In the all important Top Ten rankings, five of the top ten selling vehicles in the U.S. were offshore nameplates.

U.S. vehicle sales of 1.45 million cars and light trucks during March made it the strongest month since 2007 as the Federal Reserve continued to print money and credit flowed freely. In spite of the ongoing recovery in pickup truck sales from the Detroit Three with gasoline prices roughly 30 cents per gallon lower than a year ago, offshore brands, led by the Asians, increased market share to 55.3% compared to 53.4% in February and 54.4% in January. This represented sales 803,554 offshore nameplates, up from 636,912 in February and 567,313 in January.

Asian automakers captured the largest share of the U.S. auto market with 46.3% with sales of 673,249 units up from the 44.3% share and 636,912 vehicles sold last month. However, this was a mere 0.7% increase over the 668,285 units sold by Asian brands in March 2012.

Sales for European automakers were up 6.1% compared to last March at 130,305 units. Led by Volkswagen, European brands held 9% of the U.S. auto market, a slight decline from the 9.1% share held in February and the 9.6% share they held in January.

Detroit Three brands during March held 44.7% of the U.S. auto market with sales of 649,392 units, a 5.8% improvement over March 2012. Last month, they held 46.6% of the market and sold 555,337 vehicles.

“March sales indicate a continued pattern of recovery for the industry,” said AIADA President Cody Lusk. “Consumer confidence is up, and Americans are looking to replace older vehicles.

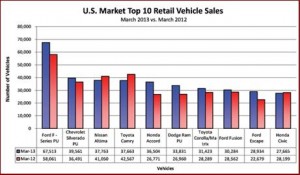

In the all important Top Ten rankings, five of the top ten selling vehicles in the U.S. were offshore nameplates. While Americans continue to purchase pickup trucks, placing the Ford F-Series and Chevrolet Silverado pickups in the lead, sales of mid-size cars are particularly strong with the Nissan Altima, Toyota Camry, and Honda Accord capturing the third, fourth, and fifth positions, respectively. The Nissan Altima bumped the Toyota Camry from its usual spot as the top-selling car, while the new Honda Accord posted a significant sales improvement of 36.4% compared with last March. The Toyota Corolla/Matrix, in seventh place, and Honda Civic, in tenth place, rounded out the list of offshore invaders.

The Ford Fusion was the only Detroit Three car in the Top Ten list, as the market continues to move toward segments where Asians dominate in family and luxury cars, and the Germans dominate luxury cars and trucks.

The North American operations of offshore brands during March made 492,837 of their U.S.-sold vehicles. North American-produced Asian cars represented 37.1% of all cars sold in the U.S., while their North American-sourced trucks represented 25.2%. European nameplates sourced from North America represented 3.1% of overall March U.S. car sales, while their North American-sourced trucks occupied 2% of overall truck sales.