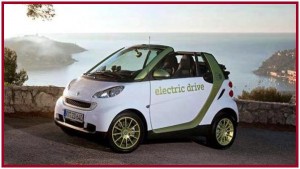

The diminutive Smart is 45% better than average. The slightly larger Toyota Yaris two-door is 93, and the Hyundai Accent is 104?

The National Highway Traffic Safety Administration has released its latest version of collision costs, the “2011 Relative Collision Insurance Cost Information Booklet.” This information guide must be available in dealer showrooms by 30 March 2011. In it NHTSA provides comparative insurance costs that are based on the crash-worthiness of passenger cars, sport utility vehicles, light trucks, and vans.

NHTSA stresses that it does not indicate a vehicle’s relative safety for occupants, just the cost of insurance based on data from the Highway Loss Data Institute (HLDI), an insurance industry funded group.

One issue with such ratings is that the cost of repair parts is a heavy factor here since more expensive cars – with things such as $1,000 LED lights at the corners – are more expensive to repair.

Furthermore, the insurance industry by and large does not base its premiums on vehicle factors, relying instead on driver factors, including age, gender, marital status, and driving record, as well as where and how far the vehicle is driven.

The result, according to NHTSA, is that “it is unlikely that your total premium will vary more than 10% depending upon the collision loss experience of a particular vehicle,” which begs the question if this mandated government exercise is worth the walk?

In the booklet, a vehicles’ collision loss experience is rated in relative terms, with 100 representing the average for all passenger vehicles. Thus, a rating of 122 reflects a collision loss experience that is 22% worse than average, while a rating of 96 reflects a collision loss experience that is 4% percent better than average.

Here there are some interesting observations, and I’m staying in a vehicle’s class for comparison purposes. The old adage that size matters still is largely true with small four-door cars as a group rated at 117, mid-size at 103 and large four-doors at 95.

However, there are unexplained anomalies. Start with small cars such as the Smart. It’s rated at 55 – that’s right the diminutive Smart is 45% better than average. The slightly larger Toyota Yaris two-door is 93, and the Hyundai Accent is 104?

Things are even murkier in the luxury class, which ranges from ratings of 80-227, and averages 136, or 36% worse than the overall average. The leader is the Lexus IS 350 convertible at 80, the loser is the BMW M3 convertible at 227? The 3 series convertible is 129. Aren’t these equivalent vehicles?

Look for yourself: The 2011 Relative Collision Insurance Cost Information Booklet can be downloaded and printed from the NHTSA Web site at: http://www.nhtsa.dot.gov/. From the NHTSA website, click on the “Vehicle Safety” tab, then choose the “Vehicle-Related Theft” category, on that page, under the “Additional Resources Panel”, click on “2011 Comparison of Insurance Costs”.