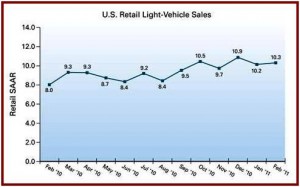

February new-vehicle retail sales are projected to come in at 727,500 units, which represents a seasonally adjusted annualized rate (SAAR) of 10.3 million units. This marks the second month of a year-over-year selling rate increase of more than 2 million units, based on the first 11 selling days of the month.

If sales continue to grow, what are now isolated shortages of some vehicles will become greater, and prices will rise. Suppliers, who drastically trimmed output during the past three years, are showing signs of not being able to keep up. (See also – Early February U.S. Vehicle Sales Up by 17% from 2010. Significant Market Warming or Just a So What?)

Retail transactions are the most accurate measurement of true underlying consumer demand for new vehicles, according to J.D. Power and Associates, the source of the prediction.

“Retail sales in February got off to a slow start due to the snowstorms that affected the country from the Midwest to the Northeast,” said Jeff Schuster, executive director of global forecasting at Power.

“However, the market rebounded quickly in the days that followed, leading to a slightly stronger selling rate than in January,” Schuster said.

Total light-vehicle sales for February are expected to come in at 913,000 units, or 17% higher than in February 2010. Fleet sales are projected to remain stable and continue to account for 20% of total sales, with volume at 186,000 units.

The predictions mirrored those made earlier in February by CNW research, which showed both the number of people shopping for a new vehicle and the number who actually buy one are rising based on reports from car dealers. CNW predicted total monthly sales in the 920,000 – 950,000 range.

The outlook for vehicle sales in 2011 continues to be positive, according to Power. Retail sales are forecasted at 10.5 million units for the year, an increase of 15% from 2010. Total sales are expected to come in at 13 million units for 2011, up 12% from 2010.