Click to Enlarge.

New-vehicle retail sales for June 2022 are forecast to decline when compared with June 2021, according to a joint forecast from J.D. Power and LMC Automotive.

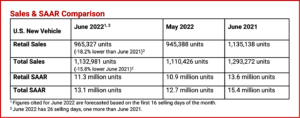

Retail sales of new vehicles this month are expected to reach 965,300 units, a 18.2% decrease compared with June 2021 when adjusted for selling days. June 2022 has 1 additional selling day compared to June 2021. Comparing the same sales volume without adjusting for selling days changes to a decrease of 15.0% from 2021.

New-vehicle retail sales in Q2 2022 are projected to reach 2,977,300 units, a 23.3% decrease from Q2 2021 when adjusted for selling days. New-vehicle retail sales for the first six months 2022 are projected to reach 5,827,300 units, a 19.1% decrease from the first six months of 2021 when adjusted for selling days. The first half of 2021 was an all-time record for retail sales. Power/LMC make no note of the Federal Reserve Board, which appears to be dedicated to sending and keeping the economy in a recession.

“The 2022 theme we have seen of sales quality over sales quantity is continuing in June. On a volume basis, June year-to-date retail sales will be just under 5.9 million units, a large decline of 19.1%. Excluding pandemic-affected 2020, this is the worst first six months’ sales volume performance since 2011. However, from a profitability standpoint, the first half of 2022 has set records for both retailers and manufacturers as vehicle prices continue to rise, manufacturer discounts get ever smaller and retailer margins set new highs,” says Thomas King, president of the data and analytics division at J.D. Power.

AutoInformed once again notes that we now have an affordability crisis. “The average transaction price for the first six months of 2022 is expected to reach a record of $44,907,a 17.5% increase from 2021. This is partially due to incentive spending per unit, expressed as a percentage of average vehicle MSRP, trending towards 2.4% for the first six months, down from 7.1% for the same time period in 2021,” said King.

“Despite record level trade-in values, the average monthly finance payment in June is on pace to hit a record high of $698, up $79 from June 2021. That translates to a 12.8% increase in monthly payments from a year ago, which is just below the 14.5% increase in transaction prices.

“Total retailer profit per unit, inclusive of grosses and finance and insurance income, is on pace to reach a monthly record of $5,123, an increase of $1,174 from a year ago. Eight of the past nine months have seen retailer profit per unit at or above $5,000. This elevated per-unit profit level is more than offsetting the drop in sales volume as total aggregate retailer profits from new-vehicle sales for the month of June is projected to be up 10.3% from June 2021, reaching $4.9 billion, the best June ever and the fourth-highest amount of any month on record.

“Due to the ongoing inventory constraints, discounts from manufacturers continue to erode. The average incentive spend per vehicle is tracking toward $930, a decrease of 59.4% from a year ago and the second consecutive month under $1,000. Incentive spending per vehicle expressed as a percentage of the average vehicle MSRP is trending toward a record low of 2.0%, down 3.4 percentage points from June 2021 and the fifth consecutive month below 3.0%. One of the factors contributing to the reduction in incentive sending is the absence of discounts on vehicles that are leased. This month, leasing will account for just 18% of retail sales. In June 2019, leases accounted for 30% of all new-vehicle retail sales,” said King.

The Total Sales Forecast

Total new-vehicle sales for June 2022, including retail and non-retail transactions, are projected to reach 1,133,000 units, a 15.8% decrease from June 2021. Comparing the sales volume without adjusting for the number of selling days translates to a decrease of 12.4% from 2021.

- The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 13.1 million units, down 2.3 million units from 2021.

- New-vehicle total sales in Q2 2022 are projected to reach 3,488,800 units, a 20.5% decrease from Q2 2021 when adjusted for selling days.

- New-vehicle total sales for the first half of 2022 are projected to reach 6,781,300 units, an 18.7% decrease from the first half of 2021 when adjusted for selling days.

Pingback: Subaru of America June Sales Flat, Q2 -18% | AutoInformed

Pingback: GM Q2 US Sales Down -15% | AutoInformed