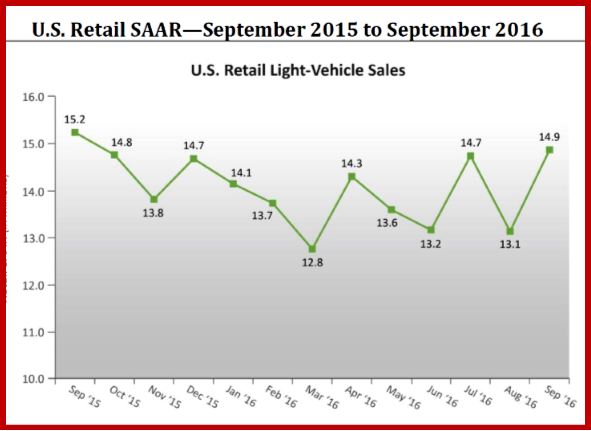

For the fifth time in the past seven months, U.S. new-vehicle retail sales are expected to drop in September, falling 1.4% from a year ago, according to a monthly sales forecast developed jointly by J.D. Power and LMC Automotive. Retail sales are projected to reach 1,185,500 units in September, while total sales are projected to fall 0.8% to 1,429,100.

For the fifth time in the past seven months, U.S. new-vehicle retail sales are expected to drop in September, falling 1.4% from a year ago, according to a monthly sales forecast developed jointly by J.D. Power and LMC Automotive. Retail sales are projected to reach 1,185,500 units in September, while total sales are projected to fall 0.8% to 1,429,100.

The average new-vehicle retail transaction price forecast for September is $30,665, a record for the month if accurate, surpassing the previous high of $30,473 in September 2015. Trucks account for 60.8% of new-vehicle retail sales so far in September, poised to match the record for any month that was set in July 2016. Pickups account for 15.9% of sales in the month.

Labor Day weekend is typically one of the highest volume sales weekends in the year. The weekend’s sales this September were 199,493 units, a 1% decrease compared with 2015. This decline was despite elevated incentive programs from manufacturers.

In fact, incentive spending thus far in September is at a record level of $3,923 per unit, surpassing the previous high of $3,753 set in December 2008 when Wall Street and the ratings agencies wrecked the economy by lying about the quality of financial paper, which wasn’t worth the paper it was printed on.

“The industry can be viewed through two competing perspectives. The first is that in absolute terms, the industry is performing at an exceptional level. While sales have fallen slightly, they are at near-record levels and transaction prices are at all-time highs,” said Deirdre Borrego, senior vice president and general manager of automotive data and analytics at J.D. Power.

“The second is less positive. With the rate of growth slowing, leading indicators are pointing to challenges ahead. Specifically, in September, incentive spending is at an all-time high.”

Retail sales year to date through September are expected to be down 1.3%, compared with the same period in 2015, while total sales are expected to be up 0.5%. LMC Automotive’s forecast for full-year total light-vehicle sales forecast remains at 17.4 million units, 0.3% decline from 2015. The forecast for retail light-vehicle sales is 14.0 million units, down 1.6% from 2015.