Where it goes from here is anybody’s guess. Congress remains hung up over the debt ceiling, and automakers have been raising prices because of the Japan earthquake induced shortages.

U.S. auto sales in June declined for the second straight month but increased 7% compared to an admittedly weak 2010. Earthquake induced inventory shortages at major Japanese automakers continued to be a major factor in sluggish sales, but marketing executives denied what could be the beginning of another recession.

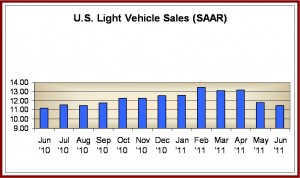

Worrisome was the decline in the seasonally adjusted annual selling rate (SAAR) to an anemic 11.45 million light vehicles, the lowest it has been in more than a year. Retail sales dipped to a mere 9 million units.

Where it goes from here is – honestly – anybody’s guess. Congress remains hung up over the debt ceiling, and automakers have been raising prices because of the Japan earthquake induced shortages, and the rising price of fuel.

“Returning production and new marketing programs will put us in a great position to take advantage of the summer selling season and with an influx of new products slated this year, we’re extremely optimistic about the second half of 2011,” said Don Esmond, senior vice president of automotive operations, Toyota Motor Sales, U.S.A.

The winners – at least by percent, which magnifies increases on a relatively small base – were Korean automaker Kia at 45,000 units, and German Volkswagen at 28,000, up 41% and 25% respectively. However, neither of these growing brands has a vehicle in the Top Ten seller list, which is now dominated by Ford and Chevrolet, with only the Toyota Camry and the Hyundai Elantra +40%, (Hyundai was up 16% overall) making the chart. Eight of the top ten vehicles averaged 25% sales improvements compared to June of 2010. The Detroit Three now hold more than 50% of the market.

Not surprisingly, given lousy economic and fuel price trends, small vehicles posted the greatest growth during June, with sales up 15% compared to June 2010. But don’t ignore trucks – Ford, Chevrolet and Dodge pickup trucks are all in the Top Ten list, with Ford F-Series and Chevrolet Silverado firmly ensconced in the first and second positions. F-Series is outselling the Number Three Chevrolet Cruze sedan by more than two to one.

A good snapshot of what is going on is AutoNation, Inc. (NYSE: AN), the largest automotive retailer. Today AutoNation announced that its retail new vehicle unit sales in June 2011 totaled 16,564, an increase of 3% compared to June 2010. Retail new vehicle unit sales in June 2011 for AutoNation’s operating segments were as follows: 5,638 for Detroit brands, up 18% versus June 2010; 7,564 for Offshore brands, down 9% versus June 2010; and3,362 for Premium Luxury, up 11% versus June 2010

Where it goes from here is – honestly – anybody’s guess. Congress remains hung up over the debt ceiling, and automakers have been raising prices because of the Japan earthquake induced shortages, and the rising price of fuel. Nowhere in sight is a return to the 15-17 million unit annual sales that were typical of the first decade of the 21st century.

Consultancy J.D. Power has reduced its 2011 retail sales forecast to a meager 10.5 million units from 10.6 million units. The forecast for total sales has been revised to 12.9 million units from 13 million units.