CEO Dan Akerson said on a conference call that GM has no plans to pay a dividend on common. Instead, GM will redeem the very expensive VEBA preferred stock and continue to strengthen its balance sheet. GM has unfunded pension liabilities of $24 billion. On its Series A U.S. Treasury held stock, GM has $5.5 billion in liabilities. All totaled, there are now 1.7 billion shares of GM outstanding.

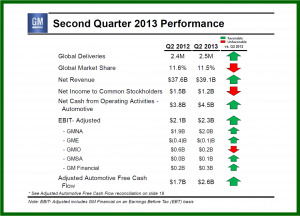

General Motors [NYSE: GM] today announced Q2 net income of $1.2 billion, or $0.75 per GM common share. This was down from the second quarter of 2012 when GM’s net income was $1.5 billion, or $0.90 per fully diluted share. Part of the decline was due to a net loss from special items, including an expensive recall in India for deliberately falsifying an emissions certification on more than 100,000 new vehicles that reduced net income by $0.2 billion, or $0.09 per share, and a tax increase at $0.29 per share, compared to the second quarter of 2012. Yesterday Ford Motor [NYSE: F] reported Q2 2013 pre-tax profits of $2.6 billion or 45 cents per share.

Virtually all of the profits came from GM vehicle sales and financing in North America even though the launch of the new Silverado and Sierra pickup trucks caused a $300 million charge. Globally GM sold 2.492 million vehicles in the quarter (+4%) with a market share of 11.5%, which was flat year-over-year.

With the exception of China where most vehicle buyers are new, GM brands continue to face strong competition. Even though GM continues to receive quality awards and strongly positive reviews on new products, and has once again become competitive in the leasing market, it is having a tough time stealing buyers from competitors. Part of this is due to its damaged reputation; part is the strength of facing products with strong customer loyally.

GM North America posted sales of 809,000 vehicles for a 17% share. In Europe, sales were 76,000 or an 8.5% share. International operations sold 268,000, which doesn’t include the Chinese market where GM and government dictated partners sold 772,000 vehicles. All told, GM calculates GM South America sold 278,000 vehicles for a 17% share. Its IO share at 9%.

GM net revenue in the second quarter of 2013 was $39.1 billion, compared to $37.6 billion in the second quarter of 2012. Earnings before interest and tax (EBIT) adjusted was $2.3 billion, compared to $2.1 billion in the second quarter of 2012.

Automotive cash flow from operating activities was $4.5 billion and automotive free cash flow adjusted was impressive at $2.6 billion. GM ended the quarter with very strong total automotive liquidity of $34.8 billion. Automotive cash and marketable securities was $24.2 billion compared with $24.3 billion for the first quarter of 2013.

CEO Dan Akerson said on a conference call that GM has no plans to pay a dividend on common. Instead, GM will redeem the very expensive VEBA preferred stock (9% dividend required) and continue to strengthen its balance sheet. GM also has unfunded pension liabilities of $24 billion. On its Series A U.S. Treasury held stock, GM has $5.5 billion in liabilities. All totaled, there are now 1.7 billion shares of GM outstanding.

| General Motors Company – millions | Q2 2013 | Q2 2012 |

| Revenue | $39.1 | $37.6 |

| Net income common stock | $1.2 | $1.5 |

| Earnings per share (EPS) fully diluted | $0.75 | $0.90 |

| Special items on EPS fully diluted | $(0.09) | – |

| EBIT-adjusted | $2.3 | $2.1 |

| Automotive net cash flow | $4.5 | $3.8 |

| Adjusted automotive free cash flow | $2.6 | $1.7 |

GM Segment Results

- GM North America reported EBIT-adjusted of $2.0 billion, compared with $1.9 billion in the second quarter of 2012.

- GM Europe reported an EBIT-adjusted of $(0.1) billion, compared with $(0.4) billion in the second quarter of 2012.

- GM International Operations reported EBIT-adjusted of $0.2 billion, compared with $0.6 billion in the second quarter of 2012.

- GM South America reported EBIT-adjusted of $0.1 billion, compared with EBIT-adjusted of $0.0 billion in the second quarter of 2012.

- GM Financial earnings before tax was $0.3 billion for the quarter, compared to $0.2 billion in the second quarter of 2012.