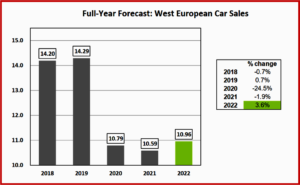

West Europe’s passenger vehicle February selling rate saw only a modest increase to 10 mn units/year, from 9.7 mn units/year in January, according to the LMC Automotive Consultancy.

“While this can be considered a step in the right direction, selling rates remain below the December 2021 number of 3.1 mn units/year or indeed the pre‐crisis result of 3.6 mn units in 2019,” LMC said. “What the latest result continues to demonstrate is that the supply constraints faced by the automotive industry remain a significant headwind to sales volumes,” LMC said.

“Our 2022 PV forecast has become more cautious since last month as supply bottlenecks are expected to be exacerbated from Russia’s invasion of Ukraine and the resulting sanctions. The selling rate is still anticipated to improve over the course of 2022 but at a slower rate than we forecast last month. Aside from the supply disruption, downward pressure is building on underlying demand through inflation and confidence,” LMC warned.

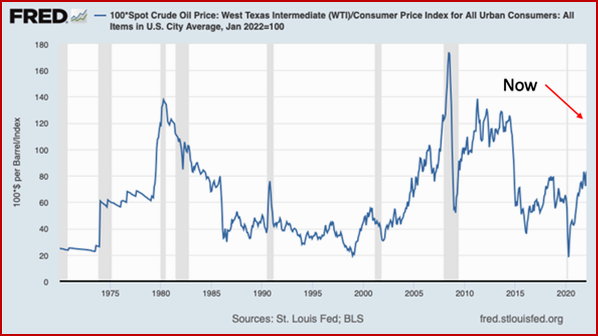

“Overall, then, the Putin-made energy crisis will be serious but probably not catastrophic. My biggest concern for the United States, at least, is political. You mightn’t think that Republicans could simultaneously demand that we stop buying Russian oil and attack President Biden for high gasoline prices. That is, you mightn’t think that if you’d spent the past 25 years sleeping in a cave,” said Paul Krugman of the New York Times.

Other LMC observations

For the UK, the February PV selling rate rose to 1.9 mn units/year, “though one should be cautious in reading too much into this uptick due to February’s relative low volume nature. In YoY terms, sales rose 15% on last year’s locked‐down month, with the more appropriate comparison to 2019 showing a 26% YoY decrease in monthly sales,” according to LMC.

Germany, the selling rate improved slightly to 2.7 mn units/year in February, from 2.6 mn units/year previously. The UK PV selling rate increased to 1.9 mn units/year in February from January’s 1.7 mn units/year. For France, the selling rate fell to just below 1.4 mn units/year. In Spain, the selling rate remained at a disappointing level, only improving slightly to 700k units/year. Finally, in Italy, the selling rate dropped to an all‐time February low of just below 1.2mn units/year.

Spain saw another weak selling rate in February due to the same supply‐side problems. At 700k units/year, last month’s result was only a modest improvement on January’s figure and was likely made worse by the increase in registration tax at the start of the year, as well as the impact of Omicron.

Italy continued to struggle as the selling rate dropping to an all‐time February low of just below 1.2mn units/year. Recent poor figures show the continued effect that supply shortages are having on the sales of new vehicles, with additional downward pressure on sales provided by the ending of EV subsidies (more support will follow from this month). Finally, the French PV market continued its slow start to 2022 as the February selling rate fell to just below 1.4mn units/year. While a strong finish to 2021 suggested that supply shortages were easing somewhat, this poor start to 2022 shows that constraints to production are still very much present and affecting new vehicle sales.

France continued its slow start to 2022 as the February selling rate fell to just below 1.4mn units/year.

“Overall, then, the Putin-made energy crisis will be serious but probably not catastrophic. My biggest concern for the United States, at least, is political. You mightn’t think that Republicans could simultaneously demand that we stop buying Russian oil and attack President Biden for high gasoline prices. That is, you mightn’t think that if you’d spent the past 25 years sleeping in a cave,” said Paul Krugman of the New York Times.