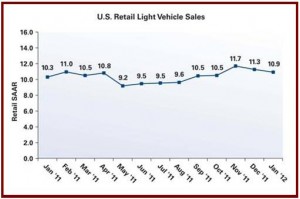

January new auto sales are projected to come in at 681,000 retail units, an increase of 6% from January 2011. This represents a seasonally adjusted annualized rate (SAAR) of 10.9 million vehicles, which is lower than the selling rates in December and November of 2011, but above January 2011.

Retail transactions are thought to be the most accurate measurement of underlying consumer demand for new vehicles, so the New Year starts for automakers with mixed results. A weak recovery of some sorts is underway, but auto sales are nowhere near their pre Great Recession levels where the retail SAAR was routinely above 14 million units.

Nevertheless consultancy J.D. Power, which derives considerable income from automakers, put a positive attitude about its latest forecast based on the first 16 selling days of the month in a release this morning.

“Retail light-vehicle sales in January are showing stability coming off the 2011 high note in December,” said John Humphrey, senior vice president of global automotive operations at J.D. Power and Associates. “Vehicles are currently remaining on dealer lots for fewer than 50 days on average, which is the lowest level for January for the past several years. This is a good indication that pent-up demand is beginning to return to the market.”

Total Light-Vehicle Sales

Total light-vehicle sales in January are expected to come in at 869,600 units, which is also 6% higher than in January 2011. Fleet sales are expected to increase by 9% compared with January 2011, accounting for 22%of total sales. This means a total SAAR of 13.5 million vehicles, the same as December 2011, but ahead of the 12.7 million SAAR in January of last year.

Sales Outlook?

LMC Automotive, which owns Power, is maintaining its forecast for 2012 at 13.8 million units for total light-vehicle sales and 11.3 million units for retail light-vehicle sales.

“The upward movement of auto sales during the second half of 2011 and the stabilization of that trend in January cast a favorable light on 2012, despite the macro-level risks the industry continues to face,” said Jeff Schuster, senior vice president of forecasting at LMC Automotive. “Coming off the North American International Auto Show in Detroit, a renewed sense of optimism is returning to the industry, as the focus continues to shift from survival to planning for the future.”

North American Production

North American light-vehicle production ended nearly 10% higher in 2011 compared with 2010, according to LMC. Volume came in at 13.0 million units, an increase of 1.2 million units from 2010.

- The Detroit Three outperformed the total industry in 2011, with a 15% increase in production from 2010.

- European automakers also saw significant production increases, up more than 34%, supported by increased localization prompted by the Eurozone crisis and currency issues.

- Production by Japanese automakers was down more than 5% from 2010 due to supply chain disruptions resulting from the tragic Japanese earthquake and tsunami and Thailand flooding disasters. Hyundai’s North American production increased by 44%, as it also increased their manufacturing operations in North America.

Vehicle inventory declined slightly to a 52-day supply at the beginning of January (compared with a 61-day supply at the beginning of December), due to strong December 2011 sales and the holiday production shutdown last month. Car inventory was at a 55-day supply in January, down from 59 days in December.