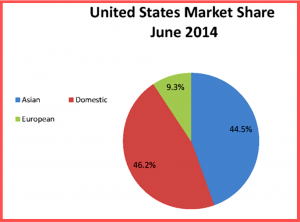

Led by the Detroit Three, June auto sales bode well for the second half of 2014 even as recalls pervade the industry. Detroit Three brands finished June with a 46.2% market share with sales of 656,965 vehicles because of strong SUV and pickup truck sales – hurting Asian brands, whose share dropped almost 2 percentage points at 632,027 vehicles, compared to 743,937 vehicles last month.

For the GM watchers, sales of 268,000 resulted in a share of 18.8%, meaning the ignition switch tragedy and fiasco has not hurt its brands thus far. “June was the third very strong month in a row for GM, with every brand up on a selling-day adjusted basis,” said Kurt McNeil, U.S. vice president of Sales Operations.

The comeback car company, Chrysler, reported U.S. sales of 171,086 units, a 9% boost – and the 51st-consecutive month of year-over-year sales gains compared with June 2013 at 156,686 units. This was the group’s best June sales since 2007. Jeep, Dodge, Ram Truck, and Fiat brands each increased sales in June compared with same month a year ago. Jeep brand sales – up 28% – were the best ever sales for the month of June. Ram pickup truck sales were up 12%, the best June sales in 10 years.

Detroit Three brands finished June with a 46.2% market share because of strong SUV, pickup and midsize car sales.

Ford Motor had mixed results with June 2014 U.S. sales of 222,064 vehicles declined 6% from a year ago. Retail sales of 145,989 vehicles declined 5%, while fleet sales of 76,075 vehicles declined 7%. The F-Series, the crown jewel dropped 11% to 61,000, possibly because all the publicity surrounding the new aluminum F-Series due late this year hurt sales of the current one. Ford claimed it was part of a “build out” plan that had the lowest incentives in the industry on pickups. Escape sank 13% at 25,000. The Number Two US automaker gave no credible explanation of other double-digit decreases for Fiesta, C-Max, Taurus and Mustang.

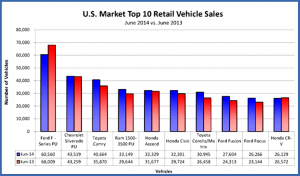

International nameplates held five of the Top 10 selling vehicle spots in June, down from six last month. In second place last month, the Toyota Camry moved into third place during June behind the Ford F-Series and Chevrolet Silverado pickups. Sales of the midsize car were up 13.4% over last June. Ram pickup was fourth. In fifth place, the Honda Accord represented the only other offshore midsize sedan on June’s top ten list. The Honda Civic (up 8.7%) remained in sixth place, followed by the Toyota Corolla (up 17%) in seventh place. Next came the Ford Fusion and Focus. The Honda CR-V finished June in tenth place.

AutoData says the seasonally adjusted annual rate or SAAR for May was 16.98 million units compared to 15.88 million units a year ago, the largest SAAR since July 2006. Overall sales, not adjusted for business days, were up 1.2% from June 2013 and 4.3% year-over-year. Year-to-date, light vehicle sales at 8.2 million are up 4.3%.

Offshore brands that saw the greatest growth in June include Audi (up 23.1%), Mazda (up 16.5%), and Subaru, which enjoyed its best June on record (up 5.4%). Honda’s sales slipped 4.3%, and Volkswagen’s sale dropped 22%.

Offshore brand North American manufacturing totaled 1.5 million vehicles that were sold in the US in June. However, this includes many vehicles made in Mexico under the job destroying NAFTA agreement. Asian brands sold 269,282 cars from these facilities, about 38% of all cars sold in the U.S. Asian brands also sold 180,688 trucks from plants in North America, totaling 25.2% of all trucks sold in the U.S. in June. European brands sold a mere 18,004 cars (representing 2.6% of all cars sold) and 12,265 trucks (representing 1.7% of all trucks sold) from their North American production sites.