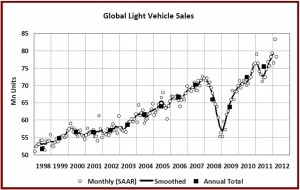

LMC Automotive predicts global auto sales will be 79.2 million in 2012, a 5% increase from 2011. All major regions are expected to post stronger sales in 2012, compared with 2011.

The positive trend in auto sales is pointing to the best year since 2007, before the reckless practices of Wall Street sent economies into the Great Recession, and caused large unemployment rates and deficits in most countries.

In March, U.S. light vehicle auto sales were up 8.7% (selling day adjusted) with a 14.4 million annual rate; fleet sales were up 11.9% from March 2011 while more profitable retail sales were up 11.9%.

Canada’s March 2012 sales remained relatively flat from the previous March with a Seasonally Adjusted Annual Rate, SAAR, at 1.7 million Ford was the top-selling manufacturer in March but Fiat-Chrysler remains the highest seller for the year with a year-to-date market share at 15.3%, just above Ford’s 15.2%.

European Light Vehicle sales once again declined in March, making for looks like a certain five straight years of declines, and again with the stark contrast between the sluggish West and the booming East of the EU region still evident. Western European demand continues to be dragged down by the difficult economic environment created by bankrupt or nearly bankrupt governments. Most markets suffered year-on-year declines.

Prominent in this ongoing EU economic disaster is the Italian market, which suffered the double hit of fiscal austerity as well as a truckers strike. In Eastern Europe the improvement came, once again, with the help of the Russian market, as sales there grew 13% helped by the relative strength in oil prices, which of course are severely damaging other economies.

China had a March selling rate of, gulp, 18 million units, down 16% from a strong February. The selling rate averaged 18.6 million units a year in Q1. On a non-seasonally adjusted year-on-year basis, sales were down 1.7% in Q1, with commercial vehicle sales accounting for the entire loss. LMC’s China forecast remains unchanged at 19.47 million units this year, up 8.2% from 2011.

In Japan, the selling rate remained strong at 5.9 million units per year in March. The ongoing ‘ecocar’ subsidy program continues to boost sales, providing lavish transfers of taxpayer Yen to Toyota and Honda, among other Japanese makers.

In Korea, the March selling rate of 1.5 units/year was weaker than expected. Sales are now expected to fall slightly to 1.52 million units this year. Across the Asian region – as well as in most others – rising fuel prices are a concern for vehicle sales.

According to preliminary estimates, Brazil’s selling rate fell in March for the third straight month at an estimated to be 3.2 million units/year. However, LMC says sales are expected to pick up in the coming months due to the ongoing interest rate cuts, falling inflation, and government stimulus measures. LMC’s 2012 forecast remain unchanged at 3.53 million units.

It’s time to cry for Argentina, though, since the selling rate averaged about 790,000 units in Q1, down sharply from 980,000 units in Q4.