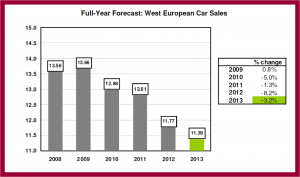

The West European market at 11.4 million is likely to finish 2013 nearly 3.5 million units lower than 2007 with only “modest improvement likely” in 2014.

August auto sales in Western Europe fell by -5.3%, dashing hopes of executives that the market had finally bottomed. The continuing five year negative sales trend confirms the bleak conditions facing the industry.

With the same number of selling days as August 2012, August 2013 results retreated once again. This means that after a recent sales run of four slightly better months, in Seasonally Adjusted Annualized Rates (SAAR), August slipped back to 11.1 million units. While it’s true that August is the smallest sales volume month in Europe, hurt by vacations and the pending registration plate changes that occur in Great Britain during September, the industry still faces a depressing uphill slog.

According to the constancy LMC, Germany, the largest market, and France, second largest, posted monthly declines. Year-to-date the German market dropped by -6.6%, and the SAAR slipped back again after climbing above 3.0 million units per year in July. The selling rate in France also fell back, after a run of three months at around 1.8 million annually, extremely weak by historical standards. Italian registrations picked up in August, though, like in France, remain low compared to the pre-recession years last decade. In Spain, the market continued to be supported by scrappage incentives, though the year-on-year comparison includes an anomaly caused by a VAT increase last year when registrations were pulled forward into August 2012.

LMC claims that there are “good reasons to continue to believe the market will begin to pick up. The Eurozone economy is expected to return to growth in the second half of the year, albeit slowly, which will provide support to the car market.” Consumer confidence has also been increasing recently. However, the West European car market at 11.4 million units is likely to finish 2013 nearly 3.5 million units lower than 2007 with only “modest improvement likely” in 2014.

The entire European car industry has declined from the peak in 2007 of more than 18 million units. The Big Five are more than 70% of the total – Germany,UK, France, , Italy Spain generally speaking. LMC thinks that by mid-decade it could be about 15 million, a modest recovery at best.