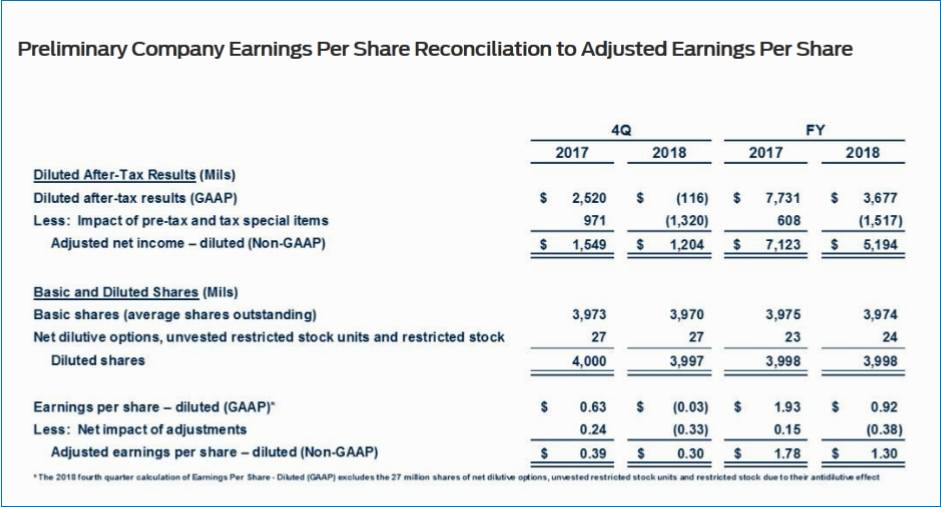

Ford Motor Company (NYSE: F) preliminary Q4 2018 results declined significantly at -$116,000,000 from Q4 2017. The -2,636,000,000 swing year-over-year saw Ford Communications saying the unmitigated disaster “highlighted its commitment to reinvent the future of mobility by transforming the company through operational fitness and allocating capital to high-growth and high-margin product segments and smart vehicles and services.” Preliminary results for full-year 2018 earnings-per-share (EPS) of $0.92 and adjusted EPS of $1.30 are in line with the company’s most recent guidance. The company ended the year with cash of $23.1 billion and liquidity of $34.2 billion.

The spin was presented at the Deutsche Bank Global Auto Industry Conference in Detroit on Tuesday where Ford also provided high-level guidance (translation soft numbers with many SEC caveats) for 2019. Ford also listed areas of “strategic” moves – or damage control actions going on throughout the company in its latest reorganization. (Ford to Restructure European Business Once Again and Volkswagen and Ford Announce Alliance Without Cross Equity)

Wall Street appeared unimpressed with the stock trading at ~$8 per share – down from more than $13 a share five years ago. This occurred, lest we forget, after four straight years of strong or record sales in the U.S. – Ford’s most important and profitable market. Economic growth in the U.S. is now four months shy from setting a record as the longest expansion in U.S. history.

The 2018 Ford Motor results also will include the impact of a non-cash pre-tax re-measurement loss of $877 million because of a year-end revaluation of global pension and other post-retirement employee benefits (OPEB) plans, also known as a pension mark-to-market adjustment. The loss was “almost exclusively related to lower asset returns as a result of the deterioration in the financial markets” (the Trump effect?) at the end of the year. While the re-measurement caused “a mark-to-market loss” for accounting purposes, the company’s funded pension plans remain fully funded.

“Over the last 19 months, we have worked to reshape and transform our company – sharpening our competitiveness, taking actions to improve our profitability and returns, and investing in our future. These actions support our drive to satisfy today’s customers – and those of tomorrow,” claimed Jim Hackett, president and CEO. (Memo: Global EV sales are currently less than 3% of the market.)

Bob Shanks, chief financial officer, said these were positive company operating results despite external challenges, including rising commodity costs, unfavorable exchange rate effects and policy changes. Ford’s results are dependent on sales of larger, more profitable vehicles, particularly in the United States. He also cited other factors, including a decline of business in China and higher warranty costs in North America.

For 2019, Shanks gave other high-level guidance, emphasizing the “challenging nature” of the global external environment:

- Continued GDP growth globally and in major markets, with a deceleration in the rate of growth in the U.S., Europe and China.

- Global industry sales volume expected to remain flat compared to 2018.

- Commodity costs to remain at the present level through 2019.

- Adjusted effective tax rate for 2019 to be in the low 20s – a full 10 percentage points higher than in 2018.

2019 First Quarter Dividend

Ford’s Board of Directors declared a first quarter regular dividend of $0.15 per share on the company’s outstanding Class B and common stock. The first quarter regular dividend maintains the same level as the regular dividends paid in 2018. The first quarter regular dividend is payable on March 1 to shareholders of record at the close of business on Jan. 31. In 2018, we distributed $3.1 billion to shareholders and by year-end 2018, cumulative distributions to shareholders totaled $18.4 billion since the company’s regular dividend was restored in 2012.

Pingback: U.S. Sales in 2020 – SUVs Will Govern a Down Market? | AutoInformed