China posted a preliminary May light selling-rate was 20.7 million per year, down nearly 6% from a record-high of 22 million units a year in April.

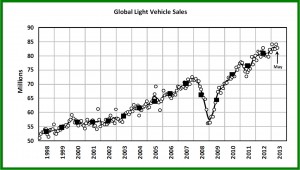

Global light vehicle sales held steady in May with a seasonally adjusted annualized rate of sales of 82.8 million, according to the latest data from LMC Automotive. The consultancy predicts that full-year 2013 sales will be 83.4 million.

As has been true for some time, the slowly recovering U.S. market, and the ongoing growth in China, the world’s largest auto market, are responsible for the growth. As usual, concerns about Europe were still evident, with newly added sales concerns in Russia and India as those markets have slowed, being the primary inhibitors to growth.

Light vehicle sales in the U.S. rebounded from a sluggish April performance and were up 8% compared with May 2012. The 15.2 million units per year selling rate improved from April’s 14.9 million annual sales rate led by strong retail sales which outperformed fleet sales. Car sales (up 4.6%) were outperformed by the total market while light truck sales that saw a 12% increase from last May. The Large Pickup segment continues to lead the overall market’s recovery with May sales up 24% as its market share increased 1.5% to 12% much to the delight and profits of the Detroit Three. In Canada, the market had its best year-on-year performance this year with a 5.5% improvement at a 1.8 million annual selling rate.

China posted a preliminary May light vehicle selling-rate was 20.7 million units per year, down nearly 6% from a record-high of 22 million units a year in April. Sales in May were boosted by new model launches following the Shanghai Auto Show in April. A minor reduction in fuel prices may have also helped sales.

In what I take to be a ‘whistling past the graveyard’ view, LMC claims that “West European demand may also begin to act as less of a drag on the global total.” This assertion was because even though during May year-on-year sales were down by 6%, the selling rate showed a small increase from recent results. This LMC claims supports the view that the market is bottoming out. As always Harry Truman’s search for a one handed economist is fruitless, with LMC also saying, of course, the situation remains fragile, and with some risk, but this is a tentative signal that the worst may be over.”

The concerns about the outlook in Russia resulted from a second month of declining sales. LMC says it now expects the year-on-year declines in Russia to continue for much of this year, although a “deep slump” is not anticipated. This underlies the weakening in Central and East European results during the last two months.

In Japan, the selling rate slowed to 5.4 million units annually in May, down nearly 3% from a strong April. The Tokyo stock market is now falling, the yen is firming again, and the excitement about so-called Abenomics seems to be diminishing.

The South Korean market continues to grow, with the selling rate reaching a six-month high of 1.57 million units per year in May. While the slowing economy is a risk, sales could rise further when labor disputes at Hyundai/Kia are resolved and supply constraints removed opines LMC.

In Brazil, the selling rate dropped to 3.8 million units per year in May after jumping to 4.1 million units annually in April. Sales growth over the rest of this year is likely to be constrained by recent interest rate hikes, high inflation, and the weakening of the real.