It looks like the recovery in the automobile business is continuing as preliminary data indicate that US Auto sales – both retail and total – will surpass last May for the highest levels thus far in 2014.

Retail light-vehicle sales are forecast at 1.3 million units and total light-vehicle sales are expected to reach nearly 1.5 million in August 2014, both a 3% increase on a selling day adjusted basis, compared with August 2013. This means 16.6 million new vehicle sales, a healthy SAAR.

Moreover, August sales will be helped from the inclusion of the Labor Day holiday in the month’s sales results. Labor Day is traditionally the biggest single sales day of the year as consumers take advantage of the holiday and model year-end sales promotions as well as the availability of the 2015 model-year vehicles arriving in showrooms, according to J.D. Power the source of the soothsaying.

The average new-vehicle retail transaction price in August 2014 is $29,300, a record high for the month surpassing $28,898 set in August 2013. TrueCar forecasts average incentive spending by manufacturers to be $2,772 per vehicle sold in August 2014, an increase of 9.3% from August 2013 and a decrease of 2% from July 2014. Year-over-year incentive spending increases are offset by higher transaction prices as consumer demand shifts from lower-margin cars to higher-margin trucks and crossovers.

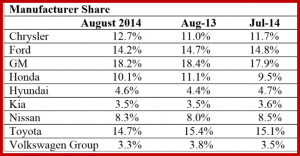

The Kelly Blue Book forecast by manufacturer: General Motors (NYSE:GM) -1.0% to 273K; Toyota (NYSE:TM) -4.6% to 221K; Ford (NYSE:F) -1.5% to 217K; Chrysler (OTCPK:FIATY) +11.1% to 184K; Honda (NYSE:HMC) -8.1% to 153K; Nissan (OTCPK:NSANY) +1.2% to 122K; Hyundai (OTC:HYMLF) -1% to 117K; Volkswagen (OTCQX:VLKAY) -11.6% to 51K.