China Light Vehicle Sales continue their drop in May. “Most factors seem to point towards both consumer demand and vehicle retail sales heading into negative territory.”

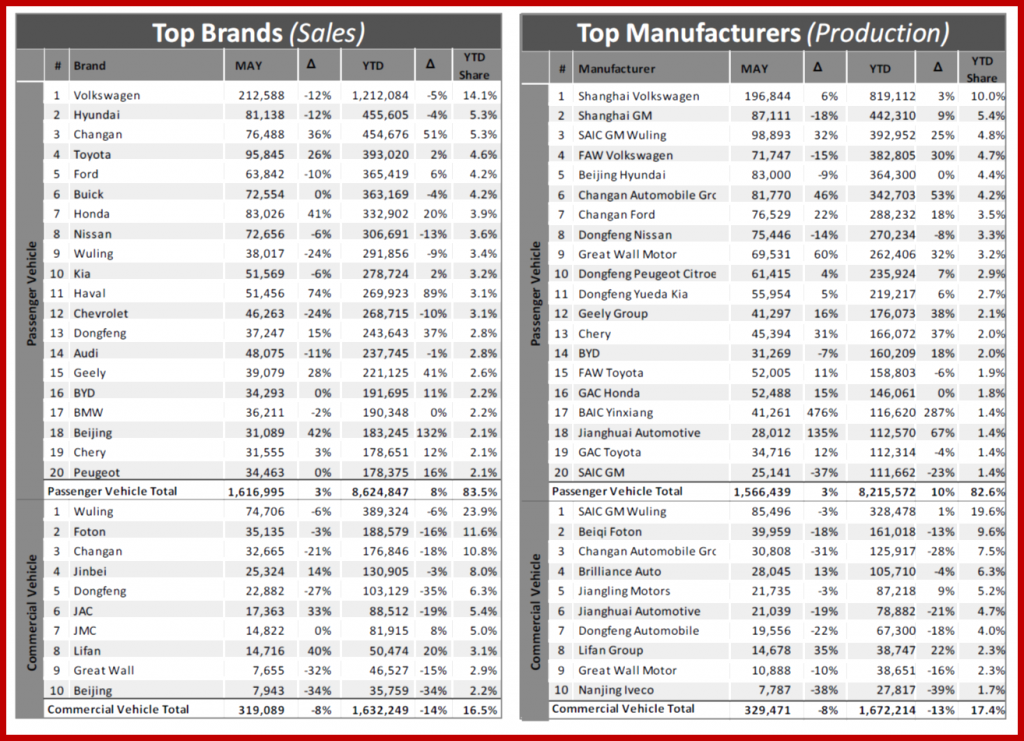

China Light Vehicle sales continued to decline in May, with year?on?year (YoY) growth in sales of locally?made models dropping to 1.4%. This was the lowest level since September 2012 when the Sino?Japan islands disputes disrupted the market. There is big trouble ahaed for The Volkswagen Group and General Motors, the leading local manufacturers respectively, both of whom rely on China for healthy profits.

However, the Light Commercial Vehicle sector has provided less harm to the overall Light Vehicle market as the yearly sales decline narrowed to -8.4% in May, versus -13.3% in April and -16.2% in March.

LMC’s analysis of the SAAR says that these results should be interpreted as a leveling off rather than as an ongoing deterioration. The selling rate of 20.2 million is a slight improvement from the 19.9 million units seen in April, albeit pointedly lower than the 20.8 million units in Q4 2014 or the 21.1 million where to buy valtrex online posted in the opening quarter of 2015.

“Most factors seem to point towards both consumer demand and vehicle retail sales heading into negative territory. The restrictions on vehicle purchases, which pulled sales forward in China’s largest cities, have led to a flat sales trend in tier?1 cities so far this year for Passenger Vehicles. Sales in Tier?2 cities have seen only single?digit growth to date in 2015, in contrast to the same period last year when they drove overall market growth, according to LMC.

LMC also thinks that the current “gloomy economic outlook has stifled any potential momentum in less developed areas of China… With this in mind, LMC believe that the painful market adjustment currently under way is far from over. In light of the lower?than?expected sales of Passenger Vehicles in May and the slower?than expected reduction in inventory levels, we have downgraded our full?year forecast for Passenger Vehicle sales in 2015 by around 100,000 units and now expect to see growth of 8.6% in the sector and 5.7% in the Light Vehicle market as a whole.”