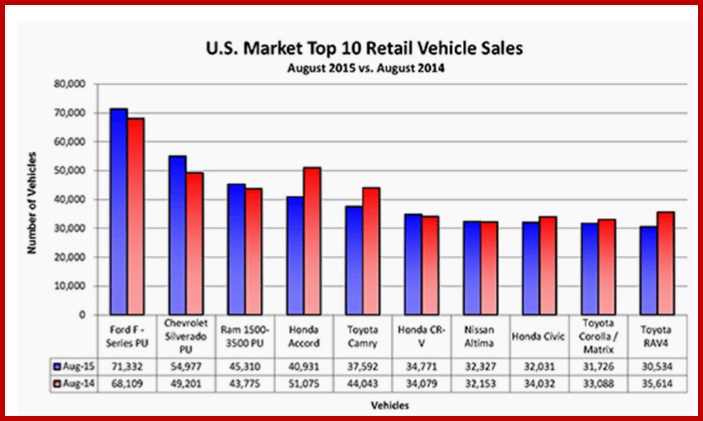

Light truck sales from the Detroit Three once again dominated the market in August, but offshore brands continue to hold their advantage. Seven out of the Top Ten selling vehicles in August were held by offshore automakers, one more than last month. In fourth place behind the Ford F-Series, the Chevrolet Silverado pickups, and the Ram 1500-3500, the Honda Accord edged the Toyota Camry as top selling car. The Honda CR-V crossover posted a record month, at +2% with 34,771 units sold to take sixth.

GM had the industry’s largest retail sales increase and gained more than 1 percentage point of retail market share year over year, based on J.D. Power PIN estimates. Fleet sales were down 24% on a 38% decline in rental deliveries. Total sales were in line with a year ago. GM continues to have the highest average transaction prices (ATPs) and had the lowest incentives as a percentage of ATP in the domestic industry, according to PIN.

FCA US reported U.S. sales of 201,672 units, a 2% increase compared with sales in August 2014 (198,379 units), and the group’s best August sales since 2002. The Jeep and Ram Truck brands each posted year-over-year isotretinoinonlinebuy.com sales gains in August compared with the same month a year ago. The Jeep brand’s 18% increase was the largest sales gain of any FCA US brand during the month. The group extended its streak of year-over-year sales gains to 65-consecutive months.

Ford Motor posted its best August U.S. sales in nine years because of strong sales of SUVs and trucks. Sales totaled 234,237 vehicles, a 5% increase year-over-year. F-Series had its best August sales results since 2006, with total sales of 71,332 – a 5% increase in sales versus a year ago. F-150 EcoBoost sales also have been growing at 63% percent of F-150 retail sales in August and an 86% increase compared to EcoBoost sales a year ago.

As a segment, Asian automakers once again led at 46.6% of the U.S. market, a decrease from 46.8% in July, but an increase from 45.4% in June. Overall, Asians sold 735,056 vehicles, up from 707,243 in July but down from 760,533 in August 2014. European nameplates fell from 8.8% of the market in July to 8.7% in August. They sold 137,782 units last month, up from 132,748 units in July and 135,069 units in August 2014. Domestic brands rose from 44.4% in July to 44.7 in August.

AutoData says the seasonally adjusted annual rate, aka SAAR, in August was at 17.8 million units compared to 17.3 million units a year ago. This is the highest reported SAAR since July 2005 and the highest August SAAR since 2003. Industry wide, 1,577,407 light vehicles were sold last month, compared to 1,511,261 in July and 1,586,015 last year. Sales for all brands in 2015, un-adjusted for business days, are up 3.8% from 2014.