Magna International Inc. (TSX: MG; NYSE: MGA) today reported financial results for the third quarter ended September 30, 2018: Record third quarter sales, up 9% year over year to $9.6 billion. However, sales were slightly lower than Magna anticipated, mainly due to lower than expected light vehicle production. Adjusted EBIT was below the comparable quarter in 2017 and was less than what Magna expected.

Magna International Inc. (TSX: MG; NYSE: MGA) today reported financial results for the third quarter ended September 30, 2018: Record third quarter sales, up 9% year over year to $9.6 billion. However, sales were slightly lower than Magna anticipated, mainly due to lower than expected light vehicle production. Adjusted EBIT was below the comparable quarter in 2017 and was less than what Magna expected.

After considering the impact of lower than anticipated volumes, the Power & Vision, Seating Systems and Complete Vehicles segments performed in line with Magna expectations. Body Exteriors & Structures segment reported results below expectations, as a result of higher than anticipated launch costs and under-performance at certain facilities, largely offset by a favorable customer pricing.

Q3

- Record third quarter diluted earnings per share of $1.62, increased 17%

- Record third quarter adjusted diluted earnings per share of $1.56, up 12%

- Returned $629 million to shareholders through share repurchases and dividends

- Reduced top end of outlook ranges for Total Sales, Adjusted Net Income attributable to Magna and revised outlook for Adjusted EBIT margin

All operating segments reported sales growth compared to the third quarter of 2017 and, excluding both acquisitions net of divestitures and foreign exchange movements, sales for all segments outgrew global light vehicle production.

On a consolidated basis, Magna posted sales of $9.62 billion for the third quarter of 2018, an increase of 9% over the third quarter of 2017. The growth was achieved in a period in which light vehicle production increased 4% in North America and was essentially unchanged in Europe. Excluding the impact of foreign currency translation and net divestitures, sales increased 11% on a consolidated basis, and by segment: 6% in both Body Exteriors & Structures and Power & Vision, 5% in Seating Systems, and 50% in Complete Vehicles.

Adjusted EBIT of $699 million in the third quarter of 2018 decreased 1.0%, resulting in an adjusted EBIT as a percentage of sales of 7.3% in the third quarter of 2018 compared to 8.0% in the third quarter of 2017. This margin decline was largely from:

- an increase in the proportion of sales generated in the Complete Vehicles segment relative to total sales, which have a significantly lower margin than the consolidated average;

- lower margins in the third quarter of 2018 in the Seating Systems segment, mainly associated with pre-operating costs incurred at new facilities and favorable customer pricing resolutions in the third quarter of 2017

- lower margins in our Power & Vision segment, largely reflecting increased spending for electrification and autonomy.

- Income from operations before income taxes of $674 million decreased 1.0% in the third quarter of 2018

- Net income attributable to Magna International Inc. increased 8% to $554 million for the third quarter of 2018, substantially reflecting a lower income tax rate

- Diluted earnings per share increased 17% to $1.62 in the third quarter of 2018, reflecting higher net income attributable to Magna International, and the favorable impact of a reduced share count. Adjusted diluted earnings per share increased 12% to $1.56 compared to $1.39 for the third quarter of 2017

In the third quarter of 2018, Magna generated cash from operations before changes in operating assets and liabilities of $899 million, and $177 million in operating assets and liabilities. Investment activities for the third quarter of 2018 included $381 million in fixed asset additions, and a $114 million increase in investments, other assets and intangible assets.

Qs 1-3

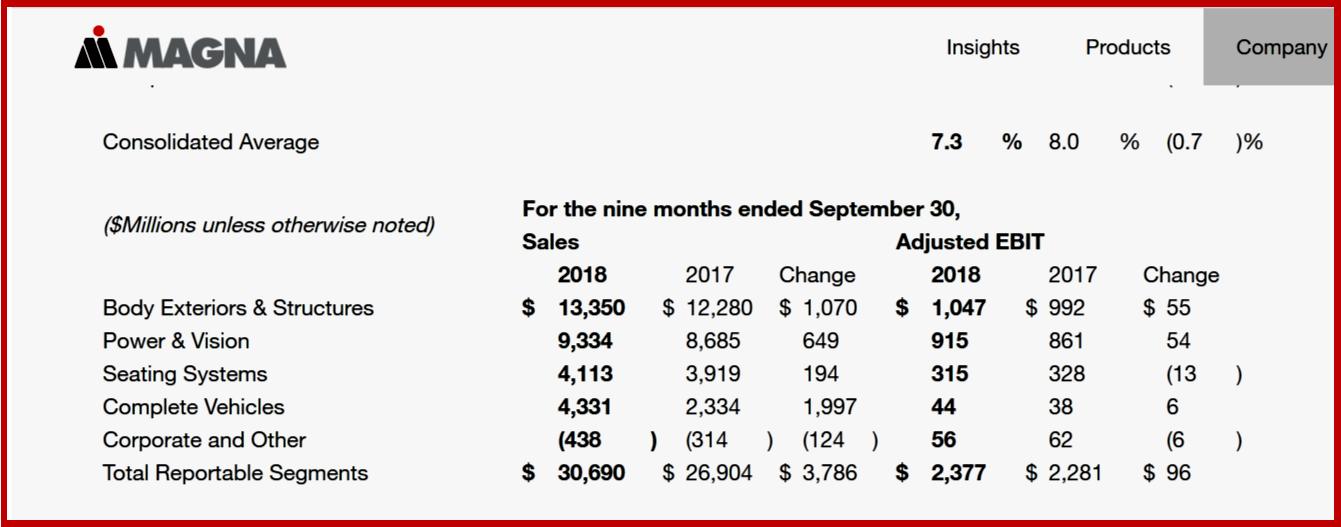

Magna posted sales of $30.69 billion for the nine months ended September 30, 2018, an increase of 14% from the nine months ended September 30, 2017. North American light vehicle production remained relatively unchanged and European light vehicle production increased 2%, in the first nine months of 2018 compared to the first nine months of 2017.

During the nine months ended September 30, 2018, income from operations before income taxes was $2.34 billion, net income attributable to Magna International Inc. was $1.84 billion and diluted earnings per share was $5.22, increases of $124 million, $203 million and $0.89, respectively, each compared to the first nine months of 2017.

During the nine months ended September 30, 2018, Adjusted EBIT increased 4% to $2.38 billion, compared to $2.28 billion for the nine months ended September 30, 2017. Magna Body Exteriors & Structures, Power & Vision, and Complete Vehicles segments each posted higher Adjusted EBIT compared to the first nine months of 2017.

During the nine months ended September 30, 2018, we generated cash from operations before changes in operating assets and liabilities of $2.87 billion and invested $750 million in operating assets and liabilities. Investment activities for the nine months of 2018 included $1.00 billion in fixed asset additions, and $331 million in investments, other assets and intangible assets.

Return of Capital

During the three and nine months ended September 30, 2018, Magna paid dividends of $109 million and $342 million, respectively. In addition, we repurchased 9.2 million shares for $520 million and 22.7 million shares for $1.35 billion, respectively, for the three and nine months ended September 30, 2018.

The Magna Board of Directors declared a quarterly dividend of $0.33 with respect to our outstanding Common Shares for the quarter ended September 30, 2018. This dividend is payable on December 7, 2018 to shareholders of record on November 23, 2018.

Share Repurchase

Subject to the approval by the Toronto Stock Exchange and the New York Stock Exchange, Magna Board of Directors approved a new Normal Course Issuer Bid (“NCIB”) to purchase up to 33.2 million of our Common Shares, representing approximately 10% of our public float of Common Shares. This NCIB is expected to commence on or about November 15, 2018 and will terminate one year later.

The Toronto Stock Exchange (“TSX”) has accepted (11/13/2018 )its Notice of Intention to Make a Normal Course Issuer Bid (the “Notice”). Pursuant to the Notice, Magna may purchase up to 33,200,000 Magna Common Shares (the “Bid”), representing approximately 10% of its public float. As at November 2, 2018, Magna had 334,257,524 issued and outstanding Common Shares, including a public float of 332,209,834 Common Shares.

The primary purposes of the Bid are purchases for cancellation, as well as purchases to fund Magna’s stock-based compensation awards or programs and/or Magna’s obligations to its deferred profit sharing plans. Magna may purchase its Common Shares, from time to time, if it believes that the market price of its Common Shares is attractive and that the purchase would be an appropriate use of corporate funds and in the best interests of the Corporation.