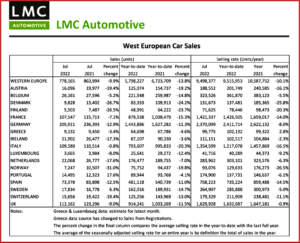

The Western Europe selling rate slipped to 9.5mn units/year in July, at the year-to-date (YTD) average of 9.5mn units/year, the LMC Automotive* said today. “July saw a decline in new vehicle registrations year-on-year (YoY) across most countries,” LMC noted. The consultancy said this “relates to the ongoing supply issues, exacerbated by the conflict in Ukraine and recent China lockdown.”

Well partially yes, but AutoInformed’s reading of economic data leads us to believe that Europe is in an ongoing recession as the US economy is growing. LMC’s take is, arguably, more optimistic than ours.

“The 2022 full year forecast remains at 9.9 mn units, broadly unchanged from last month. That does mean that selling rates will need to pick up over the remainder of the year, and so assumes that, while the production headwinds continue, they will ease from earlier in the year. However, there are increasing concerns on the demand side too, as Western Europe faces rapidly rising living costs, natural gas supply shortages and increasing interest rates,” LMC said. “While we do expect some easing of the supply issues over the coming months, there are increased risks stemming from rising inflation, interest rate hikes and eroding consumer confidence, all applying downward pressure to new vehicle demand in the region.”

LMC Data:

- The German PV selling rate increased slightly to 2.4mn units/year despite raw sales falling month-on-month (MoM).

- In the UK, the selling rate of 1.6mn units/year showed a slight increase from the poor performance in June.

- For France, the selling rate of 1.4 mn units/year was down from the previous month, but still in line with the YTD average.

- In Spain, the selling rate slipped to 760k units/year. Finally,

- The Italian PV selling rate for July showed a slight increase on June, standing at 1.3mn units/year.

*LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com.