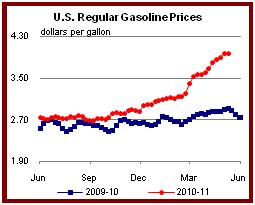

Sales are dropping due in part to an average price of regular gasoline at $3.97 per gallon, $1.06 per gallon higher than last year.

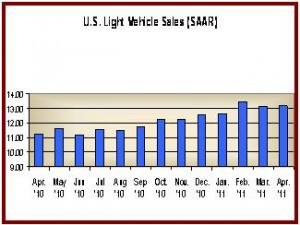

Sales of new cars and trucks in the United States during May have dropped sharply from the rates attained thus far this year as the U.S. economy continues to languish. May new-vehicle retail sales are projected to come in at 858,400 units, which represents a seasonally adjusted annualized rate (SAAR) of 9.6 million units, with all sales coming in at 11.9 million units, based on the first 11 selling days of the month.

This would be the lowest SAAR has since last September, and it points to a weak summer sales.

The retail selling rate is about 1 million units higher than it was in May 2010, though, but has dropped sharply from the 2011 year-to-date average of 10.7 million units. Retail transactions are the most accurate measurement of true underlying consumer demand for new vehicles, according to J.D. Power, the source of the projections.

Returning to historical annual selling rates of 15 to 17 million units experienced during much of the last decade appears to be a long way into the future.

“Retail sales in May are being hit by several negative variables—specifically, high gas prices, lower incentive levels and some inventory shortages,” said Jeff Schuster, executive director of global forecasting at J.D. Power and Associates.

“As a result, the industry will likely be dealing with a lower sales pace at least through the summer selling season, putting pressure on the 2011 outlook,” said Schuster.

Fleet sales are expected to be lower in May due to the inventory shortages and are projected to finish the month at 214,600 units, down 8% from May 2010.

The outlook for light vehicle sales in 2011 is beginning to weaken, reflecting the increasing risk of a selling pace slowdown that is projected to occur during the next several months. J.D. Power has now reduced the forecast for retail sales slightly to 10.6 million units from 10.7 million units. The forecast for total sales remain at 13 million units.

“Uncertainty is the driver of mounting risk to the forecast for light-vehicle sales in 2011, as gas prices hover at or above $4 per gallon and inventory is at very low levels in the small car segments,” said John Humphrey, senior vice president of automotive operations at J.D. Power and Associates. “However, the pace of the recovery set in the beginning of the year is expected to resume during the second half of 2011.”

North American Production

Year-to-date North American production is up 12% from the same time in 2010. In 2011, 4.3 million light vehicles were produced during the first four months of the year, compared with 3.8 million units built during the same period in 2010. The earthquake, tsunami and resulting nuclear power plant crisis in Japan have caused numerous production disruptions thus far due to parts shortages for the Japanese manufacturers. This will continue throughout the second quarter of 2011, with more than 400,000 units of production expected to be lost in the short term.

At 54 days’ supply, the inventory level at the beginning of May was the same as it was at the beginning of April. However, several small cars and many models imported from Japan remain in very short supply. Inventories will remain low as automakers work to build up the low inventory levels.

The North American production forecast in 2011 has been reduced slightly by Power, with volume now rounding down to 12.8 million units from 12.9 million units. As the parts situation stabilizes and unaffected manufacturers increase production, most of the lost volume is expected to be recouped during the second half of 2011.

(See also U.S. April Retail Auto Sales Predicted at 11 Million, SAAR 13 M)

| U.S. Sales and SAAR Comparisons – May 2011 Projections | |||

| May 2011 | April 2011 | May 2010 | |

| New retail | 858,400 units. +10% May ‘10 | 935,664 | 847,138 |

| Total vehicle | 1,073,000 units. +6% May ‘10. | 1,155,563 | 1,100,565 |

| Retail SAAR | 9.6 million units | 11.0 million | 8.7 million |

| Total SAAR | 11.9 million units | 13.2 million | 11.6 million |

| J.D. Power and Associates | |||