General Motor’s first profit since 2004, and its best performance since 1999 is welcome news for U.S. taxpayers who still own one-third of the company.”

General Motors Company (NYSE: GM) today announced calendar year 2010 results of $4.7 billion of net income per share of common stock, a generally positive effort during its first full year of operations after it emerged from bankruptcy as a U.S. and Canadian taxpayer owned automaker.

Fourth quarter net income was $500 million, and it was the fourth straight profitable quarter for GM as both it and the North American auto markets slowly recovered. However, GM momentum slowed in the fourth quarter, by far its weakest of the year, as costs from its public stock offering and new model intros, as well as slower U.S. truck sales and ongoing losses at Opel in Europe hurt.

Revenue for the calendar year was $135.6 billion. Automotive cash flow from operating activities was $6.6 billion and automotive free cash flow was $2.4 billion, both reflecting the impact of a $4.0 billion voluntary cash contribution to the company’s U.S. pension plans.

As a result of GM’s 2010 financial performance, the company will pay profit sharing to approximately 45,000 eligible GM U.S. hourly employees, and approximately 3,000 eligible GM Components Holdings (GMCH) employees. The average payout per employee will be approximately $4,300 for GM employees and $3,200 for GMCH employees.

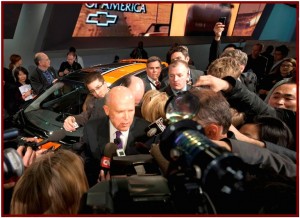

“Last year was one of foundation building,” said Dan Akerson, chairman and chief executive officer. “Particularly pleasing was that we demonstrated GM’s ability to achieve sustainable profitability near the bottom of the U.S. industry cycle, with four consecutive profitable quarters.”

GM generated the following results:

| GM 2010 Results | ||

| 4Q ’10 | CY ’10 | |

| Revenue (bils.) | $36.9 | $135.6 |

| Net income attributable to common stockholders (bils.) | $0.5 | $4.7 |

| – Adjustments and loss on preferred, included above (bils.) | $(0.4) | $(0.2) |

| Earnings per share on a fully diluted basis ($/share) | $0.31 | $2.89 |

| – Adjustments and loss on preferred, included above ($/share) | $(0.21) | $(0.14) |

| Earnings before interest and tax (EBIT) adj. (bils.) | $1.0 | $7.0 |

| Automotive net cash flow from operating activities (bils.) | $(1.7) | $6.6 |

| Automotive free cash flow (bils.) | $(2.8) | $2.4 |

| – Contribution to U.S. pension plans, included above (bils.) | $(4.0) | $(4.0) |

Fourth quarter net income includes charges of $0.4 billion, or a $0.21 reduction to fully diluted earnings per share, as a result of the previously disclosed $0.7 billion loss on the purchase of U.S. Treasury (UST) preferred shares, partially offset by the impact of EBIT adjustments. The company had approximately $0.3 billion in favorable EBIT adjustments including the previously disclosed $0.2 billion gain associated with the repayment of the VEBA Note, and $0.1 billion of cumulative gains on the sale of Nexteer and the purchase of the Strasbourg, France facility.

GM North America (GMNA) had EBIT in the fourth quarter 2010 of $0.8 billion, up from a loss of $3.4 billion in the fourth quarter 2009.

GM Europe (GME) had a loss before interest and taxes of $0.6 billion, a slight improvement from a loss of $0.8 billion in the same quarter a year ago.

GM International Operations (GMIO) had EBIT of $0.3 billion, down from $0.4 billion in fourth quarter 2009.

GM South America (GMSA) had EBIT of $0.2 billion for the fourth quarter, compared with $0.3 billion in the same quarter a year ago. GM began reporting GMSA results as an operating segment in the fourth quarter, and has revised the segment reporting for prior periods.

Automotive net cash flow from operating activities for the fourth quarter was negative at $(1.7) billion, which reflects a $4.0 billion cash contribution to the badly underfunded U.S. pension plans. After deducting $1.1 billion of capital expenditures, automotive free cash flow was negative $(2.8) billion.

In addition, GM announced today that after assessing remediation actions that it put in place to address the company’s material weakness regarding the financial reporting process, the management team and Audit Committee of the Board of Directors concluded that the material weakness no longer exists as of December 31, 2010.