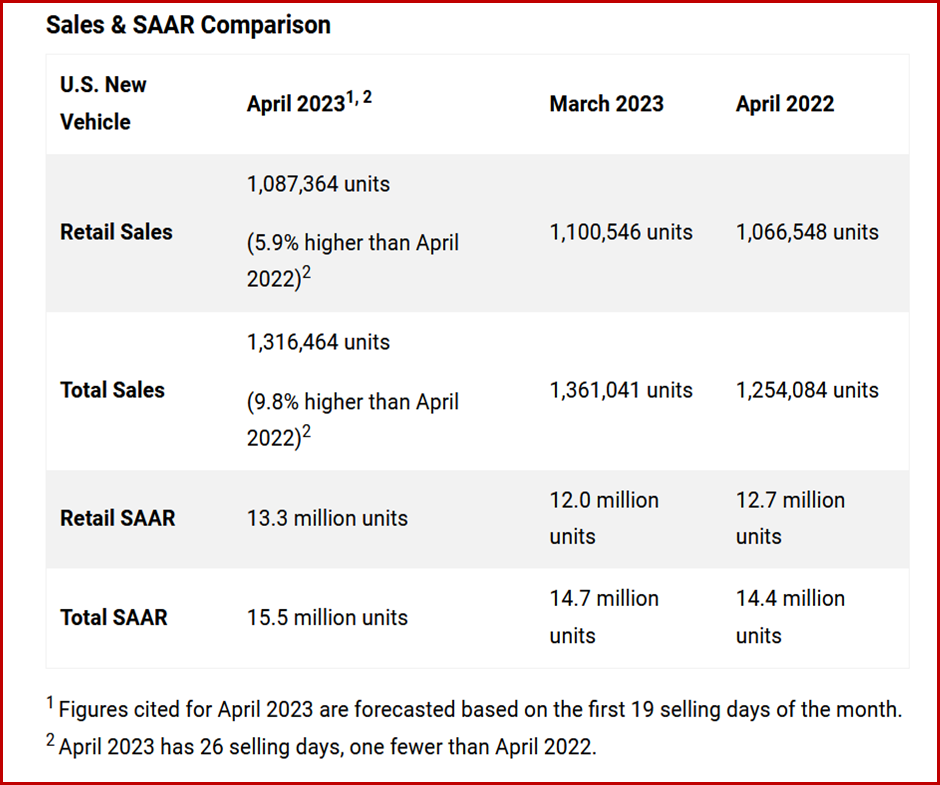

Total US new-vehicle sales for April 2023, including retail and non-retail transactions will reach 1,316,500 units, a 9.8% increase from April 2022, according to a joint forecast from J.D. Power and LMC Automotive* released today. Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 5.7% from 2022. Either way, the economic recovery continues under the current administration.

“The industry is poised for another favorable month in April, with projected retail sales expected to increase 5.9%, accompanied by a 2% increase in average transaction prices. Consequently, it’s expected that consumers will spend ~$47.5 billion on new vehicles this month, reflecting 2.9% growth compared with the same month a year ago,” said Thomas King, president of the data and analytics division at J.D. Power.

Click for more information.

Higher pricing tied with interest rate increases continue to raise monthly loan payments. The average monthly finance payment in April is forecast at $729, up $48 from April 2022, a 7.1% increase compared to a year ago. The average interest rate for new-vehicle loans is expected to be 6.8%, an increase of 227 basis points from a year ago.

Automaker incentives are in line with March 2023. Nonetheless, they have increased year-over-year. The average incentive per vehicle has risen 58.9% from April 2022 and is currently on track to reach $1599. The percentage of incentive spending per vehicle in relation to the average MSRP is currently trending at 3.3%, an increase of 1.1 percentage points from April 2022.

According to Power, one of the factors contributing to this relatively low level of spending is the absence of discounts on leased vehicles. This month, leasing is expected to account for a mere 19% of retail sales. In pre-pandemic April 2019, leased vehicles made up ~30% of all new-vehicle retail sales.

“It is anticipated that retail inventory levels for April will reach approximately 1.2 million units, which is consistent with March but marks a substantial 45% increase from April 2022. With the significant improvement in overall new-vehicle availability from a year ago, dealer margins are declining, and manufacturer incentive spending is increasing. Nevertheless, the demand for vehicles in the retail market remains strong due to pent-up demand from pandemic-related production shortages.

“Overall, the retail sales pace continues to be supply constrained. Therefore, pricing and profitability remain well above historical levels. This market condition is being sustained by manufacturers allocating more production volume to fleet sales. Rather than allocating all incremental production to retailers, manufacturers are opting to sell more vehicles to fleet customers, with fleet sales projected to increase 33% vs. April 2022,” said King.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global clients include car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US New Vehicle Sales Soar in April 2023 at 1.3 Million

Total US new-vehicle sales for April 2023, including retail and non-retail transactions will reach 1,316,500 units, a 9.8% increase from April 2022, according to a joint forecast from J.D. Power and LMC Automotive* released today. Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 5.7% from 2022. Either way, the economic recovery continues under the current administration.

“The industry is poised for another favorable month in April, with projected retail sales expected to increase 5.9%, accompanied by a 2% increase in average transaction prices. Consequently, it’s expected that consumers will spend ~$47.5 billion on new vehicles this month, reflecting 2.9% growth compared with the same month a year ago,” said Thomas King, president of the data and analytics division at J.D. Power.

Click for more information.

Higher pricing tied with interest rate increases continue to raise monthly loan payments. The average monthly finance payment in April is forecast at $729, up $48 from April 2022, a 7.1% increase compared to a year ago. The average interest rate for new-vehicle loans is expected to be 6.8%, an increase of 227 basis points from a year ago.

Automaker incentives are in line with March 2023. Nonetheless, they have increased year-over-year. The average incentive per vehicle has risen 58.9% from April 2022 and is currently on track to reach $1599. The percentage of incentive spending per vehicle in relation to the average MSRP is currently trending at 3.3%, an increase of 1.1 percentage points from April 2022.

According to Power, one of the factors contributing to this relatively low level of spending is the absence of discounts on leased vehicles. This month, leasing is expected to account for a mere 19% of retail sales. In pre-pandemic April 2019, leased vehicles made up ~30% of all new-vehicle retail sales.

“It is anticipated that retail inventory levels for April will reach approximately 1.2 million units, which is consistent with March but marks a substantial 45% increase from April 2022. With the significant improvement in overall new-vehicle availability from a year ago, dealer margins are declining, and manufacturer incentive spending is increasing. Nevertheless, the demand for vehicles in the retail market remains strong due to pent-up demand from pandemic-related production shortages.

“Overall, the retail sales pace continues to be supply constrained. Therefore, pricing and profitability remain well above historical levels. This market condition is being sustained by manufacturers allocating more production volume to fleet sales. Rather than allocating all incremental production to retailers, manufacturers are opting to sell more vehicles to fleet customers, with fleet sales projected to increase 33% vs. April 2022,” said King.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global clients include car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.