taxpayers made money.

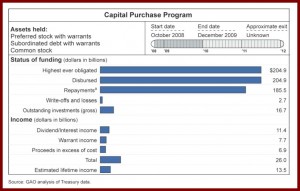

The U.S. Department of the Treasury announced today that it is starting secondary public offerings of the preferred stock it holds in seven so-called CPP institutions (Capital Purchase Program under the Troubled Assets Relief Program). TARP, which injected huge amounts of taxpayer cash into U.S. banks, was sold to the American public as a way to encourage banks to lend money to free up the frozen capital markets. From October 2008 through December 2009, Treasury invested almost $205 billion in 707 financial institutions as part of the federal government’s efforts to help stabilize U.S. financial markets and the economy.

However, some the banks used part of the funds to pay huge executive bonuses, repurchase stock and pay dividends, according to the Government Accountability Office. Now GAO concerns are being raised about the health of the banks remaining in the program.

In its latest report in March GAO said, “While repayments, dividends, and interest from institutions participating in the Capital Purchase Program (CPP) have exceeded the program’s original investment disbursements, the number of missed payments has increased over the life of the program. As of 31 January 2012, Treasury had received $211.5 billion from its CPP investments, exceeding the $204.9 billion it had disbursed. Of that amount, $16.7 billion remains outstanding, and most of these investments were concentrated in a relatively small number of institutions. In particular, as of 31 January 2012, 25 institutions accounted for $11.2 billion, or 67%, of outstanding investments. As of 30 November 2011, Treasury estimated that CPP would have a lifetime income of $13.5 billion after all institutions exited the program.

The banks that are part of a Merrill Lynch and Sandler O’Neill conducted auction are:

- Taylor Capital Group, Inc., Rosemont, IL

- Ameris Bancorp, Moultrie, GA

- First Defiance Financial Corp., Defiance, OH

- Farmers Capital Bank Corp., Frankfort, KY

- LNB Bancorp Inc., Lorain, OH

- First Capital Bancorp Inc., Glen Allen, VA

- United Bancorp Inc., Ann Arbor, MI

GAO’s recommendation that Treasury “provide Congress and the public with more transparent and comprehensive information on remaining CPP institutions and enhance its reporting, the Secretary of the Treasury should consider analyzing and reporting on remaining and former CPP participants separately.

Treasury said it would “consider this recommendation carefully.”