Nevertheless, the 2012 forecast for total light-vehicle sales in the United States remains unchanged at 14.4 million units with retail sales at 11.7 million units.

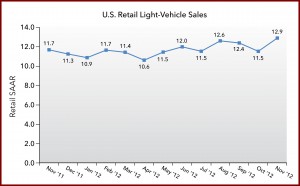

November U.S. auto sales for new retail vehicles are now predicted at 931,900 cars and light trucks, a 14% bump up year-over-year, which would mean a seasonally adjusted annualized rate or SAAR of 12.9 million units. If accurate, November would see the highest retail rate for the auto industry since January 2008, before the corrupt practices of Wall Street collapsed the global economy and caused the Great Recession alter that year. Retail transactions are said to be the most accurate measurement of true underlying consumer demand for new vehicles.

Total light-vehicle sales in November are expected to increase 12% from November 2011, with volume at 1,113,500 units. Fleet sales are expected to hold steady just under a 17% share of total sales, which is the same level as October, and slightly lower than the 18% fleet share posted last November.

“Sales have strengthened each week in November, which bodes well for a strong finish to the month and the year,” said John Humphrey, of J.D. Power and Associates, the source of the prognostications.

Humphrey made that statement based on 15 days of actual sales from dealers who provide real time data. Nevertheless, the 2012 forecast for total light-vehicle sales in the United States remains unchanged at 14.4 million units with retail sales at 11.7 million units.

The U.S. sales forecast for 2013 also remains unchanged at 15 million units for total light-vehicles and 12.2 million for retail sales, but represents a slower growth rate of 4% from 2012, which will likely end up with double digit sales growth of at least tow times maybe three times that much. (Offshore Brands Hold Share in U.S. Auto Sales During Stormy October)

Much of the rising demand appears to be coming from the replacement of older vehicles in the face of continued high levels of unemployment, and economic uncertainty. The continued printing of U.S. dollars by the Federal Reserve and correspondingly lower interest rates, which reward borrowers but punishes savers, is a major factor in auto sales growth.

North American light-vehicle production volume remains up 20% through the first 10 months of 2012, compared with the same period in 2011. Volume through October is at nearly 13.1 million units, the same volume level as in all of 2011.

Vehicle inventory in early November rose to a 71-day supply—the highest supply level in 2012, and compared with 59 days in October. The supply growth is said to be the result of an increase in inventory ahead of anticipated year-end sales, as well as the impact of Hurricane Sandy, which caused significant damage along the East Coast and slowed demand in the last week of October.

Car inventory has risen to a 66-day supply from 51 days in October, while truck inventory has increased to a 77-day supply from 65 days. Vehicle inventory levels should stabilize in November and into December, according to Power, as sales are expected to recover from consumers who had delayed their purchases last month, as well as the need to replace flood-damaged vehicles.